Equity Crowdfunding Diversification Strategy Ethis Blog

Equity Crowdfunding Diversification Strategy Ethis Blog Related: investing through equity crowdfunding (ecf): the pros and cons. why you should consider equity crowdfunding diversification in your investment portfolio . depending on your risk appetite and financial goals, equity crowdfunding may make a good investment vehicle in your diversification strategy. let’s drill down into the five reasons. Equity crowdfunding plays a major role in changing this status quo. it has opened the door for everyday investors to circulate money directly to the real economy of msmes, smes as well as startups, thus allowing these businesses to have the capital they need to grow. 2) easily accessible.

Equity Crowdfunding Diversification Strategy Ethis Blog One of them is crowd investing. at ethis, we make it easy for you to invest in profitable projects and exciting high growth companies across the globe via equity crowdfunding and p2p lending. learn more at ethis.co. related: equity crowdfunding vs p2p lending. Key takeaways. equity crowdfunding empowers investors to hold a stake in early stage companies or established enterprises, comparing potential rewards against the risk of capital loss. the eis offers a substantial impetus for investment through 30% income tax relief, capital gains tax exemptions, and loss relief for faltering ventures. Equity crowdfunding (also called investment crowdfunding) means you are investing your money into unlisted companies who are seeking capital in exchange for a stake in their company, which is “equity”. investment crowdfunding is a high risk, long term investment. investment crowdfunding can be unreliable, but, high risk investments can. The benefits of equity crowdfunding diversification—spreading the risk—apply not only to your overall investment portfolio (on a macro level), but to each asset class (on a micro level) as well. at the macro level, a diversified investment portfolio might include stocks, bonds, mutual funds, real estate, hard assets like precious metals.

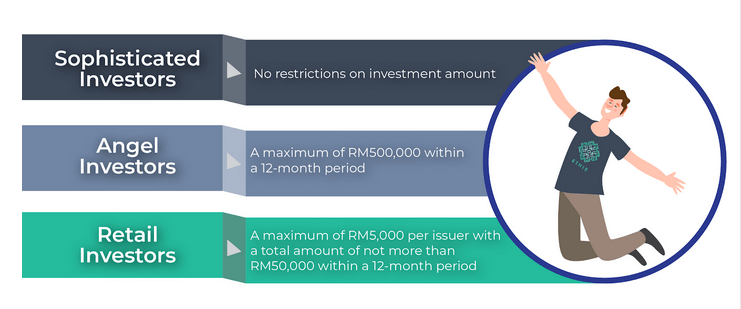

Equity Crowdfunding Diversification Strategy Ethis Blog Equity crowdfunding (also called investment crowdfunding) means you are investing your money into unlisted companies who are seeking capital in exchange for a stake in their company, which is “equity”. investment crowdfunding is a high risk, long term investment. investment crowdfunding can be unreliable, but, high risk investments can. The benefits of equity crowdfunding diversification—spreading the risk—apply not only to your overall investment portfolio (on a macro level), but to each asset class (on a micro level) as well. at the macro level, a diversified investment portfolio might include stocks, bonds, mutual funds, real estate, hard assets like precious metals. Equity crowdfunding, or ecf, is a method for private companies, known as issuers, to raise funds for their ventures via equity shares. the issuer offers their company’s equity in exchange for the funding from the ‘crowd’ or investors. in return for the money invested, investors gain a stake in the company and potentially earn their returns. Crowdfunding can be a great way for startups to raise funds to launch their businesses. there are several types of crowdfunding sources that startups can use, including reward based crowdfunding, equity crowdfunding, donation based crowdfunding, debt crowdfunding, and peer to peer lending. each type of crowdfunding has its own advantages and.

Equity Crowdfunding Diversification Strategy Ethis Blog Equity crowdfunding, or ecf, is a method for private companies, known as issuers, to raise funds for their ventures via equity shares. the issuer offers their company’s equity in exchange for the funding from the ‘crowd’ or investors. in return for the money invested, investors gain a stake in the company and potentially earn their returns. Crowdfunding can be a great way for startups to raise funds to launch their businesses. there are several types of crowdfunding sources that startups can use, including reward based crowdfunding, equity crowdfunding, donation based crowdfunding, debt crowdfunding, and peer to peer lending. each type of crowdfunding has its own advantages and.

Comments are closed.