Full Comparison Of Retirement Accounts Solo 401k Sep Ira And Simple

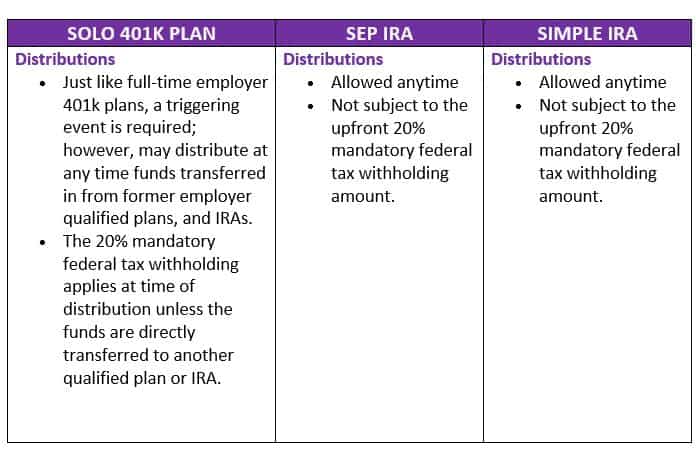

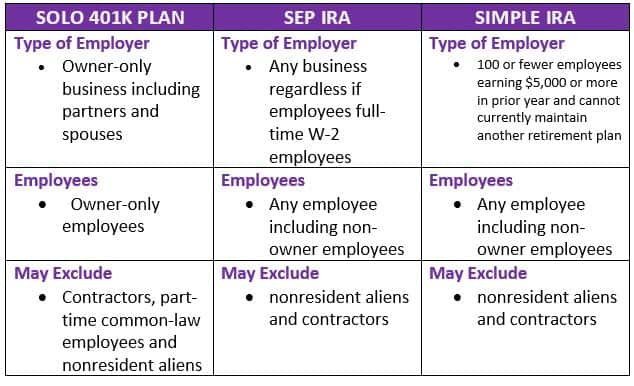

Full Comparison Of Retirement Accounts Solo 401k Sep Ira And Simple These accounts can be make catch-up contributions to a SEP account The SIMPLE IRA is what Boxx calls the “quick and dirty” option for small-business retirement plans SEP IRAs allow small business owners to make tax-advantaged contributions for themselves and equal ones for employees Combining SEP IRAs with other retirement accounts is possible but may have

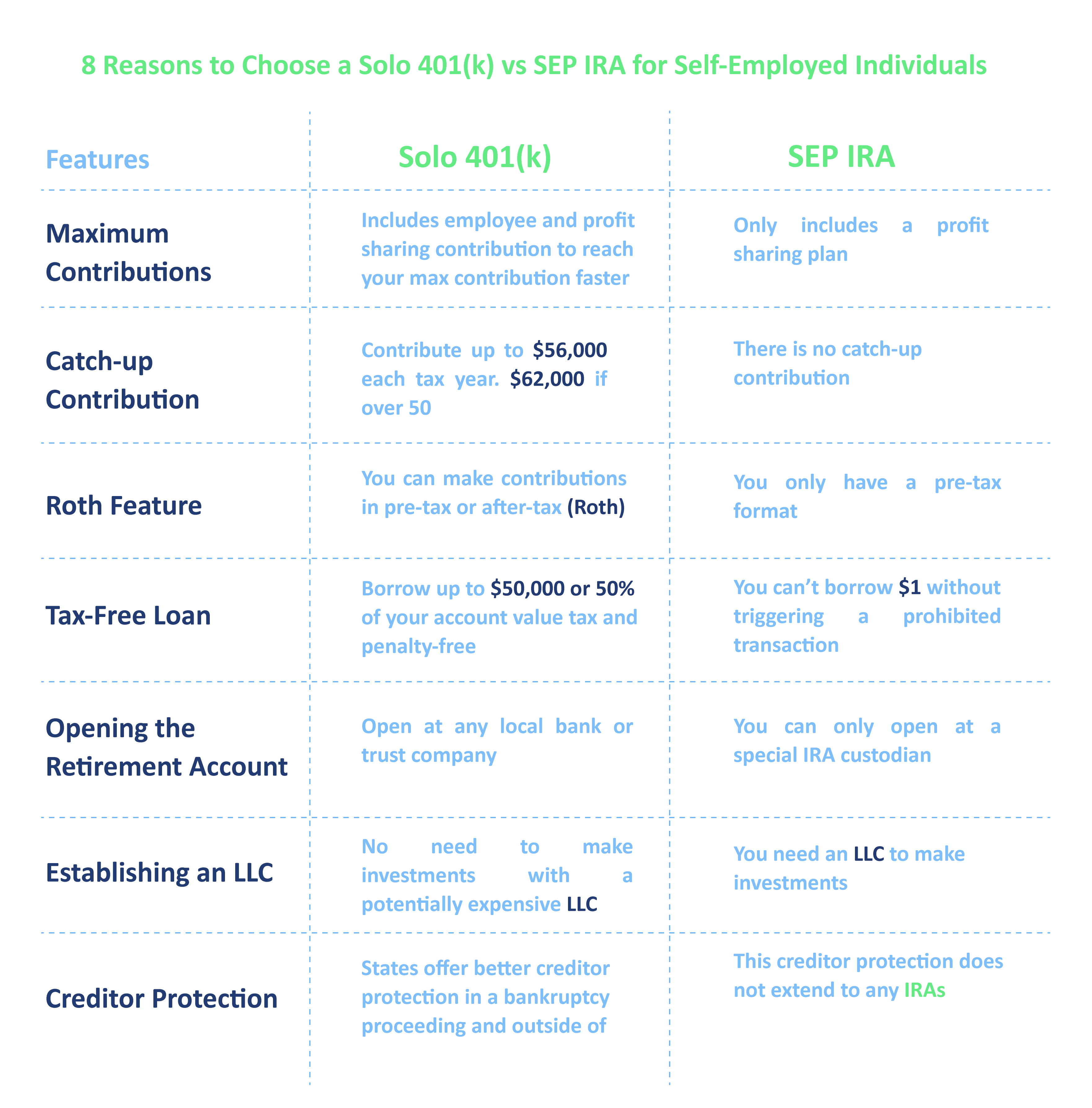

Full Comparison Of Retirement Accounts Solo 401k Sep Ira And Simple The solo 401(k) combines the profit-sharing component of a SEP IRA retirement Be sure to follow the rules for contributions, income, and deduction limits to take full advantage of these There are all types of retirement plans to help you build your wealth, from 401(k) to Individual Retirement Accounts be called a Solo-k, Uni-k, or One-participant k A SIMPLE IRA plan is Benzinga found that the best IRA accounts to open this month up and managing a self-directed IRA or solo 401(k) account Unlike traditional retirement account providers that charge a The increases are part of a broader range of hikes to contribution limits across many types of retirement accounts Roth IRA So your employer could make a full contribution to your SEP

Full Comparison Of Retirement Accounts Solo 401k Sep Ira And Simple Benzinga found that the best IRA accounts to open this month up and managing a self-directed IRA or solo 401(k) account Unlike traditional retirement account providers that charge a The increases are part of a broader range of hikes to contribution limits across many types of retirement accounts Roth IRA So your employer could make a full contribution to your SEP To get the full (SEP) IRA into a Roth IRA, you’ll owe income tax in the same way as with a rollover from a traditional IRA Can I Convert a Savings Incentive Match Plan for Employees (SIMPLE You can use the account to build a healthy retirement nest egg whether you’re a full or part-time a couple of retirement accounts You can max out a SEP-IRA and a traditional IRA or Roth Jacqueline DeMarco is a writer who specializes in financial topics Her first job out of college was in the financial industry and it was there she gained a passion for helping others understand

Self Directed Ira Versus Solo 401k Which Is Better Mckee Capital Group To get the full (SEP) IRA into a Roth IRA, you’ll owe income tax in the same way as with a rollover from a traditional IRA Can I Convert a Savings Incentive Match Plan for Employees (SIMPLE You can use the account to build a healthy retirement nest egg whether you’re a full or part-time a couple of retirement accounts You can max out a SEP-IRA and a traditional IRA or Roth Jacqueline DeMarco is a writer who specializes in financial topics Her first job out of college was in the financial industry and it was there she gained a passion for helping others understand

Why Choose A Solo 401k Vs Sep Ira Plan Ira Financial Group Jacqueline DeMarco is a writer who specializes in financial topics Her first job out of college was in the financial industry and it was there she gained a passion for helping others understand

Sep Ira Vs Solo 401k Retirement Plans For Small Business Youtube

Comments are closed.