Form 941 Rev January 2002 Employer S Quarterly Federal Tax Re

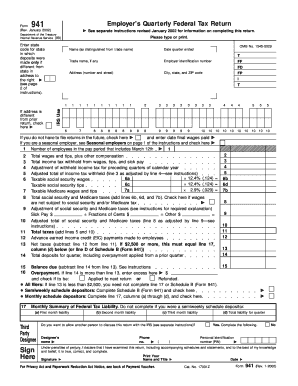

Form 941 Rev January 2002 Employer S Quarterly Federal Tax Return Form 941 (rev. 1 2002) form 941 employer’s quarterly federal tax return (rev. january 2002) see separate instructions revised january 2002 for information on completing this return. department of the treasury internal revenue service please type or print. omb no. 1545 0029 t ff fd fp i t if address is different from prior return, check here. Employers use schedule d (form 941) to explain certain discrepancies between forms w 2, wage and tax statement, and forms 941, employer's quarterly federal tax return, for the totals of: social security wages. medicare wages and tips. social security tips, federal income tax withheld. advance earned income credit (eic) payments.

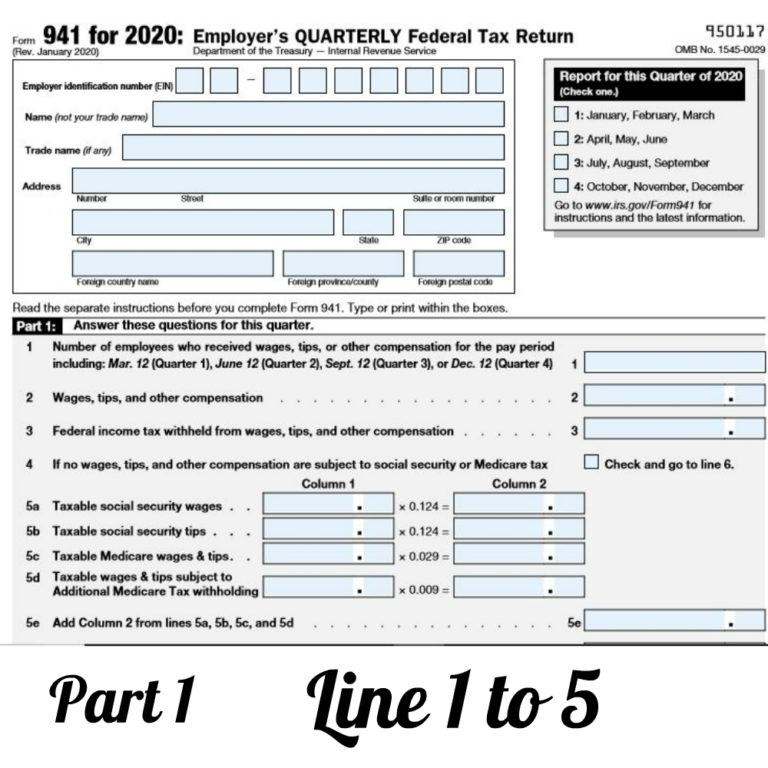

Fillable Online Form 941 Schedule B Rev January 2002 Employer S For small employers. an employer that owes employment taxes of $1,000 or less for the year can file form 944, employer’s annual federal tax return if given irs permission to do so. call 800 829. Here's a step by step guide and instructions for filing irs form 941. 1. gather information needed to complete form 941. form 941 asks for the total amount of tax you've remitted on behalf of your. Irs form 941 is a 3 page form with 5 parts. you must complete all 3 pages of form 941 and sign on page 3. failure to do so may delay the processing of your return. here's a step by step for each part of irs form 941. the employer reports the number of staff employed, wages, and taxes withheld in part 1. Irs form 941 is the employer’s quarterly tax return. this form reports withholding of federal income taxes from employees’ wages or salaries, as well as medicare and social security withholdings (fica taxes). employers can use form 941 to calculate how much they must contribute to their employees’ medicare and social security taxes.

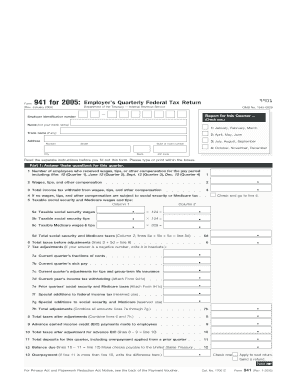

Irs Form 941 Employer S Quarterly Federal Tax Return Forms Docs 2023 Irs form 941 is a 3 page form with 5 parts. you must complete all 3 pages of form 941 and sign on page 3. failure to do so may delay the processing of your return. here's a step by step for each part of irs form 941. the employer reports the number of staff employed, wages, and taxes withheld in part 1. Irs form 941 is the employer’s quarterly tax return. this form reports withholding of federal income taxes from employees’ wages or salaries, as well as medicare and social security withholdings (fica taxes). employers can use form 941 to calculate how much they must contribute to their employees’ medicare and social security taxes. Complete form 941 v if you're making a payment with form 941. the irs will use the completed voucher to credit your payment more promptly and accurately. we last updated the employer's quarterly federal tax return in january 2024, so this is the latest version of form 941, fully updated for tax year 2023. 941 ss, line 10. completing the employer’s record of federal tax liability. if you are required to report your tax liabilities on schedule b (form 941) as discussed above, file the schedule with forms 941 or 941 ss. do not complete columns (a) through (d) of the monthly summary of federal tax liability (line 17 on form 941 or 941 ss).

How To Fill Out 2020 Form 941 Employer S Quarterly Federal Tax Return Complete form 941 v if you're making a payment with form 941. the irs will use the completed voucher to credit your payment more promptly and accurately. we last updated the employer's quarterly federal tax return in january 2024, so this is the latest version of form 941, fully updated for tax year 2023. 941 ss, line 10. completing the employer’s record of federal tax liability. if you are required to report your tax liabilities on schedule b (form 941) as discussed above, file the schedule with forms 941 or 941 ss. do not complete columns (a) through (d) of the monthly summary of federal tax liability (line 17 on form 941 or 941 ss).

Fillable Online Form 941 Rev January 2005 Employer S Quarterly

Comments are closed.