Fast Easy How To Use The Macd Indicator In Any Market

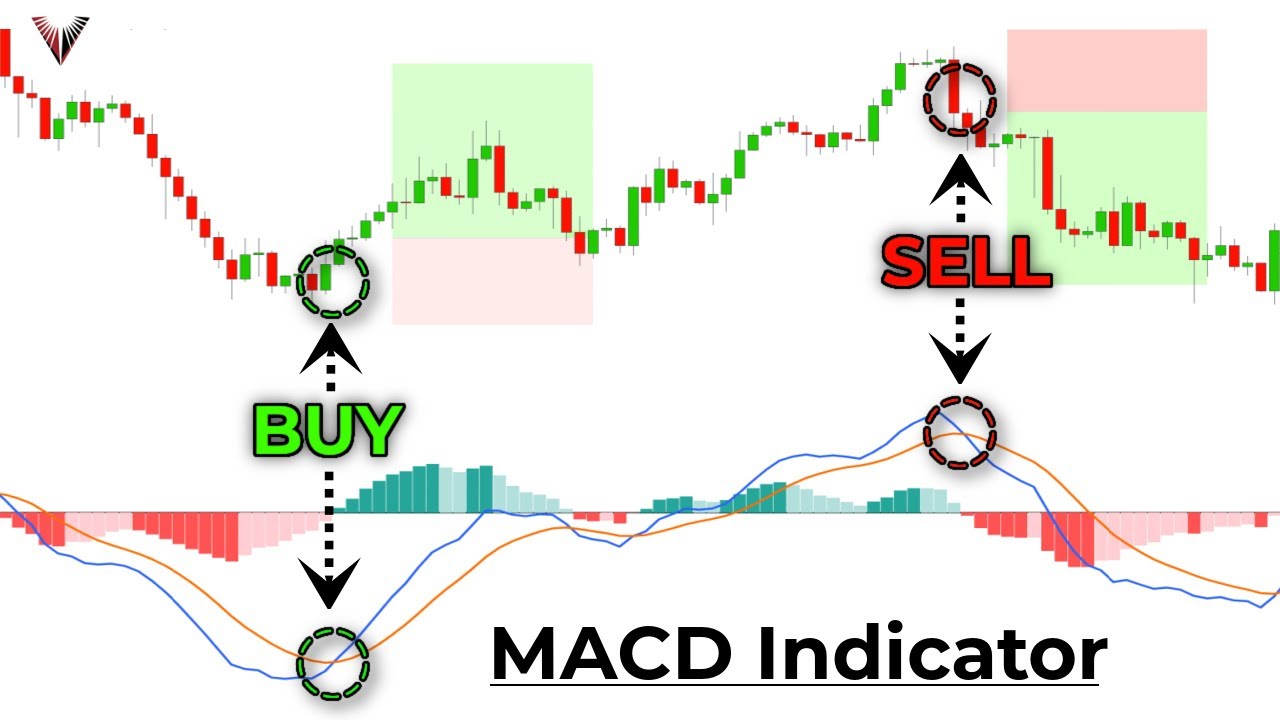

Fast Easy How To Use The Macd Indicator In Any Market Macdtrader About press copyright contact us creators advertise developers terms privacy policy & safety how works test new features nfl sunday ticket press copyright. The macd indicator, also known as the macd oscillator, is one of the most popular technical analysis tools. there are three main components of the macd shown in the picture below: macd: the 12 period exponential moving average (ema) minus the 26 period ema. macd signal line: a 9 period ema of the macd. macd histogram: the macd minus the macd.

Ultimate Beginners Guide To Using Macd Indicator For Trading 2023 In this tutorial, we will cover 5 trading strategies using the indicator and how you can implement these methodologies within your own trading system. beyond the strategies, we will explore if the macd stock indicator is appropriate for day trading and how well the macd stock indicator stacks up against moving averages. Value = macd line. avg = moving average of the macd line. diff = difference between the value and the avg. value line is the value we get when we subtract the 26ema from the 12ema. in the picture below, we open the user dialog box for the macd study inside tos and see the signal settings. let’s take a closer look. Macd is an acronym for m oving a verage c onvergence d ivergence. this technical indicator is a tool that’s used to identify moving averages that are indicating a new trend, whether it’s bullish or bearish. after all, a top priority in trading is being able to find a trend, because that is where the most money is made. 2) the space between the macd. when the two macd indicator lines separate, it means that momentum is increasing and the trend is getting stronger. when the two macd lines are coming closer together, it shows that the price is losing strength. furthermore, we can use the 0 line as a trend tiebreaker. when the two macd lines are above the 0 line.

:max_bytes(150000):strip_icc()/dotdash_Final_Moving_Average_Convergence_Divergence_MACD_Aug_2020-02-58bf5e34f0f94730b6e2d56ef9032b6d.jpg)

Macd Indicator Explained With Formula Examples And Limitations Macd is an acronym for m oving a verage c onvergence d ivergence. this technical indicator is a tool that’s used to identify moving averages that are indicating a new trend, whether it’s bullish or bearish. after all, a top priority in trading is being able to find a trend, because that is where the most money is made. 2) the space between the macd. when the two macd indicator lines separate, it means that momentum is increasing and the trend is getting stronger. when the two macd lines are coming closer together, it shows that the price is losing strength. furthermore, we can use the 0 line as a trend tiebreaker. when the two macd lines are above the 0 line. Macd is a trend following momentum indicator that shows the relationship between two moving averages of a security’s price. the calculation involves subtracting the 26 period exponential moving average (ema) from the 12 period ema, resulting in what is known as the macd line. macd line: the difference between the 12 day and 26 day emas. The macd indicator is a powerful tool that can complement price action in trading. it is not meant to be used in isolation. this article will provide a comprehensive guide on how to use the macd indicator effectively and increase your winning rate. it will cover topics such as understanding the macd indicator and its formula, common mistakes to.

The Macd Indicator For Beginners Become An Expert Immediately Youtube Macd is a trend following momentum indicator that shows the relationship between two moving averages of a security’s price. the calculation involves subtracting the 26 period exponential moving average (ema) from the 12 period ema, resulting in what is known as the macd line. macd line: the difference between the 12 day and 26 day emas. The macd indicator is a powerful tool that can complement price action in trading. it is not meant to be used in isolation. this article will provide a comprehensive guide on how to use the macd indicator effectively and increase your winning rate. it will cover topics such as understanding the macd indicator and its formula, common mistakes to.

How To Use The Macd Indicator Babypips

What Is Macd Moving Average Convergence Divergence Britannica Money

Comments are closed.