Financial Life Cycle

5 Stages Of Financial Life Cycle Printable Templates Protal Learn how to navigate the nuanced financial requirements of each stage of life, from youth to retirement. find out how to invest, save, protect and enjoy your wealth with life cycle financial planning. Stage four: distribution of wealth (retirement) the fourth and final stage of your financial life cycle is retirement. your working days are over, and you've officially entered your golden years. with your income from work likely at $0, you're now living off your retirement accounts (assuming you're of age to take distributions) and either.

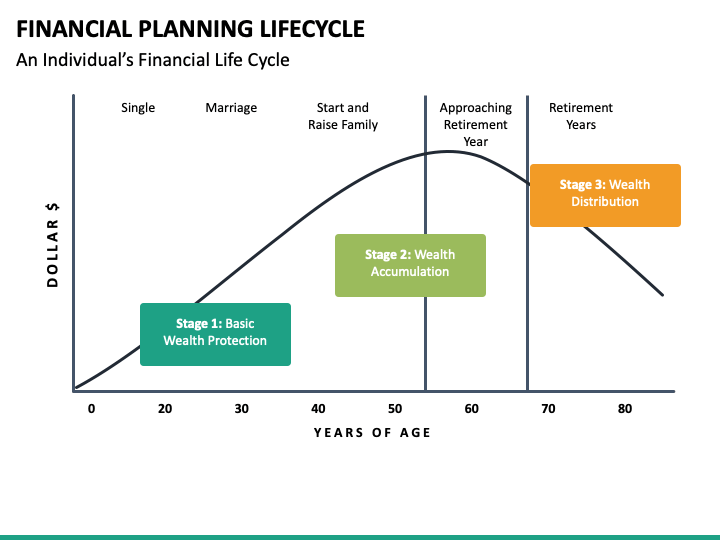

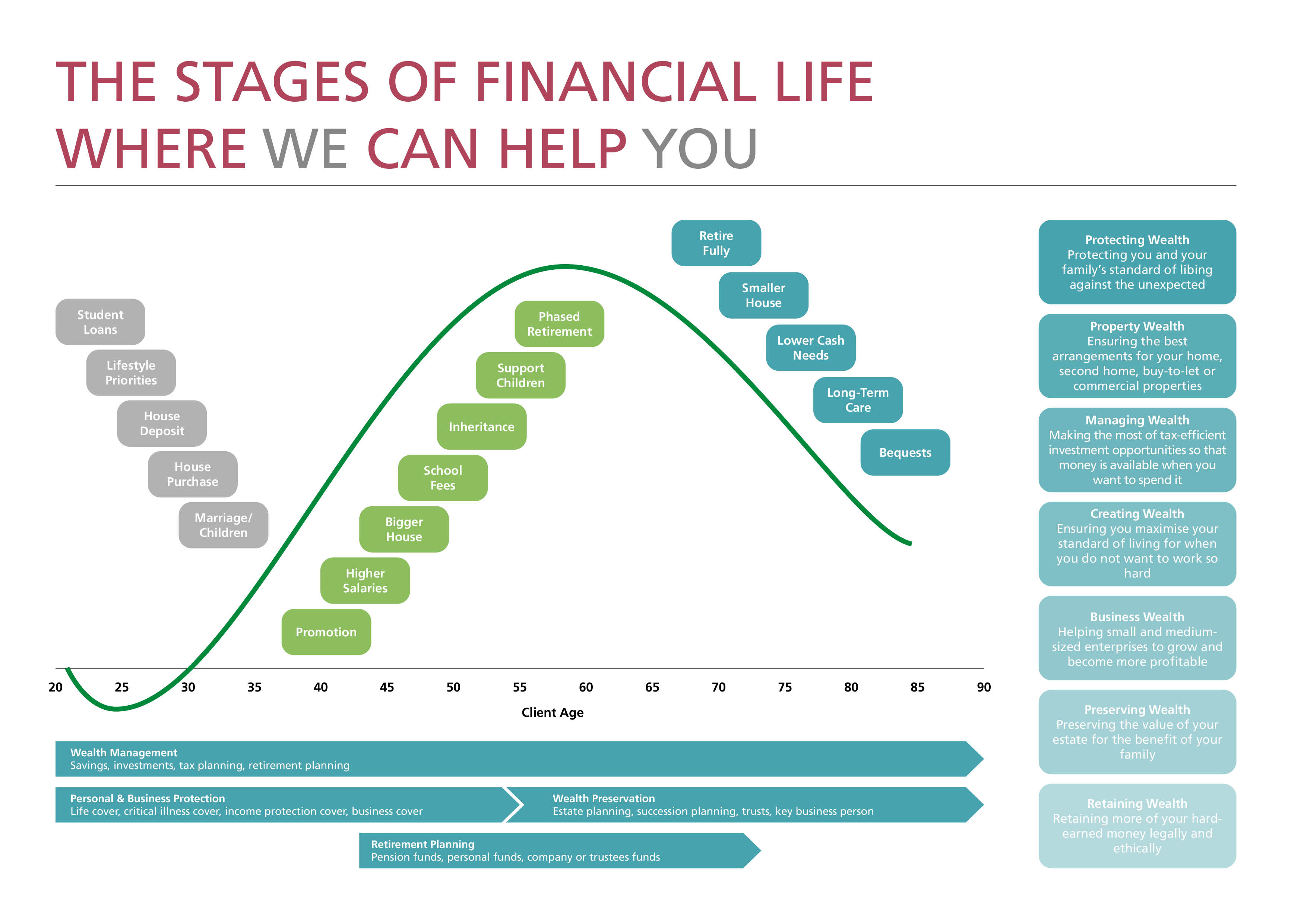

5 Stages Of Financial Life Cycle Printable Templates Protal The 5 stages of the personal financial life cycle are: 1) early career and accumulation, 2) family formation and protection, 3) mid career and growth, 4) pre retirement and preservation, and 5) retirement and distribution. these stages represent different financial goals and challenges individuals may face throughout their lives. The financial planning life cycle offers a structured approach to managing finances through different life stages. it outlines key steps for achieving financial goals and security. embarking on the journey of financial planning can often seem daunting to beginners. with its critical importance in securing a financially stable future. Learn how to manage your wealth over four stages of the financial life cycle: accumulation, growth, preservation and transfer. get tips from huntington bank's robert klug on how to align your personal and business finances and reduce risk. Planning for each stage of the financial life cycle individually can lead to disjointed decision making and inefficient financial plans. a holistic approach, however, provides several key benefits: 1. offers alignment with both short and long term goals. aligning your personal financial planning with your short and long term goals forges a.

Financial Life Cycle What Are The Stages Yadnya Investment Academy Learn how to manage your wealth over four stages of the financial life cycle: accumulation, growth, preservation and transfer. get tips from huntington bank's robert klug on how to align your personal and business finances and reduce risk. Planning for each stage of the financial life cycle individually can lead to disjointed decision making and inefficient financial plans. a holistic approach, however, provides several key benefits: 1. offers alignment with both short and long term goals. aligning your personal financial planning with your short and long term goals forges a. Here are the key investing steps for all of life’s stages and some portfolios to get you started. margaret giles oct 23, 2023. as our lives evolve, so do our financial and investment priorities. What are the steps in the financial planning process? the steps in the financial planning process typically include: (1) gathering financial information, (2) setting financial goals, (3) analyzing the financial situation, (4) developing a financial plan, (5) implementing the plan, (6) monitoring the plan, and (7) making adjustments as needed.

Stages Of Financial Life Cycle Printable Templates Protal Here are the key investing steps for all of life’s stages and some portfolios to get you started. margaret giles oct 23, 2023. as our lives evolve, so do our financial and investment priorities. What are the steps in the financial planning process? the steps in the financial planning process typically include: (1) gathering financial information, (2) setting financial goals, (3) analyzing the financial situation, (4) developing a financial plan, (5) implementing the plan, (6) monitoring the plan, and (7) making adjustments as needed.

Financial Life Cycle

Comments are closed.