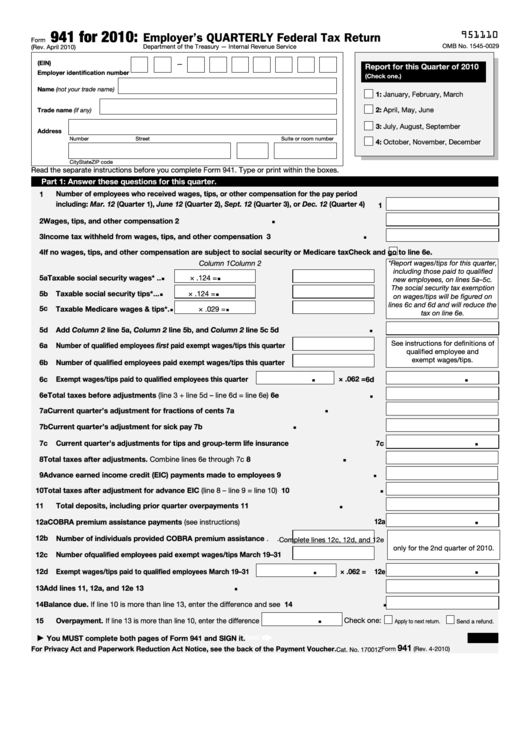

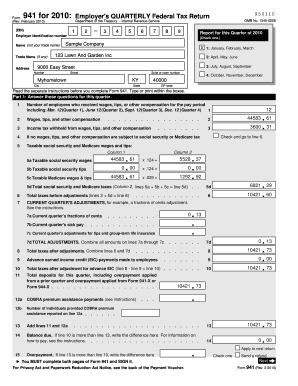

Form 941 Employer S Quarterly Federal Tax Return 2010 Printable Pdf

Fillable Form 941 Employer S Quarterly Federal Tax Return The electronic federal tax payment system (eftps). see section 11 of pub. 15 (circular e) for deposit instructions. do not use form 941 v to make federal tax deposits. caution. use form 941 v when making any payment with form 941. however, if you pay an amount with form 941 that should have been deposited, you may be subject to a penalty. see. Employers use schedule d (form 941) to explain certain discrepancies between forms w 2, wage and tax statement, and forms 941, employer's quarterly federal tax return, for the totals of: social security wages. medicare wages and tips. social security tips, federal income tax withheld. advance earned income credit (eic) payments.

Form 941 Employers Quarterly Federal Tax Return Clover Fil Box 4—name and address. enter your name and address as shown on form 941. enclose your check or money order made payable to “united states treasury.”. be sure to enter your ein, “form 941,” and the tax period (“1st quarter 2024,” “2nd quarter 2024,” “3rd quarter 2024,” or “4th quarter 2024”) on your check or money order. Download a blank fillable form 941 employer's quarterly federal tax return 2010 in pdf format just by clicking the "download pdf" button. open the file in any pdf viewing software. adobe reader or any alternative for windows or macos are required to access and complete fillable content. Form 943, employer's annual federal tax return for agricultural employees, which is used instead of form 941 to report once a year on the amount of withheld federal income and fica taxes (employee and employer share). form 944, employer's annual federal tax return, which is filed instead of the quarterly employer returns if the employer is "small.". Here's a step by step guide and instructions for filing irs form 941. 1. gather information needed to complete form 941. form 941 asks for the total amount of tax you've remitted on behalf of your.

How To Fill Out 2020 юааformюаб юаа941юаб юааemployerтащsюаб юааquarterlyюаб юааfederalюаб юааtaxюаб Form 943, employer's annual federal tax return for agricultural employees, which is used instead of form 941 to report once a year on the amount of withheld federal income and fica taxes (employee and employer share). form 944, employer's annual federal tax return, which is filed instead of the quarterly employer returns if the employer is "small.". Here's a step by step guide and instructions for filing irs form 941. 1. gather information needed to complete form 941. form 941 asks for the total amount of tax you've remitted on behalf of your. To request to file quarterly forms 941 to report your social security and medicare taxes for the 2024 calendar year, you must either call the irs at 800 829 4933 between january 1, 2024, and april 1, 2024, or send a written request postmarked between january 1, 2024, and march 15, 2024. after you contact the irs, the irs will send you a written. Updated april 09, 2024. a form 941 (employer’s quarterly federal tax return) is an irs document used by employers to report federal payroll taxes withheld from employees’ wages on a quarterly basis. federal payroll taxes include income tax and the employer and employee’s fica contributions to social security and medicare.

Comments are closed.