Five Steps To Enterprise Risk Management Risk Decisions

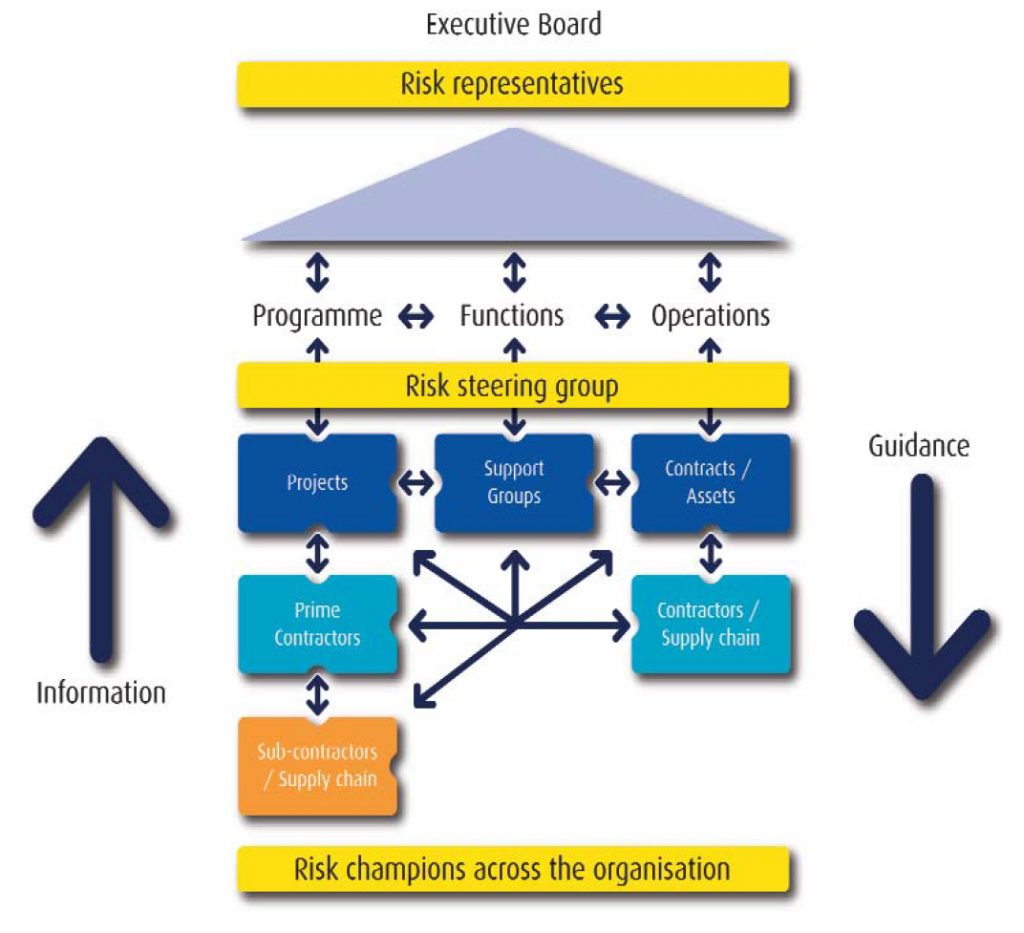

Enterprise Risk Management What It Is How To Achieve It Step 1 – establish an enterprise risk structure. erm requires the whole organisation to identify, communicate and proactively manage risk, regardless of position or perspective. everyone needs to follow a common approach, which includes a consistent policy and process, a single repository for their risks and a common reporting format. Enterprise risk management (erm) is a constantly evolving field, but remains focused on identifying and minimizing risks that companies face. these risks might be specific to an industry (for example, hipaa compliance in the healthcare field) or those faced by virtually every organization in the 21st century, such as cyber threats.

Five Steps To Enterprise Risk Management Risk Decisions The process is essentially the same for any type of entity and includes the following five core steps for documenting, assessing and managing risks. 1. identify risks. the first step in the risk management process is to determine the potential business risks your organization faces. that requires some context: to consider what could go wrong. The enterprise risk management process. an enterprise risk management framework consists of the following steps: establish risk appetite. all banks have a buffer that protects them if losses in the future turn out to be larger than expected. this buffer, referred to as capital, is finite and limits the risk a bank can take. Enterprise risk management is a framework for dealing with organizational risk as a whole. it combines tried and tested risk management strategies and best practices into a single holistic methodology. as the name suggests, it covers enterprise wide risks, including financial, operational, legal, contractual and regulatory risks. Enterprise risk management identifies, assesses, and manages operational, financial, and strategic risks. operational risks arise from internal failures, such as cybersecurity issues. financial risks, such as market or credit issues, are linked to the economy. strategic risks result from high level decisions affecting long term objectives, such.

Five Core Steps Of The Risk Management Process Enterprise risk management is a framework for dealing with organizational risk as a whole. it combines tried and tested risk management strategies and best practices into a single holistic methodology. as the name suggests, it covers enterprise wide risks, including financial, operational, legal, contractual and regulatory risks. Enterprise risk management identifies, assesses, and manages operational, financial, and strategic risks. operational risks arise from internal failures, such as cybersecurity issues. financial risks, such as market or credit issues, are linked to the economy. strategic risks result from high level decisions affecting long term objectives, such. Risk intelligent decision making. leading practice risk is built into decision making. selectively seize opportunities because of ability to exploit risks. integrated activities are implemented consistently across the enterprise and are correlated and aggregated across risk types and business units, and encompass most risk types. defined. Steps of the risk management process. identify the risk. analyze the risk. prioritize the risk. treat the risk. monitor the risk. with any new project comes new risks lying in wait. these risks can differ from misalignment between stakeholders to lack of resources to major regulatory changes in the industry.

Risk Management Lifecycle 5 Steps To A Safer More Resilient Risk intelligent decision making. leading practice risk is built into decision making. selectively seize opportunities because of ability to exploit risks. integrated activities are implemented consistently across the enterprise and are correlated and aggregated across risk types and business units, and encompass most risk types. defined. Steps of the risk management process. identify the risk. analyze the risk. prioritize the risk. treat the risk. monitor the risk. with any new project comes new risks lying in wait. these risks can differ from misalignment between stakeholders to lack of resources to major regulatory changes in the industry.

5 Top Tips To Make The Risk Management Process More Efficient

What Risk Managers Need To Know To Establish An Enterprise Risk

Comments are closed.