Five Solid Reasons To Get Life Insurance Lifeinsurance

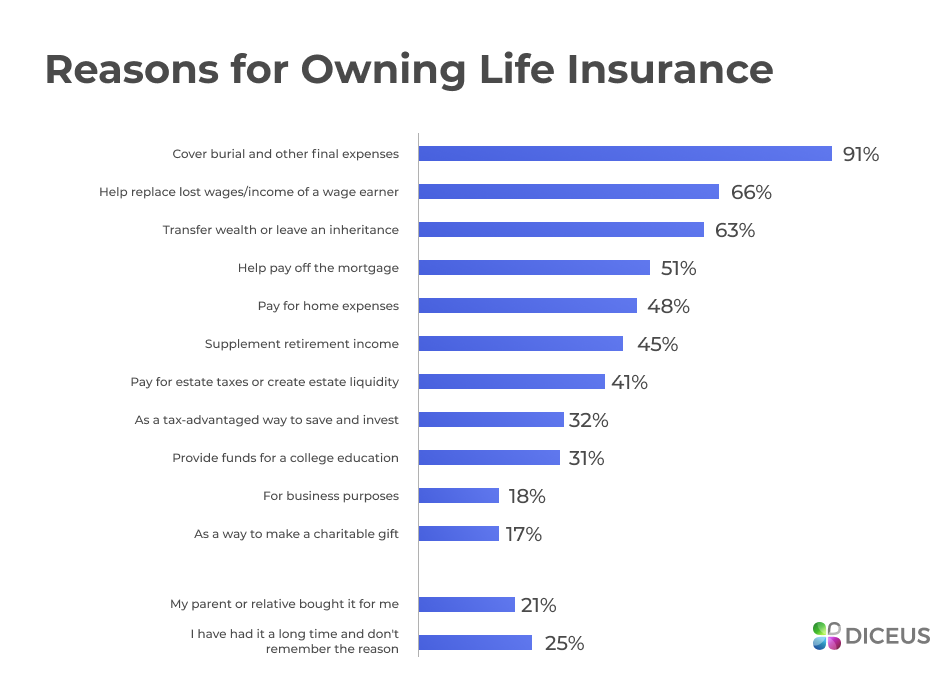

Five Solid Reasons To Get Life Insurance Lifeinsurance According to a recent nerdwallet study, the most common reason americans buy life insurance is to cover final expenses. the second most commonly selected reason is to leave an inheritance. Benefits of term life insurance. term life insurance lets you lock in a level rate for a set number of years. after the term is up, the policy expires unless you renew (at a new, higher rate). a.

Life Insurance Financial Services Accident Insurance Retirement Here are some reasons why you need it, courtesy of small business owners who know the score: 1. to protect your income. if you are the sole income earner in your family, life insurance is crucial. Life insurance can help protect your family’s future by replacing income, paying off debts and covering end of life expenses. those with mortgage debt, breadwinners and older adults may benefit most from life insurance. life insurance serves as a safeguard, helping prevent financial difficulties for beneficiaries. One of the most compelling reasons to buy life insurance is to provide financial support to dependents when they need it most — after the policyholder's passing. when a family loses a loved one, especially a breadwinner, it can be a double blow: emotional loss and a potential financial crisis. 10 reasons to buy life insurance. you may have heard you should get life insurance to protect your family in case you die but there are many other reasons to purchase a policy.

Five Solid Reasons To Get Life Insurance Lifeinsurance One of the most compelling reasons to buy life insurance is to provide financial support to dependents when they need it most — after the policyholder's passing. when a family loses a loved one, especially a breadwinner, it can be a double blow: emotional loss and a potential financial crisis. 10 reasons to buy life insurance. you may have heard you should get life insurance to protect your family in case you die but there are many other reasons to purchase a policy. With whole life insurance, you can help make sure that your loved ones have the money they need to help: 3. tax free benefit. your beneficiaries will be able to enjoy every penny you leave them. that’s because the benefit of a life insurance policy is generally passed along federal income tax free. 4. There are two main types of life insurance: term life insurance and permanent life insurance. term life insurance lasts for a set period of time, such as 10 or 20 years, and it's the cheapest type.

Five Solid Reasons To Get Life Insurance Lifeinsurance With whole life insurance, you can help make sure that your loved ones have the money they need to help: 3. tax free benefit. your beneficiaries will be able to enjoy every penny you leave them. that’s because the benefit of a life insurance policy is generally passed along federal income tax free. 4. There are two main types of life insurance: term life insurance and permanent life insurance. term life insurance lasts for a set period of time, such as 10 or 20 years, and it's the cheapest type.

Five Solid Reasons To Get Life Insurance Lifeinsurance

Ultimate Guide To Buy A Term Life Insurance Its Time To Boost

Comments are closed.