How Digital Banking Experiences Help Consumers Save

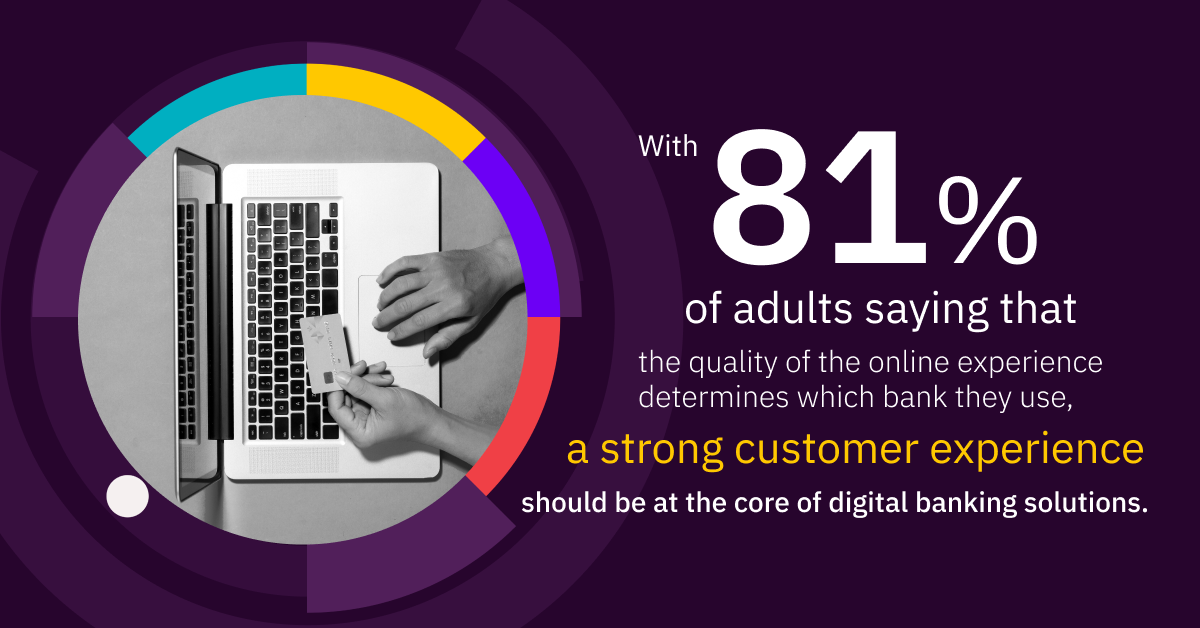

How Digital Banking Experiences Help Consumers Save 1. convenience. the ability to bank wherever and whenever you want is one of the main benefits of mobile and online banking solutions. many mobile banking apps, for instance, let you deposit. Consumers give their digital banking experience high marks. 97% rated their bank’s online and mobile app experience as “excellent,” “very good” or “good”. 94% said their overall access to banking services today is “excellent,” “very good” or “good”. 8 in 10 said tech improvements by banks are making it easier for.

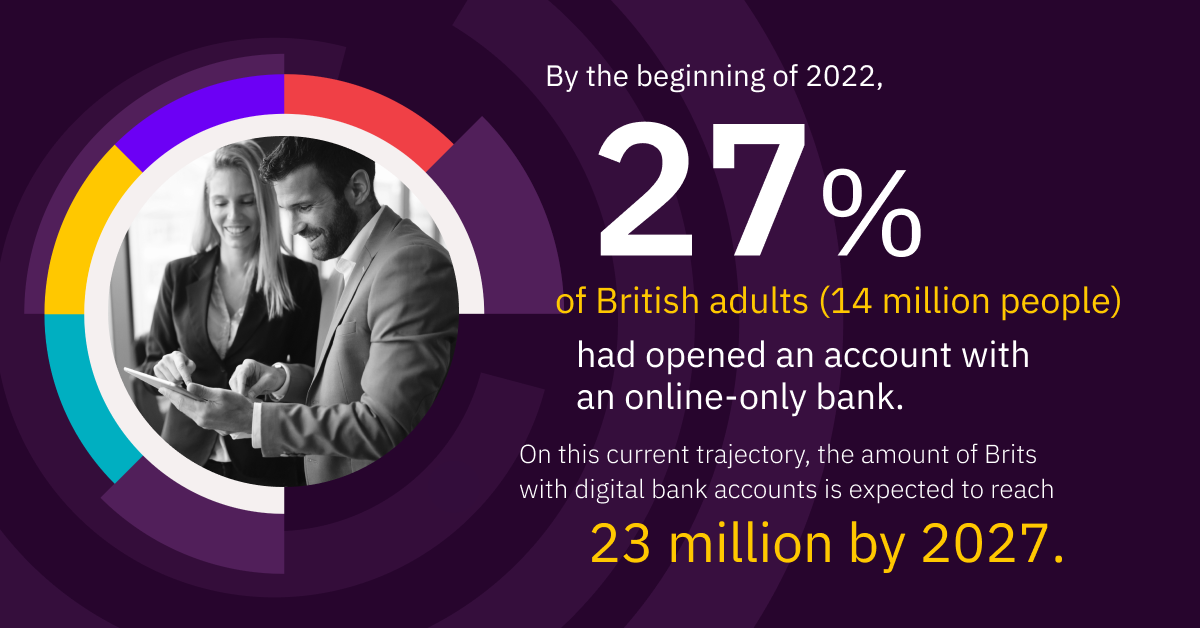

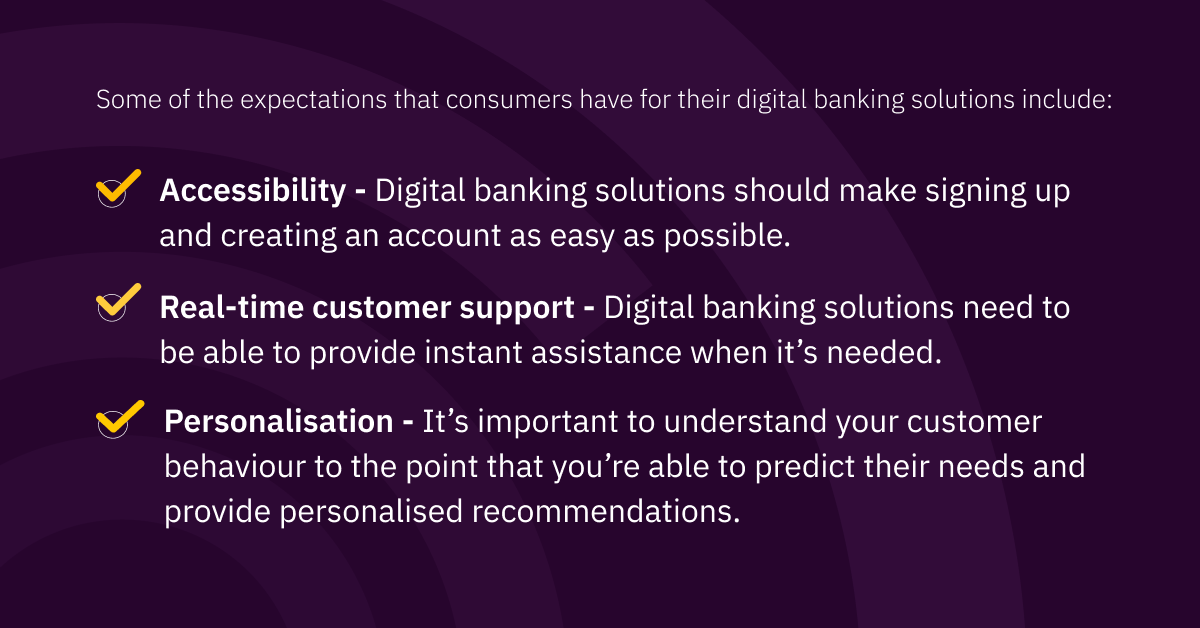

How Digital Banking Experiences Help Consumers Save According to epperson, the goal for digital first banking should be a fully integrated platform that can provide data driven insights and recommendations. “customers want to know if they have 15 subscriptions they forgot about that are costing them money,” he says. “they want to know how they compare to others in their demographic.”. With digital banking, you can deposit checks, view balances, transfer money, review your digital statements, and analyze investments. as a result, online and mobile banking users obtain convenience, a reduced environmental footprint, and a more robust banking experience. and as technology continues to evolve, new digital banking and related. The impact can be substantial. we have seen banks achieve a 10% to 20% increase in customer satisfaction and return on digital investment, two to four times faster time to market and new product development, a 15% to 25% reduction in development costs, and a better than 90% improvement in employee engagement. 1. mobile customer service. in 2024, mobile customer service will emerge as a pivotal trend, reshaping the customer experience. with increasing numbers of customers relying on mobile devices for their banking needs, providing seamless and efficient customer service through mobile channels has become paramount.

How Digital Banking Experiences Help Consumers Save The impact can be substantial. we have seen banks achieve a 10% to 20% increase in customer satisfaction and return on digital investment, two to four times faster time to market and new product development, a 15% to 25% reduction in development costs, and a better than 90% improvement in employee engagement. 1. mobile customer service. in 2024, mobile customer service will emerge as a pivotal trend, reshaping the customer experience. with increasing numbers of customers relying on mobile devices for their banking needs, providing seamless and efficient customer service through mobile channels has become paramount. Dxps made specifically for banks are designed to manage the complete engagement to results lifecycle across all digital channels, ultimately driving: increased revenues. dxps help financial institutions increase loans, grow deposits and issue more cards, all by engaging at the right time with the needed service. The future of the digital banking customer experience. in this episode, we discuss digital banking customer experiences, the impact of technology in retail banking, and modern marketing in banking. co hosts kristin korzekwa and bill dworsky are joined by liz wolverton, head of consumer banking and brand experience at synovus.

How Digital Banking Experiences Help Consumers Save Dxps made specifically for banks are designed to manage the complete engagement to results lifecycle across all digital channels, ultimately driving: increased revenues. dxps help financial institutions increase loans, grow deposits and issue more cards, all by engaging at the right time with the needed service. The future of the digital banking customer experience. in this episode, we discuss digital banking customer experiences, the impact of technology in retail banking, and modern marketing in banking. co hosts kristin korzekwa and bill dworsky are joined by liz wolverton, head of consumer banking and brand experience at synovus.

Comments are closed.