Hedge Fund Definition History How It Works Strategies

Hedge Fund Definition History How It Works Strategies The bottom line. hedge funds offer wealthy individuals and institutions a way to invest in products and strategies where returns are tied more to a manager’s skill (“alpha”) than the market as a whole. but these strategies are very costly and may or may not provide outsize returns. A hedge fund is a limited partnership of private investors whose money is pooled and managed by professional fund managers. these managers use a wide range of strategies, including leverage.

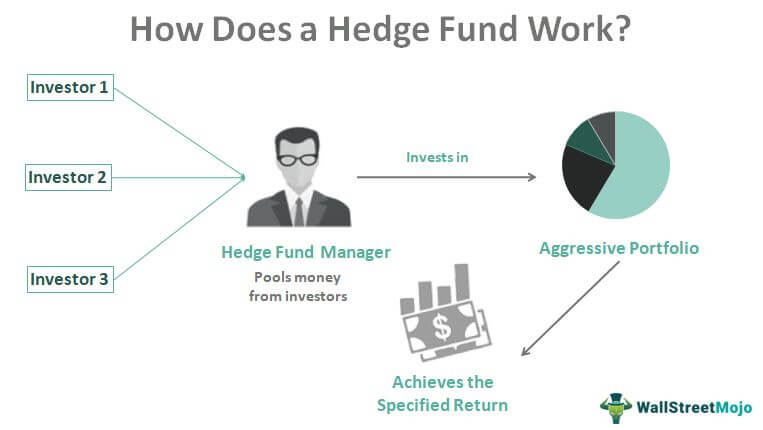

Hedge Fund Definition History How It Works Strategies A hedge fund is a specific kind of investment fund that pools capital from institutional investors, high net worth individuals, or accredited investors and uses a variety of investment strategies in order to generate returns. hedge funds are organized as limited partnerships or limited liability companies and are overseen by an experienced. A hedge fund is a pool of money that is invested in stocks and other assets. hedge funds are generally more aggressive, riskier, and more exclusive than mutual funds. their managers have freer. Hedge funds are pooled investment funds that aim to maximize returns and protect against market losses by investing in a wider array of assets. hedge funds charge higher fees and have fewer. A hedge fund is a pooled investment fund that holds liquid assets and that makes use of complex trading and risk management techniques to improve investment performance and insulate returns from market risk. among these portfolio techniques are short selling and the use of leverage and derivative instruments. [1].

How Does A Hedge Fund Work Structure Benefits Fees Hedge funds are pooled investment funds that aim to maximize returns and protect against market losses by investing in a wider array of assets. hedge funds charge higher fees and have fewer. A hedge fund is a pooled investment fund that holds liquid assets and that makes use of complex trading and risk management techniques to improve investment performance and insulate returns from market risk. among these portfolio techniques are short selling and the use of leverage and derivative instruments. [1]. Hedge fund investing has been common for both institutions and high net worth individuals in the past couple of decades. global macro strategy: definition, how it works, types of funds. Hedge fund history. the first hedge fund is believed to have started in 1949 by alfred w. jones, who used a strategy of buying stocks hedged with short sales. jones later created a hedge fund with.

Comments are closed.