Double Entry Accounting A 2 Minute Tutorial

Accounting Basics 2 Double Entry Youtube ⭐️join this channel to get exclusive daily quiz questions: c accountingstuff joinin this video i attempt to explain double entry accou. Welcome to this 10 minute crash course on the basics of double entry accounting! if the terms 'debits' and 'credits' have ever left you scratching your head,.

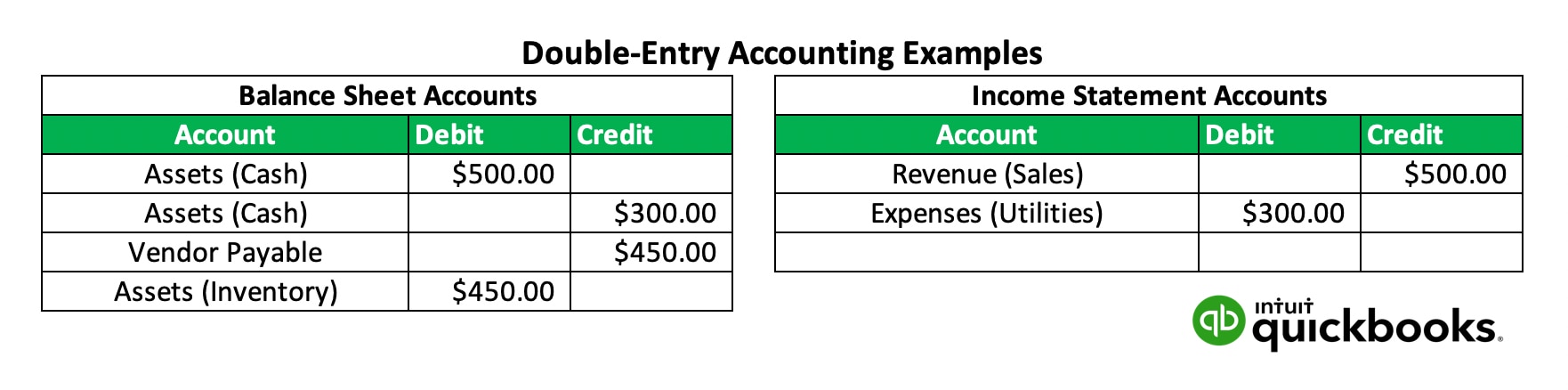

Double Entry Accounting Youtube Put together everything you have learned about debits and credits, the five account types and t accounts to unravel the mysteries of double entry bookkeeping. Double entry accounting is a bookkeeping system in which each transaction affects at least two accounts and maintains a balance between debits and credits. this approach reduces the likelihood of accounting errors. companies of all sizes use double entry accounting to run their businesses. Double entry accounting is a foundational concept in the world of finance, used to maintain accurate and balanced financial records. this method of bookkeeping involves recording each financial transaction in at least two separate accounts, ensuring that the accounting equation, assets = liabilities equity, is always satisfied. businesses of all sizes utilize double entry accounting as […]. Double entry accounting is a method of bookkeeping that tracks where your money comes from and where it’s going. every financial transaction gets two entries, a “debit” and a “credit” to describe whether money is being transferred to or from an account, respectively. each accounting entry affects two different accounts: for example.

What Is Double Entry Accounting Quickbooks Canada Double entry accounting is a foundational concept in the world of finance, used to maintain accurate and balanced financial records. this method of bookkeeping involves recording each financial transaction in at least two separate accounts, ensuring that the accounting equation, assets = liabilities equity, is always satisfied. businesses of all sizes utilize double entry accounting as […]. Double entry accounting is a method of bookkeeping that tracks where your money comes from and where it’s going. every financial transaction gets two entries, a “debit” and a “credit” to describe whether money is being transferred to or from an account, respectively. each accounting entry affects two different accounts: for example. A selection of popular tutorials from the double entry bookkeeping tutorial guide. cash flow and balance sheet link; chart of accounts basics; allowance method for uncollectible accounts; effect of inventory errors; future value of a lump sum; latest tutorials. a selection of the most recent tutorials from the double entry bookkeeping tutorial. The double entry accounting system is based on the accounting equation: assets = liabilities equity. this equation means that the total value of a company's assets must equal the sum of its liabilities and equity. this equation must always be in balance. in other words, if a company has $100 in assets and $50 in liabilities, then its equity.

Learn Double Entry Accounting Basics Youtube A selection of popular tutorials from the double entry bookkeeping tutorial guide. cash flow and balance sheet link; chart of accounts basics; allowance method for uncollectible accounts; effect of inventory errors; future value of a lump sum; latest tutorials. a selection of the most recent tutorials from the double entry bookkeeping tutorial. The double entry accounting system is based on the accounting equation: assets = liabilities equity. this equation means that the total value of a company's assets must equal the sum of its liabilities and equity. this equation must always be in balance. in other words, if a company has $100 in assets and $50 in liabilities, then its equity.

A Tutorial Doubleentryaccounting Org On Double Entry Bookkeeping And

Double Entry Accounting 2022

Comments are closed.