Free Online Bookkeeping Course 7 Double Entry Bookkeeping System

Free Online Bookkeeping Course 7 Double Entry Bookkeeping System The basics of double entry bookkeeping including simple ways to remember debits and credits.need help with sage or other accounting software? drop us an emai. The ohsc’s free online bookkeeping course is a 20 hour program that covers the fundamentals of bookkeeping, including basic terminology, essential financial records, double entry bookkeeping, ledger preparation, and more. the course is completely free to complete, though you’ll need to pay a small fee ranging from £25 to £45 for a copy of.

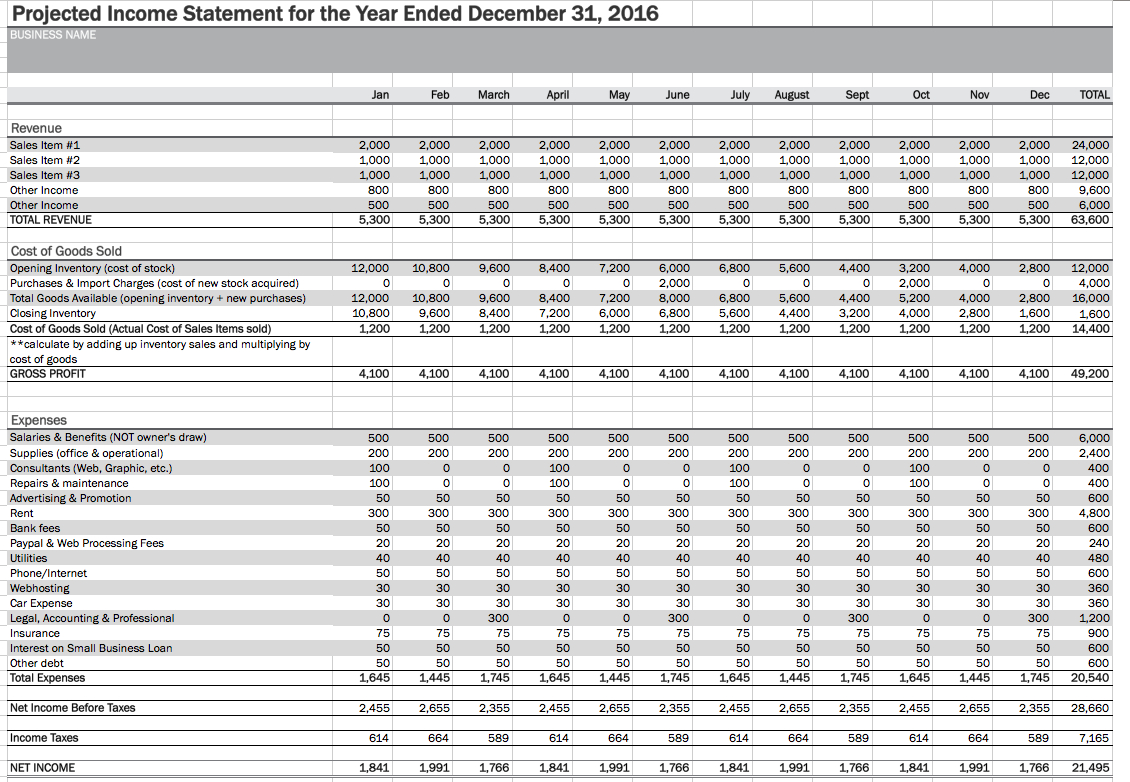

Simple Double Entry Bookkeeping Spreadsheet Pertaining To Double Entry This free online bookkeeping and accounting course teaches you about double entry accounting. it will give you an introduction to double entry accounting and teach you how to carry out double entry accounting and bookkeeping for transactions on the receivables ledger, on the payables ledger, and for bank and cash transactions. this course will. Alison certificates. . . . . master the double entry accounting system with this fascinating free online course that instructs you on how it operates, its advantages and how it can increase a company’s profitability. you will learn how this method provides you with more comprehensive data about a transaction compared to the single entry. Cost: free, but pro subscriptions are available for a one time fee of $49 or $99. course description: this course is an in depth exploration of major bookkeeping subjects, ranging from accounting. Course modules: lesson 1: an introduction to bookkeeping. lesson 2: bookkeeping & accounting terms. lesson 3: double entry bookkeeping basics. lesson 4: using and closing t accounts. lesson 5: financial statements. to start the bookkeeping course, scroll down. this course is free, and no registration is required!.

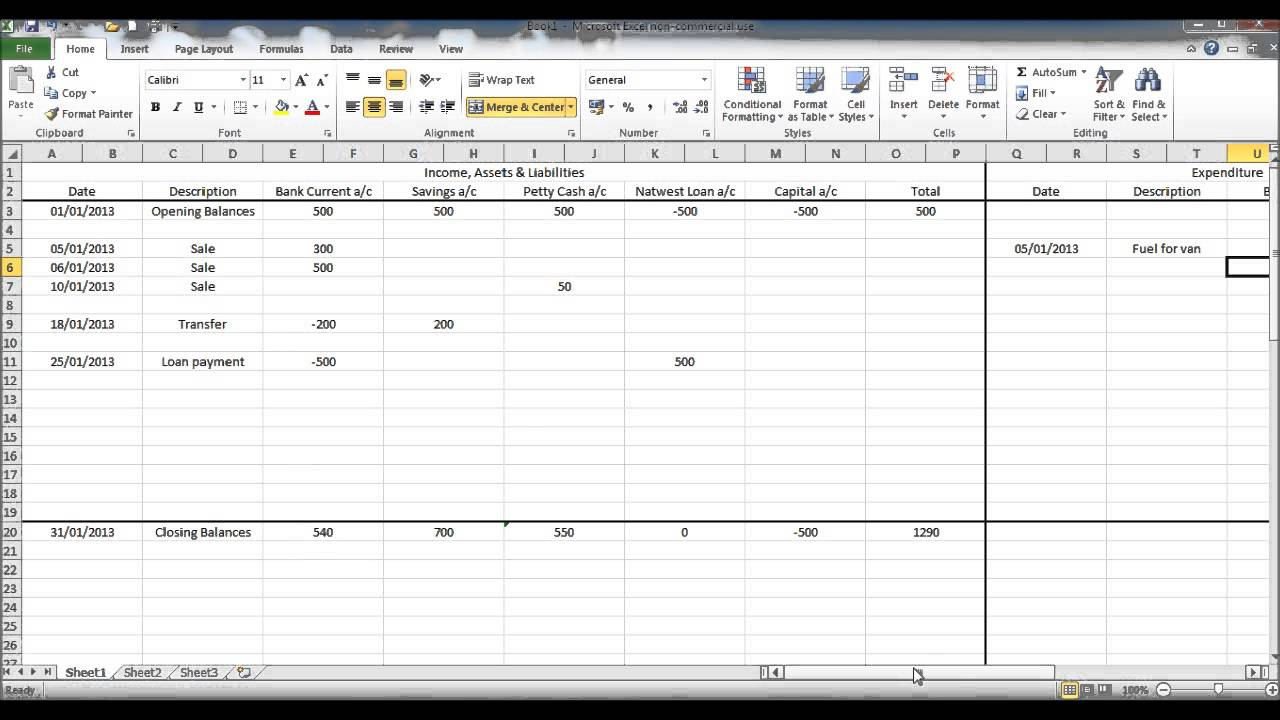

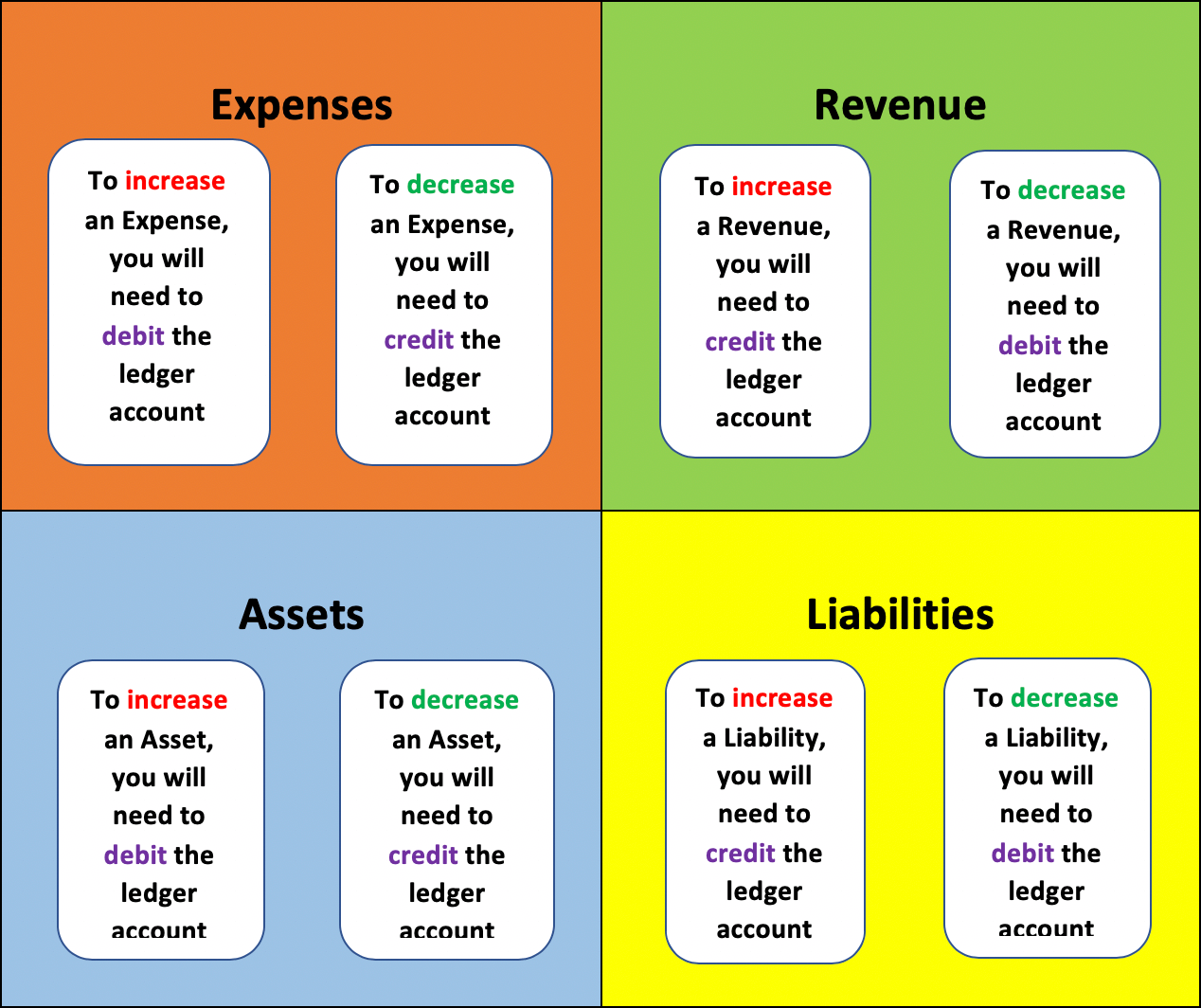

Double Entry Bookkeeping Excel Spreadsheet Free Db Excel Cost: free, but pro subscriptions are available for a one time fee of $49 or $99. course description: this course is an in depth exploration of major bookkeeping subjects, ranging from accounting. Course modules: lesson 1: an introduction to bookkeeping. lesson 2: bookkeeping & accounting terms. lesson 3: double entry bookkeeping basics. lesson 4: using and closing t accounts. lesson 5: financial statements. to start the bookkeeping course, scroll down. this course is free, and no registration is required!. After studying this course, you should be able to: understand and apply the essential numerical skills required for bookkeeping and accounting. understand and explain the relationship between the accounting equation and double entry bookkeeping. record transactions in the appropriate ledger accounts using the double entry bookkeeping system. The double entry accounting system is based on the accounting equation: assets = liabilities equity. this equation means that the total value of a company's assets must equal the sum of its liabilities and equity. this equation must always be in balance. in other words, if a company has $100 in assets and $50 in liabilities, then its equity.

Double Entry Bookkeeping Explained After studying this course, you should be able to: understand and apply the essential numerical skills required for bookkeeping and accounting. understand and explain the relationship between the accounting equation and double entry bookkeeping. record transactions in the appropriate ledger accounts using the double entry bookkeeping system. The double entry accounting system is based on the accounting equation: assets = liabilities equity. this equation means that the total value of a company's assets must equal the sum of its liabilities and equity. this equation must always be in balance. in other words, if a company has $100 in assets and $50 in liabilities, then its equity.

Double Entry Bookkeeping System By Nvarchitect Via Flickr Accounting

Comments are closed.