Financial Planning For Established Families Life Stages Of A Financial Plan Episode Four

Financial Planning For Established Families Life Stages Of A Sign up for our financial planning masterclass here: financialmasterclass.ca there are over 10 modules in the course that go over a different part of. At its core, life cycle financial planning serves as a personalized compass. it helps you navigate the nuanced financial requirements that characterize the different stages of life. life cycle.

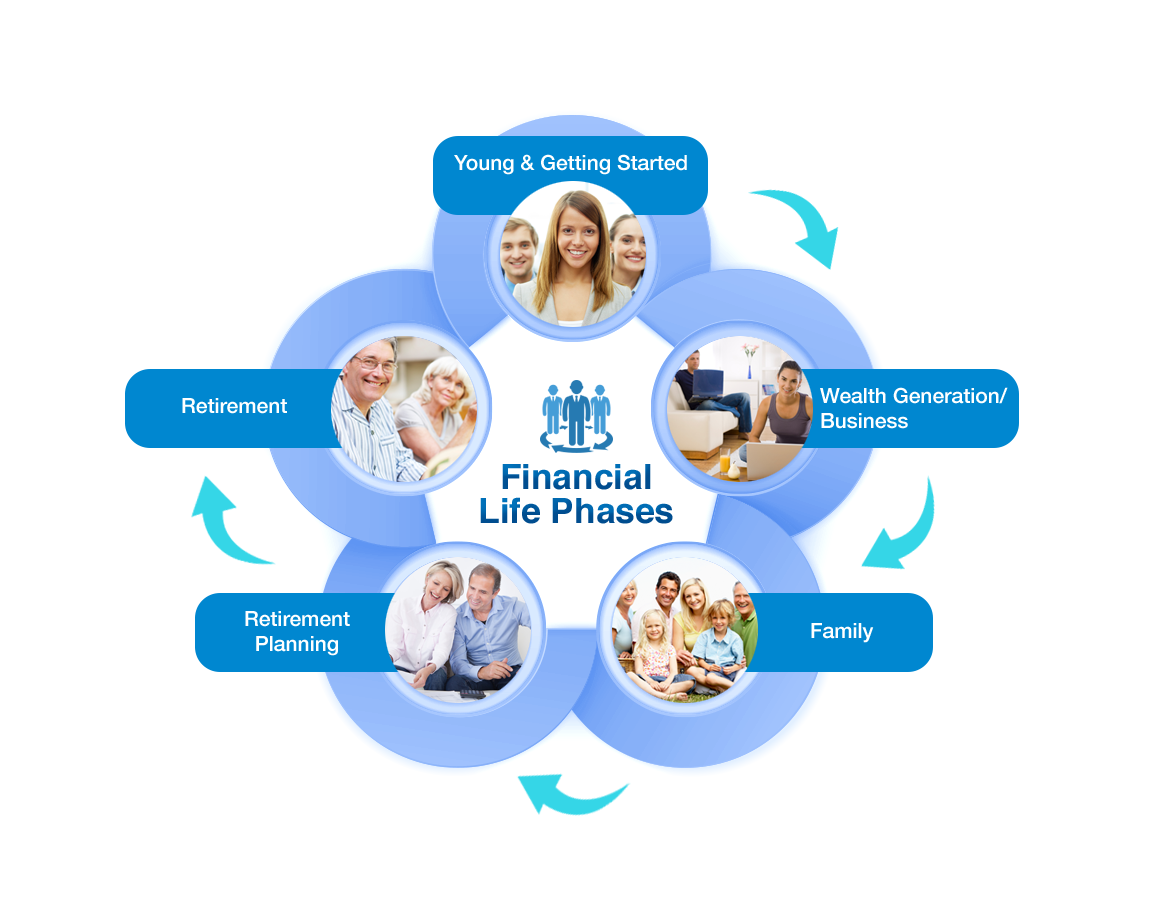

Financial Life Phases Wealthlife Retirement. post retirement. these family budget and financial planning tips will help you at each stage. newlyweds. at this stage, your finances are legally combined with another person’s, perhaps for the first time. ideally, you disclosed your financial details to each other before you got married — even before you got engaged — and you. Establishing a career (ages 30 45) as your financial resources grow over time, so should your planning strategies. establish clear financial goals, such as buying a home, starting a family or saving for your children’s college educations. increase your retirement savings. it’s wise to direct at least 10% to 15% to your retirement accounts. Planning for each stage of the financial life cycle individually can lead to disjointed decision making and inefficient financial plans. a holistic approach, however, provides several key benefits: 1. offers alignment with both short and long term goals. aligning your personal financial planning with your short and long term goals forges a. Financial life planning is a holistic approach to managing personal finances that considers an individual's values, goals, and life stages. it aims to create a customized financial strategy that helps individuals achieve their short term and long term objectives while maintaining financial stability and well being.

Life Stage Financial Planning Financial Planning Singapore The Planning for each stage of the financial life cycle individually can lead to disjointed decision making and inefficient financial plans. a holistic approach, however, provides several key benefits: 1. offers alignment with both short and long term goals. aligning your personal financial planning with your short and long term goals forges a. Financial life planning is a holistic approach to managing personal finances that considers an individual's values, goals, and life stages. it aims to create a customized financial strategy that helps individuals achieve their short term and long term objectives while maintaining financial stability and well being. Financial planning at this stage. at this stage of your life, you may be considering: moving forward in a career. caring for a young or growing family. starting to save for children‘s education. buying a home. health and how it impacts finances and family. investing in general or through a 401 (k). Common financial priorities during this stage: budgeting retirement income. maximizing tax efficiency. detailed estate planning. these are the four most common life stages for financial.

Comments are closed.