Financial Future Consumer Bankruptcy Show

Global Bankruptcy Trends Will 2022 Be The Year Of Financial Reckoning Chapter 7 bankruptcy, also known as straight or liquidation bankruptcy, involves selling off some of your assets to pay off what you can and discharging the rest of your debts. the court assigns a trustee to your case who will manage the liquidation of your assets and pay your creditors with the proceeds. certain assets are exempt, but the. Facts and figures. in the 16 year span from oct. 1, 2005, to sept. 30, 2021, about 15.3 million nonbusiness bankruptcy petitions were filed in the federal courts (i.e., filings involving mainly consumer debt). of those, 10.3 million – 67 percent of total nonbusiness filings – were filed under chapter 7, and 5 million – 32 percent of total.

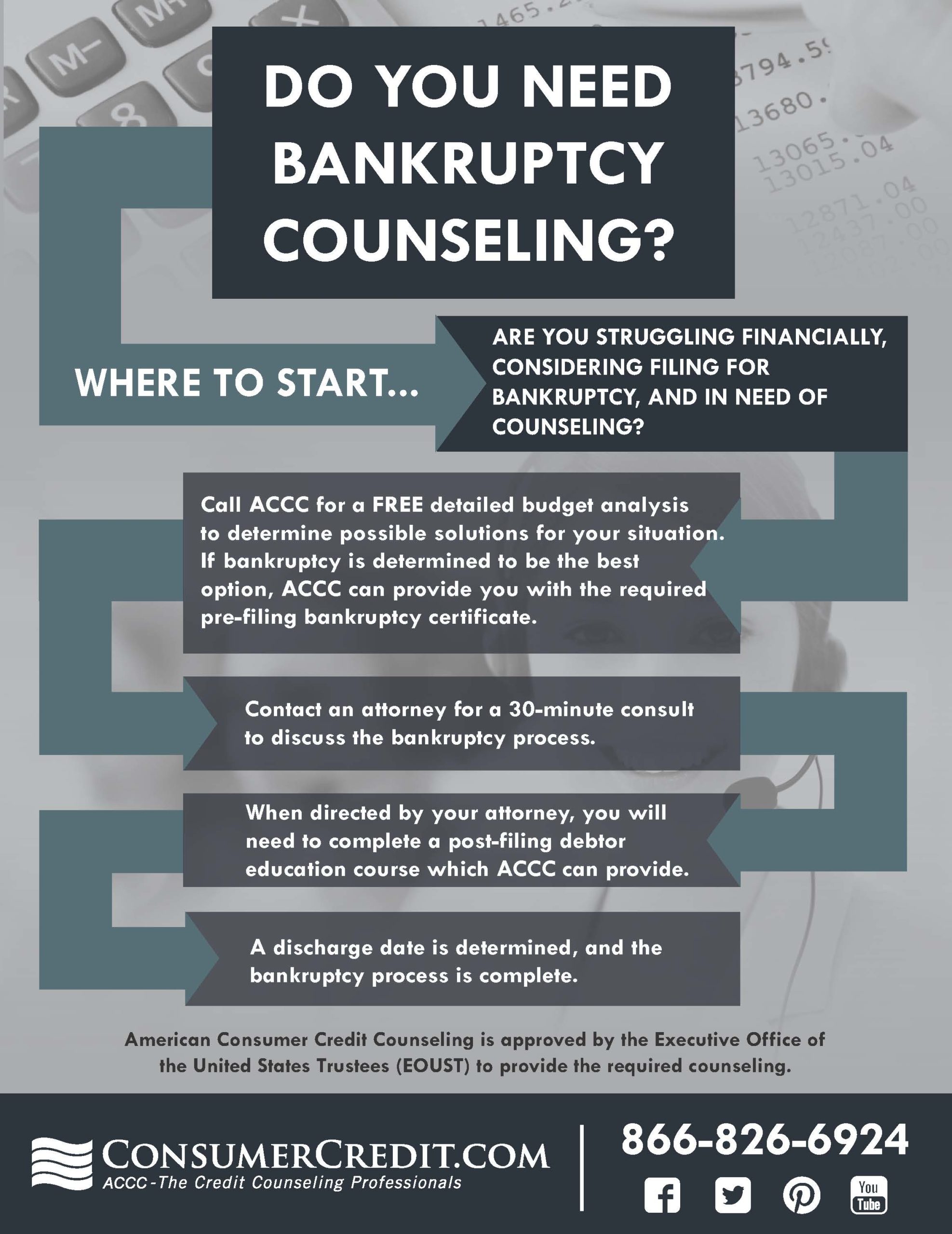

Understanding The Bankruptcy Process Consumercredit Chapter 7 stays on your record for 10 years, while chapter 13 stays for seven years. that would seem to suggest that chapter 7 is worse for your credit score, but with chapter 7, your debt, or at. Fact 5: bankruptcy will not ruin your financial future. there’s no way around it: you can expect to have limited access to credit and to pay higher interest rates for the seven to 10 years that. In 2023, chapter 7 bankruptcy filings rose 15.8% from 225,455 to 261,277 over the previous year. a successful chapter 7 bankruptcy can erase unsecured debts. you also could be permitted to keep key assets considered “exempt” property. non exempt property will be sold to repay part of your debt. Bankruptcy is the legal process that a person or business initiates when they are unable to meet their financial obligations. through the legal process of bankruptcy, debtors will liquidate their assets or restructure their finances in order to fund or eliminate their debts that they are unable to pay.

New Campaign Consumer Debt Helpers Bankruptcy Lunasol Media In 2023, chapter 7 bankruptcy filings rose 15.8% from 225,455 to 261,277 over the previous year. a successful chapter 7 bankruptcy can erase unsecured debts. you also could be permitted to keep key assets considered “exempt” property. non exempt property will be sold to repay part of your debt. Bankruptcy is the legal process that a person or business initiates when they are unable to meet their financial obligations. through the legal process of bankruptcy, debtors will liquidate their assets or restructure their finances in order to fund or eliminate their debts that they are unable to pay. It’s important to remember that bankruptcy will stay on your credit report for 7 to 10 years. you will need to focus on rebuilding your credit during this time by making regular payments on time and keeping your balances low. you will want to have 2 5 consumer cards that you use and make timely payments on to rebuild your credit score with. Bankruptcy is a legal tool to help consumers and businesses resolve overwhelming debt. it’s a complicated process that’s best taken on with the assistance of an attorney. chapter 7 and chapter.

Comments are closed.