Financial Modeling For Startups Create A Model Using Examples

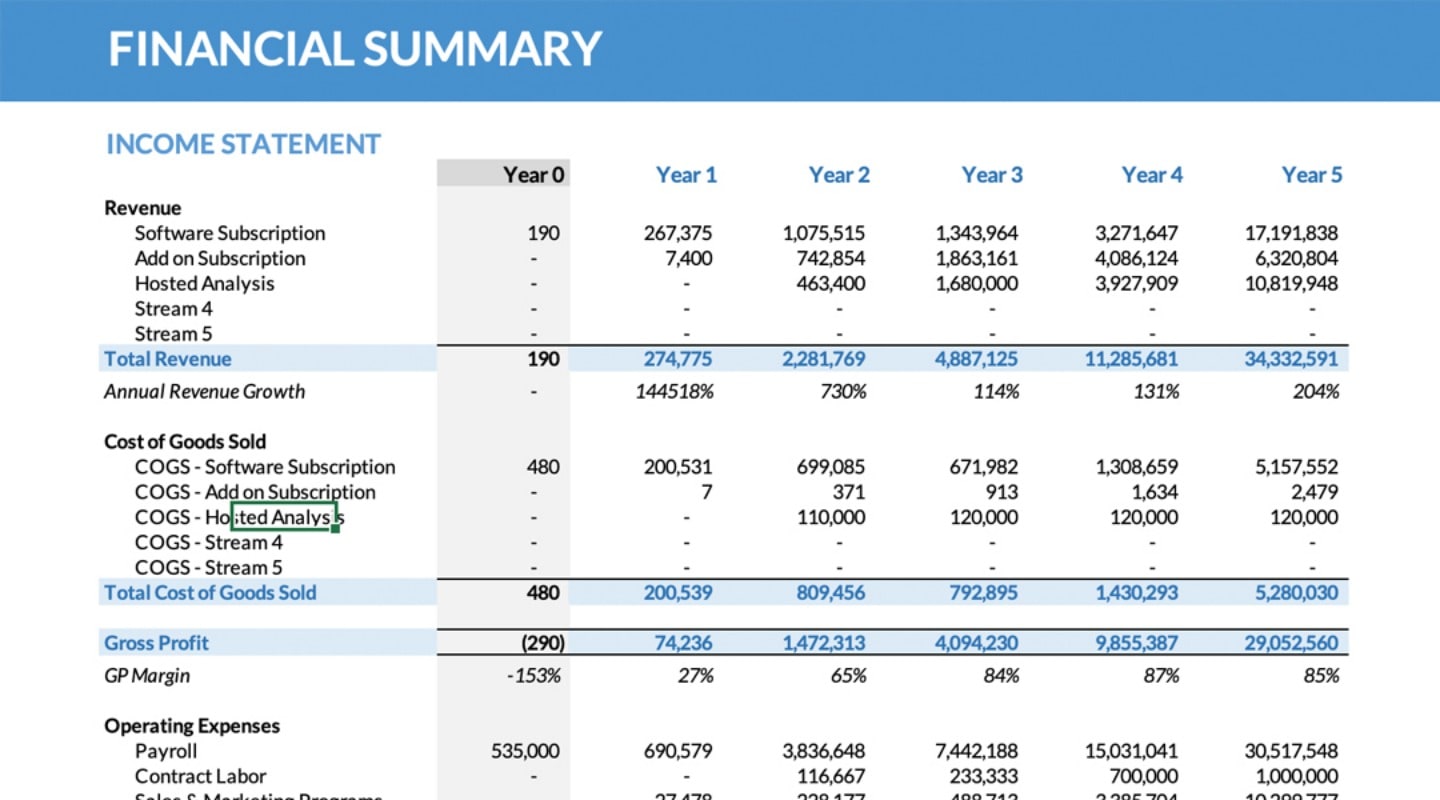

Financial Modeling For Startups Create A Model Using Examples Financial modeling for startups – assumptions. 1. revenue: it is a crucial assumption for startup financial models. as startups don’t have much financial data, analysts assess the markets of similar industries. the assumptions are based on another company’s data matching the startup’s size or scope. 2. 1. start with revenue projections. revenue is the lifeblood of any startup. it’s the primary indicator of market demand and the foundation for all other financial assumptions. “revenue will influence the rest of the profit and loss (p&l) assumptions,” says tiffany hovland, cpa and vice president of growth operators.

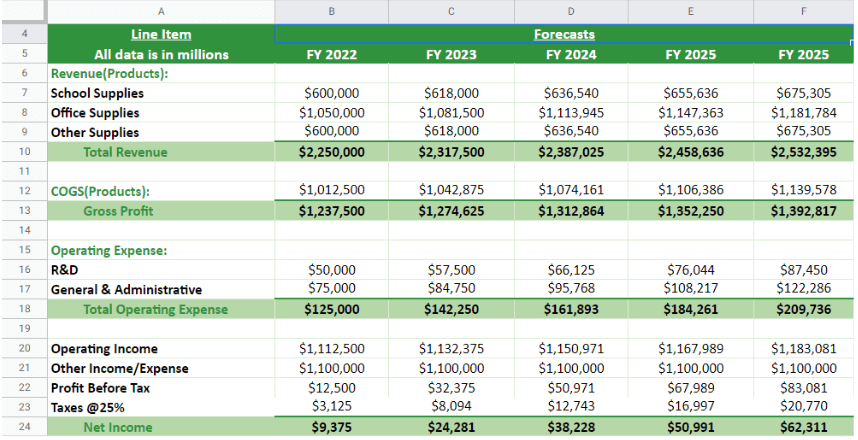

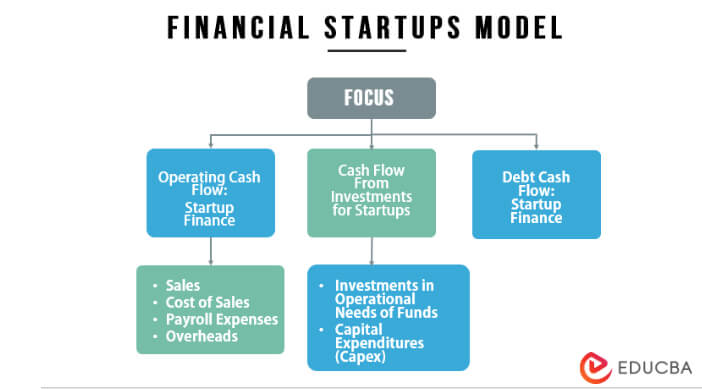

Financial Modeling For Startups Create A Model Using Examples Steps to create a startup financial model. here we use the top down approach to create the financial model in excel. revenue: the first thing is to determine and forecast the revenue for the product you are launching. it can be a bit tricky because you are a new entrant into the market. Step 1: create financial projections for your firm (tick in the box!). step 2: determine the projected free cash flows. step 3: determine the discount factor. step 4: calculate the net present value of your free cash flows and terminal value by using the discount factor. step 5: sum up all results of step 4. Step 2. identify key performance indicators (kpis) determine the critical metrics that will drive your business forward. kpis are the backbone of your model, helping you track performance and make informed decisions. use industry standard kpis as a benchmark and tailor them to your business needs. You can create a financial model for a startup by determining the key performance indicators (kpis) of the startup company, modeling its revenue, using a financial template as a starting point, projecting your staffing and marketing costs, and estimating additional expenses based on other successful companies in your industry.

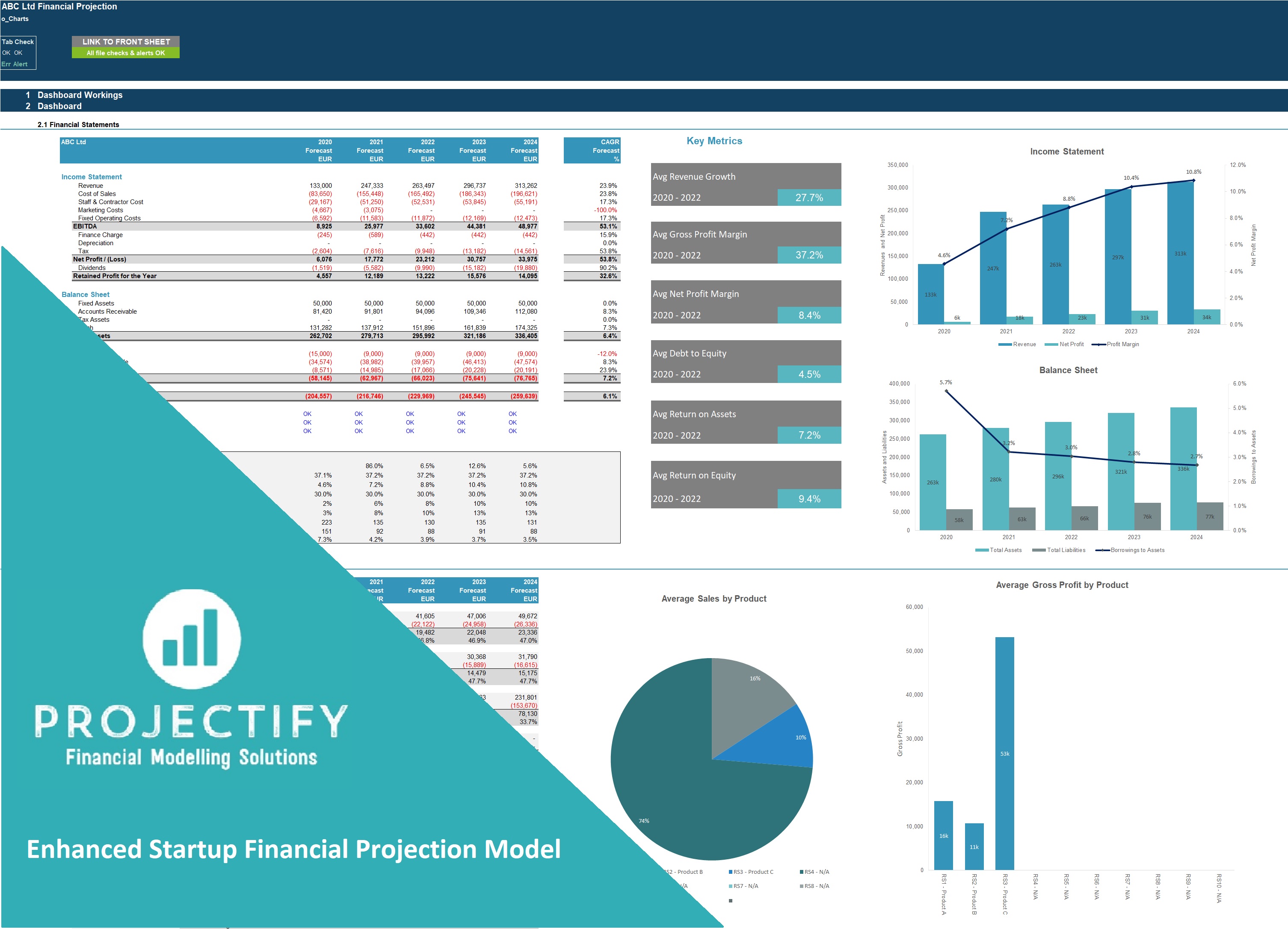

Startup Financial Model Excel Template Step 2. identify key performance indicators (kpis) determine the critical metrics that will drive your business forward. kpis are the backbone of your model, helping you track performance and make informed decisions. use industry standard kpis as a benchmark and tailor them to your business needs. You can create a financial model for a startup by determining the key performance indicators (kpis) of the startup company, modeling its revenue, using a financial template as a starting point, projecting your staffing and marketing costs, and estimating additional expenses based on other successful companies in your industry. Table of contents. why your financial model matters. step 1: start with your revenue model. step 2: factor in your costs. step 3: forecast your cash flow. step 4: include a profit and loss statement. step 5: don't forget about the balance sheet. getting your model ready to raise. The complete guide to financial modeling: best practices, examples, and more. the perfect financial model can help you see into the future of your business. it can help you apply past trends to understand future performance, see what impact new assumptions would have on your outcomes, and outline quantitative for strategic initiatives.

How To Build A Startup Financial Model Table of contents. why your financial model matters. step 1: start with your revenue model. step 2: factor in your costs. step 3: forecast your cash flow. step 4: include a profit and loss statement. step 5: don't forget about the balance sheet. getting your model ready to raise. The complete guide to financial modeling: best practices, examples, and more. the perfect financial model can help you see into the future of your business. it can help you apply past trends to understand future performance, see what impact new assumptions would have on your outcomes, and outline quantitative for strategic initiatives.

Comments are closed.