How Do Private Equity Firms Find Companies To Buy Venture Capitalist Explains

How Do Private Equity Firms Find Companies To Buy Venture Capitalist How do private equity firms find companies to buy | venture capitalist explains how do private equity firms find companies to buy? private equity deals ar. Why private equity firms buy companies | venture capitalist explains have you ever wondered why private equity companies buy companies? and i don't just m.

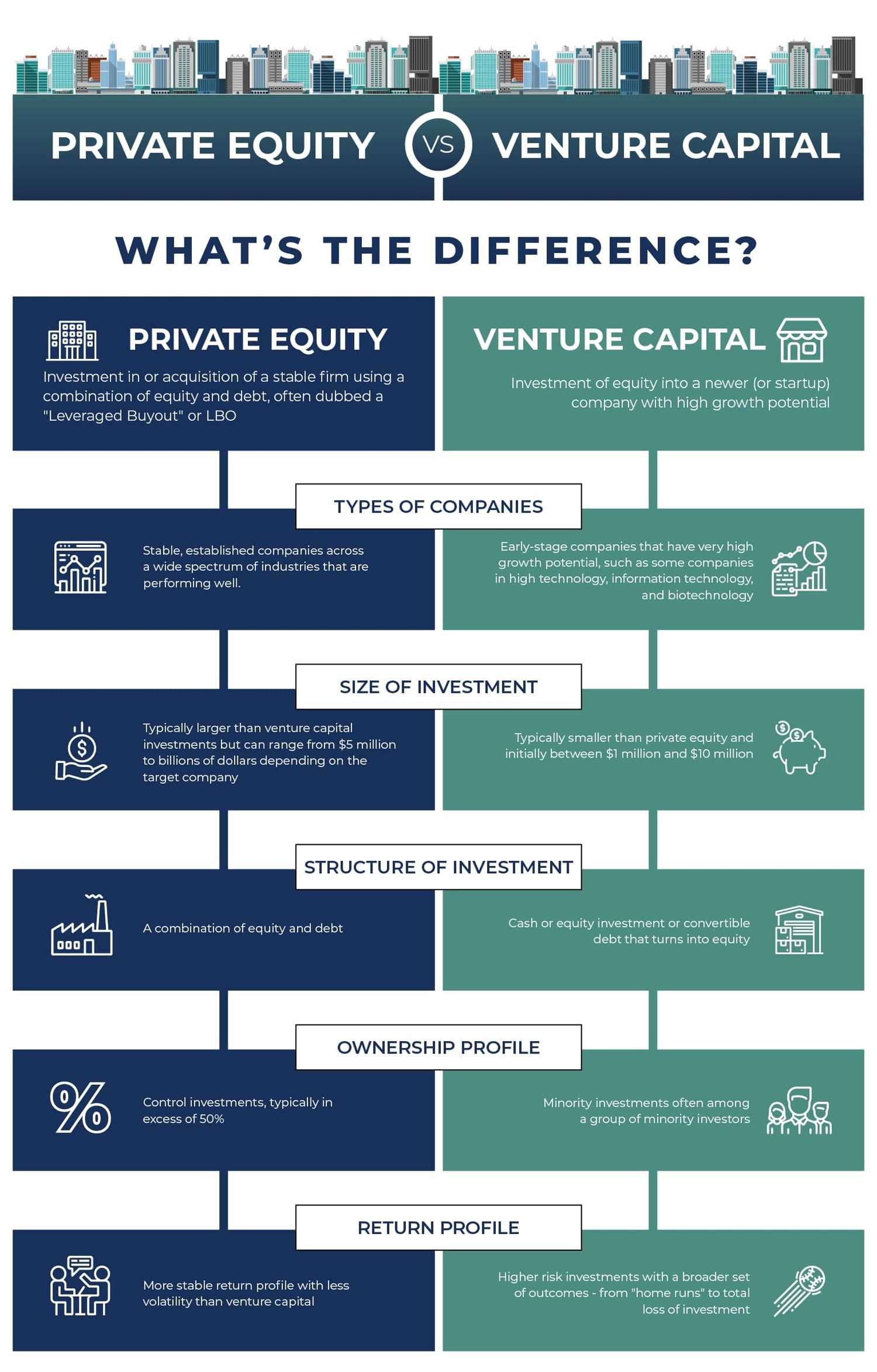

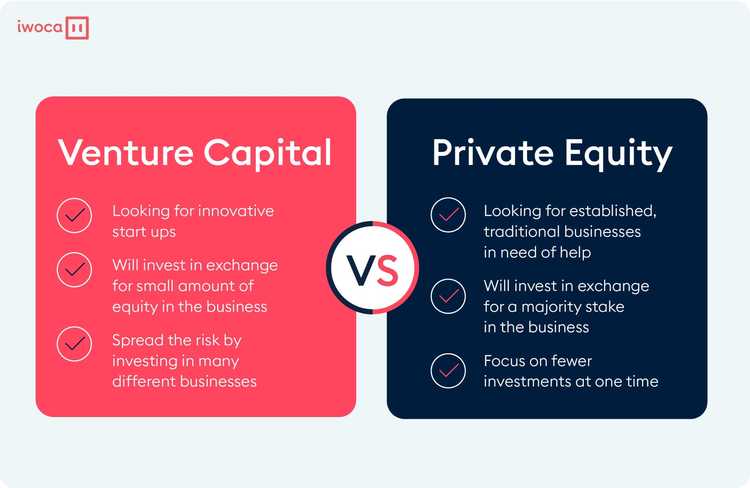

Private Equity Vs Venture Capital What S The Difference Private equity firms mostly buy 100% ownership of the companies in which they invest. as a result, the firm is in total control of the companies after the buyout. venture capital firms invest in. A venture capitalist (vc) is an investor who provides young companies with capital in exchange for equity. startups often turn to vcs for funding to scale up and bring their products to the market. Private equity (pe) and venture cap (vc) both describe investing in relatively new companies, but vcs usually look for a quick return, while pes generally invest for the longer haul. How venture capitalists make decisions. summary. for decades now, venture capitalists have played a crucial role in the economy by financing high growth start ups. while the companies they’ve.

Private Equity Vs Venture Capital What S The Difference Private equity (pe) and venture cap (vc) both describe investing in relatively new companies, but vcs usually look for a quick return, while pes generally invest for the longer haul. How venture capitalists make decisions. summary. for decades now, venture capitalists have played a crucial role in the economy by financing high growth start ups. while the companies they’ve. Structure: vc firms use equity (i.e., the cash they’ve raised from outside investors) to make their investments, while pe firms use a combination of equity and debt. stage: pe firms acquire mature companies, while vcs invest in earlier stage companies that are growing quickly or have the potential to grow quickly. Key points. private equity investing usually involves buying and managing non public distressed companies, with the goal of increasing their value. venture capital (vc) funds early stage start ups.

What S The Deal With Venture Capital Definition Process And Trends Structure: vc firms use equity (i.e., the cash they’ve raised from outside investors) to make their investments, while pe firms use a combination of equity and debt. stage: pe firms acquire mature companies, while vcs invest in earlier stage companies that are growing quickly or have the potential to grow quickly. Key points. private equity investing usually involves buying and managing non public distressed companies, with the goal of increasing their value. venture capital (vc) funds early stage start ups.

Comments are closed.