Federal Consumer Laws Require Financial Institutions To Provide Paper Statements

Ppt Consumer Finance Powerpoint Presentation Free Download Id 1370911 A number of important consumer protection laws require written (i.e., paper) disclosures. in particular, financial institutions must provide “periodic” (usually monthly) statements in writing for: credit card accounts. bank accounts if accessible by atm, debit card or other electronic transactions. Federal regulations require certain financial institutions to provide paper statements. according to consumer action: banks must issue written statements on any account that can be accessed.

Financial Regulation And The Federal Budget Congressional Budget Office It’s legal for companies to charge for paper statements in nearly every state. there’s no federal law banning paper statement fees. but companies must get customers’ consent in order to switch from paper to online statements. federal laws require banking and utility companies to provide customers with important financial information. While federal regulations do not explicitly state that it is illegal to charge for paper statements, nclc argues that “financial institutions should not, and legally cannot, charge a fee for providing something they are mandated by law to provide.” for now, many financial institutions provide free paper statements, but unless the argument. “financial institutions and other entities that collect sensitive consumer data have a responsibility to protect it,” said samuel levine, director of the ftc’s bureau of consumer protection. “the updates adopted by the commission to the safeguards rule detail common sense steps that these institutions must implement to protect consumer. The gramm‒leach‒bliley act (glba) requires financial institutions to provide consumers with a privacy notice disclosing that a consumer’s nonpublic personal information (npi) is shared with nonaffiliated third parties, describing the consumer’s ability to opt out of sharing practices in certain circumstances, and explaining how to.

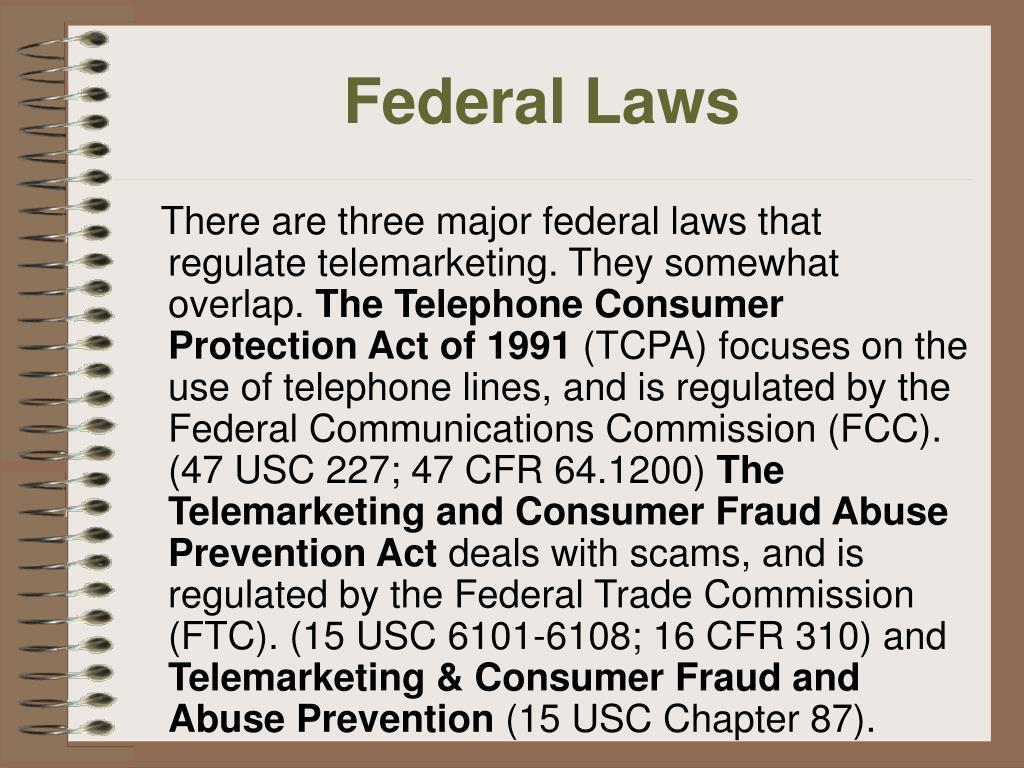

Ppt Federal Consumer Protection Laws Powerpoint Presentation Free “financial institutions and other entities that collect sensitive consumer data have a responsibility to protect it,” said samuel levine, director of the ftc’s bureau of consumer protection. “the updates adopted by the commission to the safeguards rule detail common sense steps that these institutions must implement to protect consumer. The gramm‒leach‒bliley act (glba) requires financial institutions to provide consumers with a privacy notice disclosing that a consumer’s nonpublic personal information (npi) is shared with nonaffiliated third parties, describing the consumer’s ability to opt out of sharing practices in certain circumstances, and explaining how to. Electronic statements sound eco friendly, but they are not for everyone. bank account, credit card and mortgage statements provide important information and serve a critical consumer protection function. consumers must have the right to receive that information in the manner that works for them. for many consumers, from those without regular broadband internet access to the…. Financial institutions should be advised that many of the general principles, requirements, and controls that apply to paper transactions may also apply to electronic financial services. this guidance letter contains two sections: 1) the compliance regulatory environment, and 2) the role of consumer compliance in developing and implementing.

Comments are closed.