Explore Aetna Plan G Medicare Supplement Benefits Coverage

Start Saving With Aetna S Senior Products Plan G Medicare supplement insurance plans transcript. ** plan n requires a $20 copayment for office visits and a $50 copayment for emergency room visits. copayments do not count toward the annual part b deductible. *high deductible plan f and plan g are also available; same benefits apply once calendar year deductible is paid. San diego, ca (91911) $207.58. philadelphia, pa (19019) $153.77. salt lake city, ut (84092) $135.95. you can request a free quote for aetna medicare supplement plan g by visiting aetna medicareplans . you can find out how much aetna plan g costs where you live, learn about discounts that may be available and more.

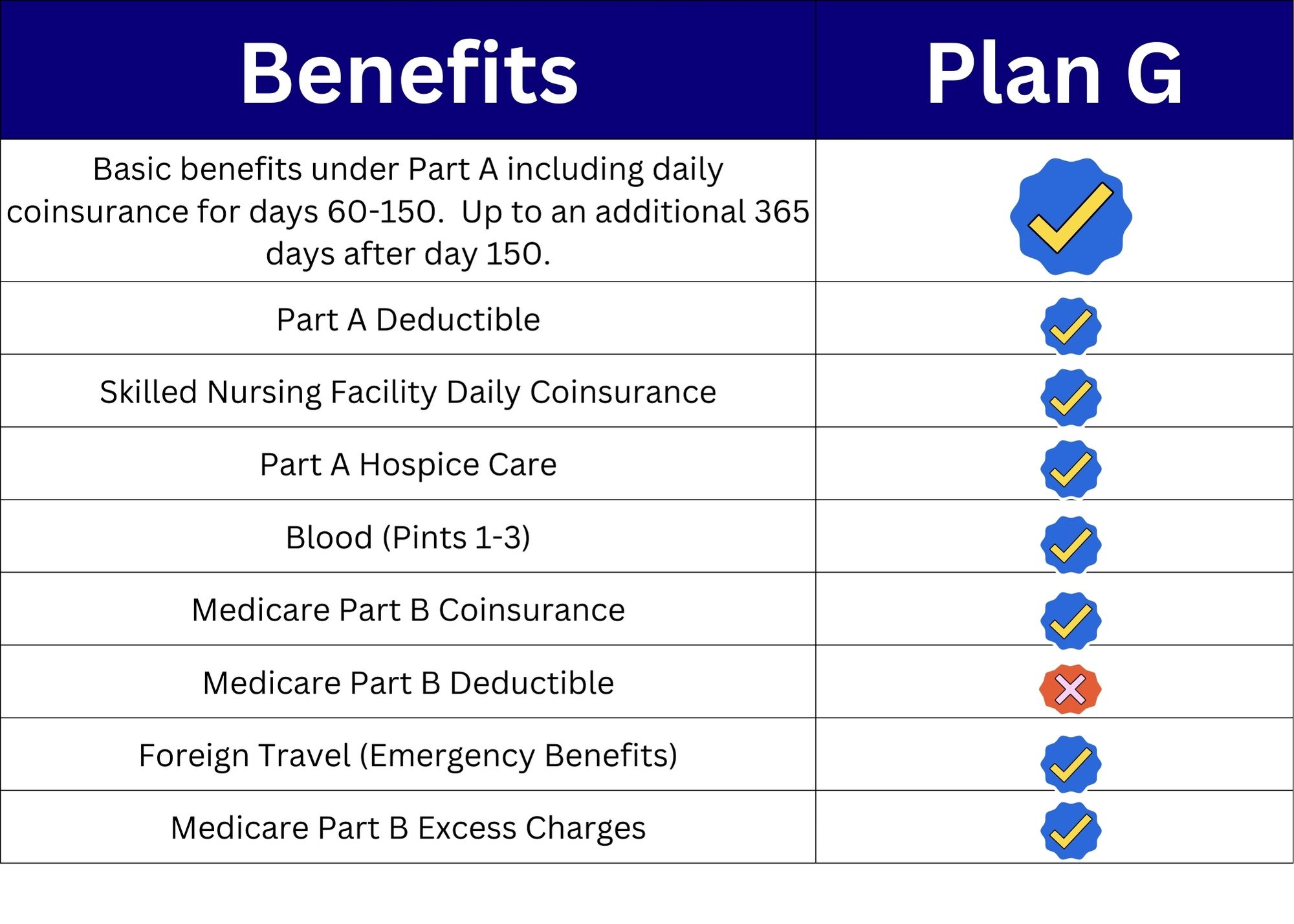

Explore Aetna Plan G Medicare Supplement Benefits Coverage Choosing aetna plan g medicare supplement comes with numerous benefits, including coverage for medicare part a and b deductibles, skilled nursing facility care, and foreign travel emergency coverage. these benefits can help reduce out of pocket costs and provide peace of mind in the event of unexpected medical needs. * high deductible plan f and plan g are also available; same benefits apply once calendar year deductible is paid. the following plans are available only to those who are first eligible for medicare before 2020: plan c; plan f* * high deductible plan f and plan g are also available; same benefits apply once calendar year deductible is paid. Cons. higher premiums: because it has high coverage, plan g also tends to have higher premiums. excess charges are rare: one of plan g’s unique features is coverage for part b excess charges. Aetna medicare supplement plan g benefits. medicare supplement plan g offers the most comprehensive coverage. plan g covers: medicare part a hospital coinsurance. inpatient hospital costs up to 365 days after medicare benefits are used. part a hospice care copays or coinsurance. part a deductible. part b preventive office visit coinsurance.

Explore Aetna Plan G Medicare Supplement Benefits Coverage Cons. higher premiums: because it has high coverage, plan g also tends to have higher premiums. excess charges are rare: one of plan g’s unique features is coverage for part b excess charges. Aetna medicare supplement plan g benefits. medicare supplement plan g offers the most comprehensive coverage. plan g covers: medicare part a hospital coinsurance. inpatient hospital costs up to 365 days after medicare benefits are used. part a hospice care copays or coinsurance. part a deductible. part b preventive office visit coinsurance. Aetna® shines in star ratings with 88% of medicare advantage members in 4 out of 5 star plans or higher for 2025. aetna medicare is an hmo, ppo plan with a medicare contract. our snps also have contracts with state medicaid programs. enrollment in our plans depends on contract renewal. every year, medicare evaluates plans based on a 5 star. Plan g covers nearly all costs not covered by original medicare, including: part a coinsurance and hospital costs up to an additional 365 days after a person uses all their medicare benefits. part.

Comments are closed.