How Does A Hedge Fund Work Structure Benefits Fees

How Does A Hedge Fund Work Structure Benefits Fees Management fees are paid to the fund manager irrespective of the funds' performance and are required for the operational regular functioning of the fund. if the fund's unsatisfactory performance, this can drop to 1.5% or 1.75%. e.g., a manager with $1 billion of assets under management earns $20 million as management fees. If the fund charges the standard "two and twenty", the total annual fees made by the fund at the end of each year can be calculated as follows . year 1: fund aum at beginning of year 1 = $1,000m.

How Does A Hedge Fund Work Structure Benefits Fees For example, if a hedge fund with $100 million in assets under management generates a 20% return in a given year (net of the management fee), the fund would earn $20 million in profits. with a 2 and 20 fee structure, the fund manager would receive: management fee: 2% x $100 million = $2 million; performance fee: 20% x $20 million = $4 million. The covid 19 pandemic also may have accelerated the upending of the 2 and 20 fee structure. what makes hedge funds unique? hedge funds vs. mutual funds. while both hedge funds and mutual funds tend to invest largely in public company stock, they pool money from different sources and collect fees in different ways. The typical hedge fund fee structure consists of a management fee and a performance fee. the management fee is usually a percentage of assets under management (aum), ranging from 1% to 2% annually. the performance fee, also known as an incentive fee, is a percentage of the fund’s profits, typically ranging from 15% to 20%. Performance fees are typically set at 20% of the fund’s profits. although the 2 20 structure is the more traditional model used, hedge fund managers are facing mounting pressure to reduce fees. as of 2019, preqin has observed marginal decreases to the industry’s fee structure, to an average of 1.50% management fee and 19.00% performance fee.

How Does A Hedge Fund Work Structure Benefits Fees The typical hedge fund fee structure consists of a management fee and a performance fee. the management fee is usually a percentage of assets under management (aum), ranging from 1% to 2% annually. the performance fee, also known as an incentive fee, is a percentage of the fund’s profits, typically ranging from 15% to 20%. Performance fees are typically set at 20% of the fund’s profits. although the 2 20 structure is the more traditional model used, hedge fund managers are facing mounting pressure to reduce fees. as of 2019, preqin has observed marginal decreases to the industry’s fee structure, to an average of 1.50% management fee and 19.00% performance fee. The fees associated with hedge funds vary, but a common structure is a 2% annual management fee and a 20% performance fee that comes into effect if the fund surpasses a certain threshold of. Hedge funds employ the 2% management fee and 20% performance fee structure. in 2022, the average expense ratio across all mutual funds and exchange traded funds was 0.37%.

A Simple Guide To Understanding Hedge Funds The fees associated with hedge funds vary, but a common structure is a 2% annual management fee and a 20% performance fee that comes into effect if the fund surpasses a certain threshold of. Hedge funds employ the 2% management fee and 20% performance fee structure. in 2022, the average expense ratio across all mutual funds and exchange traded funds was 0.37%.

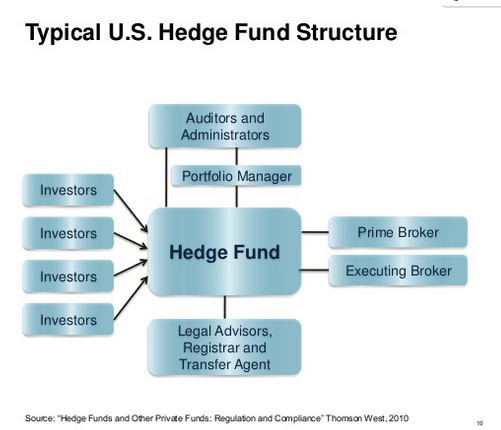

Typical Us Hedge Fund Structure Hedge Think Digital Meeting Place

Comments are closed.