Finance Blog Mint2save Understanding Equifax Consumer Credit Report

Finance Blog Mint2save Understanding Equifax Consumer Credit Report In todays disruptive financial times, credit score generators like equifax are no less than a boon to the bank as well as the customers. a detailed credit score can help the bank realize the customer’s basic intention behind the loan, his dedication towards servicing previous loans and decide how risky can the whole transaction be. a credit. Equifax is a consumer credit reporting agency in the u.s., it is considered as one of the three largest american credit agencies beside experian and trans union.equifax is headquartered in the usa and operates in more than 15 countries through europe, asia, north america and latin america it was founded in 1899, it is the oldest of the three agencies which gathers, maintains, reviews and.

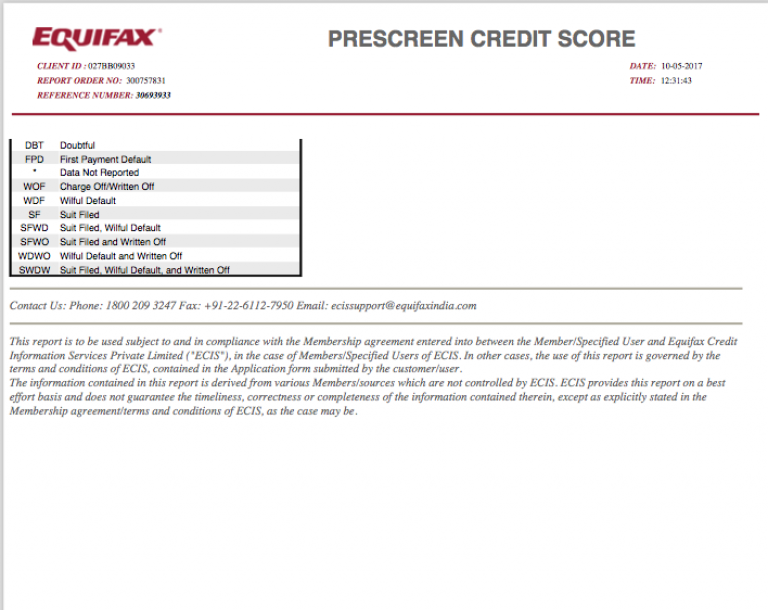

Finance Blog Mint2save Understanding Equifax Consumer Credit Report Understanding equifax consumer credit report. 14 may 2017 | 2761 views; when it comes to credit, your past decides your future, courtesy credit reports and credit score. here are some tips which will help you in understanding equifax credit report the contrasting processes adopted in th. Consumers can review their equifax credit report online free of charge via myequifax or request their credit report through annualcreditreport . consumers can also order credit reports by phone at (877) 322 8228 or by mail at the address below. your equifax credit report will be mailed to you within 15 days. Credit account information as reported to equifax by your lenders and creditors. this information includes the types of accounts, the date those accounts were opened, your credit limit or loan amount, current balances on the accounts and payment history. inquiry information. Typically, credit bureaus update reports on a monthly basis, though this can vary based on when lenders report new data. conclusion. understanding the big three credit bureaus—equifax, experian, and transunion—can help you take control of your financial health.

Finance Blog Mint2save Understanding Equifax Consumer Credit Report Credit account information as reported to equifax by your lenders and creditors. this information includes the types of accounts, the date those accounts were opened, your credit limit or loan amount, current balances on the accounts and payment history. inquiry information. Typically, credit bureaus update reports on a monthly basis, though this can vary based on when lenders report new data. conclusion. understanding the big three credit bureaus—equifax, experian, and transunion—can help you take control of your financial health. Your credit reports include information about the types of credit accounts you’ve had, your payment history and other information such as your credit limits. your credit reports are important pieces of financial information that help lenders measure your level of credit risk, or the likelihood you’ll pay your bills on time. Know the data on your credit report. you know your credit report is important, but the information that credit reporting companies use to create that report is just as important—and you have a right to see that data. use our list of credit reporting companies to request and review each of your reports. browse the list.

Comments are closed.