Four Steps Of Automated Debt Collection Process Presentation Graphics

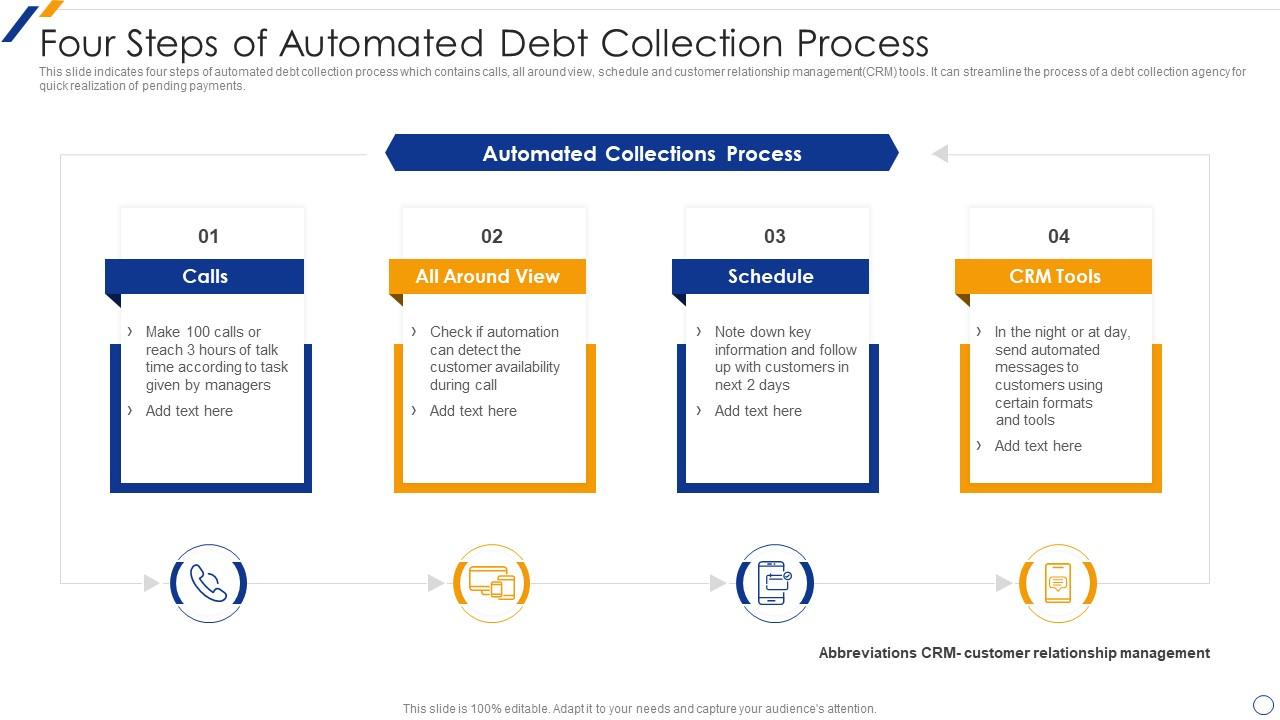

Four Steps Of Automated Debt Collection Process Presentation Graphics Introducing our premium set of slides with four steps of automated debt collection process. ellicudate the four stages and present information using this ppt slide. this is a completely adaptable powerpoint template design that can be used to interpret topics like customer availability, automated collections process, crm tools. This slide indicates four steps of automated debt collection process which contains calls, all around view, schedule and customer relationship managementcrm tools. it can streamline the process of a debt collection agency for quick realization of pending payments.presenting four steps of automated debt recovery process portrait pdf to dispense.

Automated Debt Collection And Management Process Ppt Sample This slide indicates four steps of automated debt collection process which contains calls, all around view, schedule and customer relationship management crm tools. it can streamline the process of a debt collection agency for quick realization of pending payments. Purpose of the following slide is to display the detailed analysis of the debt collection process as it highlights the key steps in the process, these steps can be detailed analysis of case, establishing contact with client, assessing the case, security adjustment presenting debt retrieval techniques detailed analysis of debt collection process. Automated debt collection and management process. this slide consist of automated debt collection process that enables automatic communication across several channels. it includes four steps such as contact customers after list generation, take 360 view, follow up task, etc. presenting our set of slides with automated debt collection and. Four steps of automated debt recovery process portrait pdf. this slide indicates four steps of automated debt collection process which contains calls, all around view, schedule and customer relationship managementcrm tools. it can streamline the process of a debt collection agency for quick realization of pending payments.presenting four steps.

Four Steps Of Automated Debt Recovery Process Portrait Pdf Powerpoint Automated debt collection and management process. this slide consist of automated debt collection process that enables automatic communication across several channels. it includes four steps such as contact customers after list generation, take 360 view, follow up task, etc. presenting our set of slides with automated debt collection and. Four steps of automated debt recovery process portrait pdf. this slide indicates four steps of automated debt collection process which contains calls, all around view, schedule and customer relationship managementcrm tools. it can streamline the process of a debt collection agency for quick realization of pending payments.presenting four steps. According to the transunion report in 2023, 11% of debt collection companies, also known as third party collection (3 pc) companies, already use ai in their tasks. the report further details that: 58% of these companies use ai to predict payment outcomes, such as a person’s ability or willingness to pay a debt. • applied analytics: using analytics in your debt collection process can help you avoid bad debts and difficult collections. with the help of analytics, you can easily assess a customer’s.

5 Ways To Improve Your Debt Collection Process Through Automation According to the transunion report in 2023, 11% of debt collection companies, also known as third party collection (3 pc) companies, already use ai in their tasks. the report further details that: 58% of these companies use ai to predict payment outcomes, such as a person’s ability or willingness to pay a debt. • applied analytics: using analytics in your debt collection process can help you avoid bad debts and difficult collections. with the help of analytics, you can easily assess a customer’s.

Debt Management Debt Collection Process Ppt Powerpoint Presentation

Debt Collection Process Ppt Powerpoint Presentation Inspiration Cpb

Comments are closed.