Fast Way To Calculate Compound Interest

What Is Compound Interest And How To Calculate It The Compound Click on the lower right corner of cell b3 and drag the formula down to cell b7. the numbers will fill in appropriately. place a 0 in cell c2. in cell c3, type "=b3 b$2" and press enter. this should give you the difference between the values in cell b3 and b2, which represents the interest earned. Interest calculation for 5 years. yearly rate → compounded rate 5% 5.12% the compounded rate (5.12%) is the effective yearly rate you earn on your investment after compounding. in comparison, the 5% rate is the nominal yearly rate. 28.34% the ror represents the profit or loss % returned from your investment over the entire investment term.

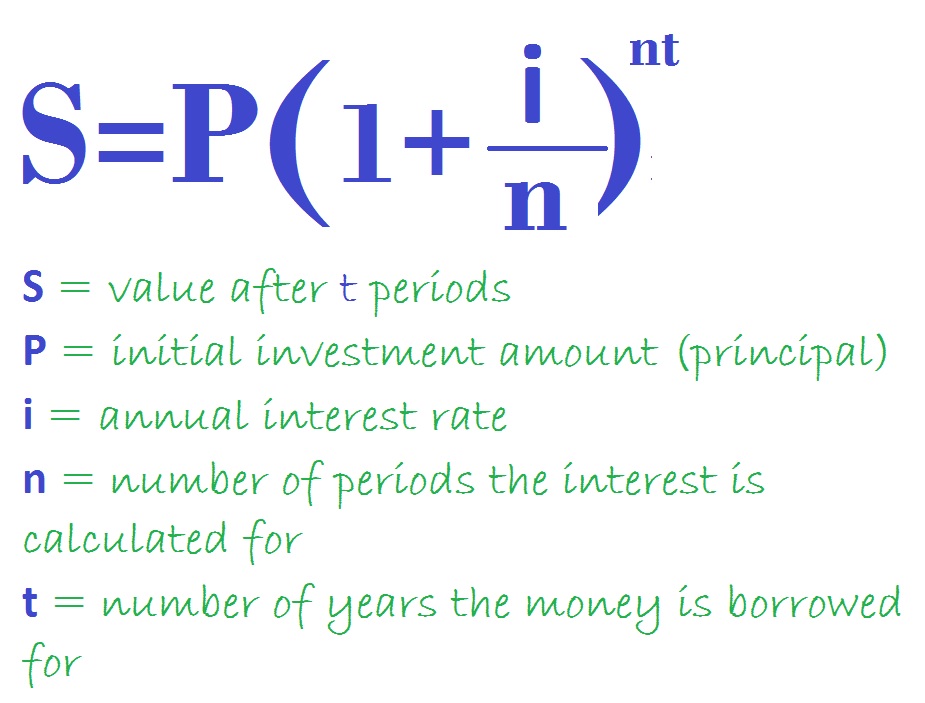

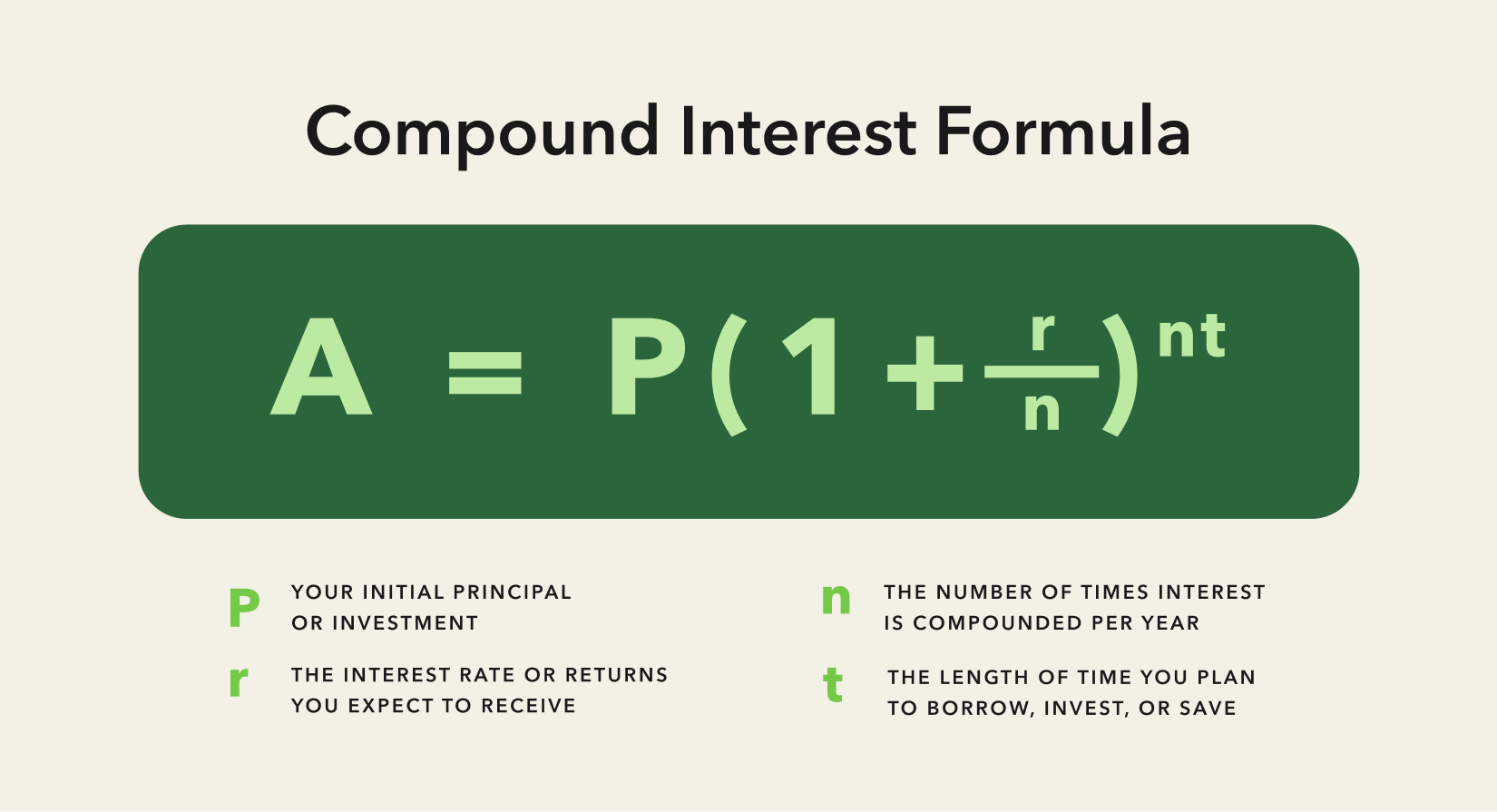

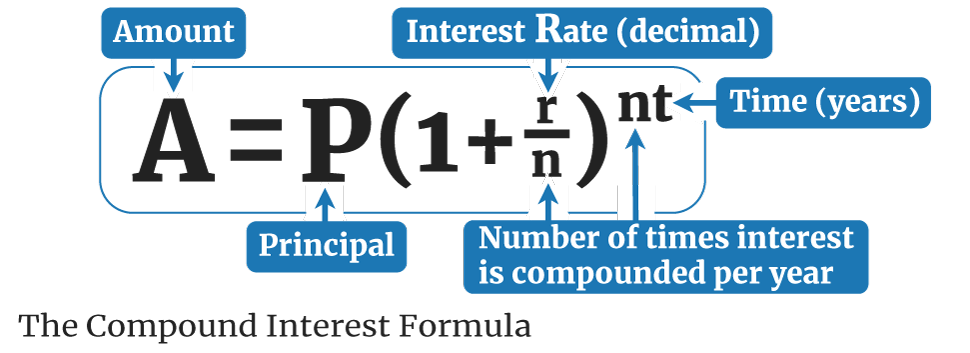

Compound Interest Calculator Acorns Use the formula a=p (1 r n)^nt. for example, say you deposit $5,000 in a savings account that earns a 5% annual interest rate and compounds monthly. you would calculate a = $5,000 (1 0.00416667. Calculate the interest (= "loan at start" × interest rate) add the interest to the "loan at start" to get the "loan at end" of the year; the "loan at end" of the year is the "loan at start" of the next year; a simple job, with lots of calculations. but there are quicker ways, using some clever mathematics. make a formula. To calculate compound interest is necessary to use the compound interest formula, which will show the fv future value of investment (or future balance): fv = p × (1 (r m)) (m × t) this formula takes into consideration the initial balance p, the annual interest rate r, the compounding frequency m, and the number of years t. Khan academy. if you're seeing this message, it means we're having trouble loading external resources on our website. if you're behind a web filter, please make sure that the domains *.kastatic.org and *.kasandbox.org are unblocked. explore. search. donate. log in sign up.

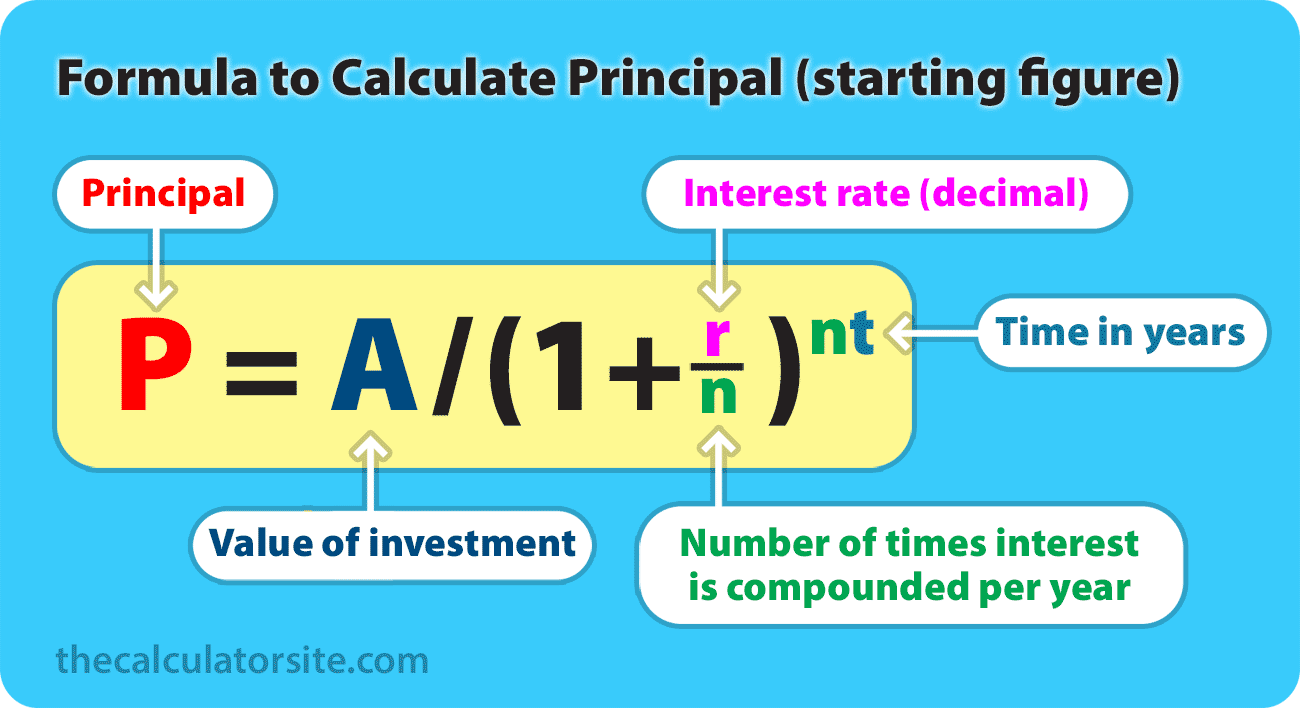

Compound Interest Calculator Simple And Easy To Use To calculate compound interest is necessary to use the compound interest formula, which will show the fv future value of investment (or future balance): fv = p × (1 (r m)) (m × t) this formula takes into consideration the initial balance p, the annual interest rate r, the compounding frequency m, and the number of years t. Khan academy. if you're seeing this message, it means we're having trouble loading external resources on our website. if you're behind a web filter, please make sure that the domains *.kastatic.org and *.kasandbox.org are unblocked. explore. search. donate. log in sign up. This calculator uses the compound interest formula to find the total principal plus accrued interest. it uses this same formula to solve for principal, rate or time given the other known values. you can also use the compound interest equation to set up a compound interest calculator in an excel 1 spreadsheet. a = p (1 r n)nt. Compound interest formula with examples by alastair hazell. reviewed by chris hindle compound interest, or 'interest on interest', is calculated using the compound interest formula a = p*(1 r n)^(nt), where p is the principal balance, r is the interest rate (as a decimal), n represents the number of times interest is compounded per year and t is the number of years.

Compound Interest Formula With Examples This calculator uses the compound interest formula to find the total principal plus accrued interest. it uses this same formula to solve for principal, rate or time given the other known values. you can also use the compound interest equation to set up a compound interest calculator in an excel 1 spreadsheet. a = p (1 r n)nt. Compound interest formula with examples by alastair hazell. reviewed by chris hindle compound interest, or 'interest on interest', is calculated using the compound interest formula a = p*(1 r n)^(nt), where p is the principal balance, r is the interest rate (as a decimal), n represents the number of times interest is compounded per year and t is the number of years.

Comments are closed.