How Does Tax Affect Consumer And Producer Surplus

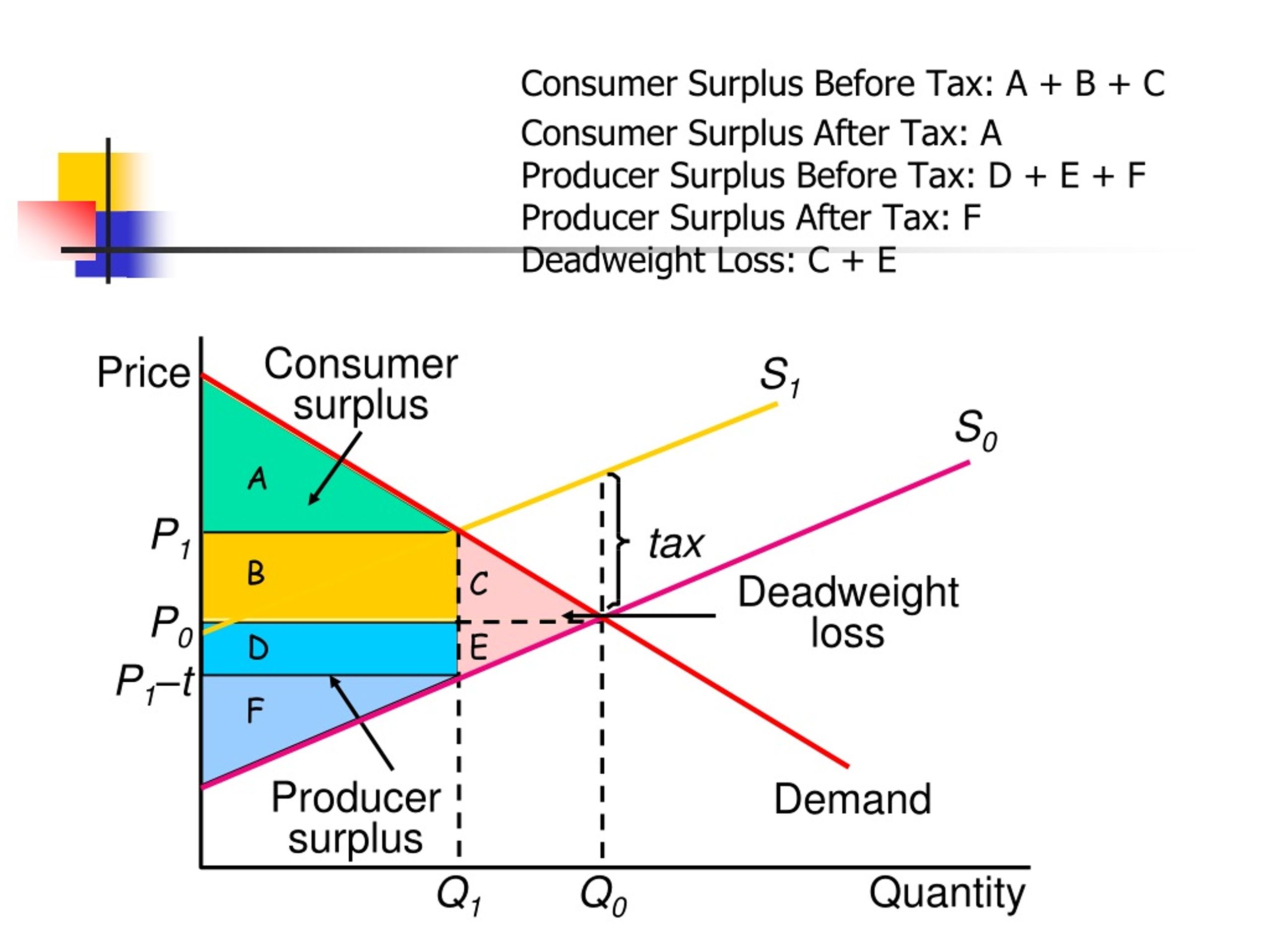

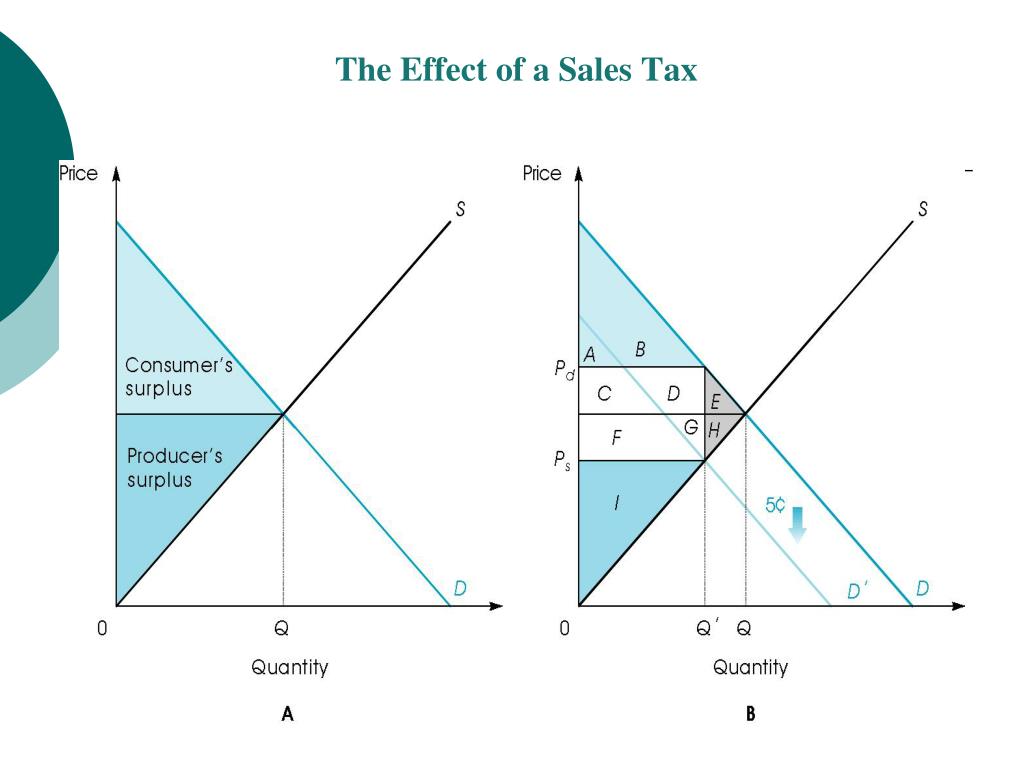

Ppt Taxation Powerpoint Presentation Free Download Id 79797 The first wedge tested is only $0.7, followed by $1.5, until the $3.0 tax is found. figure 4.7c. market surplus. like with price and quantity controls, one must compare the market surplus before and after a price change to fully understand the effects of a tax policy on surplus. figure 4.7d. An indirect tax is a tax imposed by the government that increases the supply costs of producers. the amount of the tax is always shown by the vertical distance between the pre and post tax supply curves. because of the tax, less can be supplied to the market at each price level. consumer surplus. consumer surplus is the difference between the.

Ppt Lecture 6 Consumer S And Producer S Surplus Powerpoint The effect of taxes. with the introduction of a tax, the consumer and producer surplus could both fall. if in the earlier example a government sales tax of $1 was levied on any sale of the product. In this case, although producers pay the tax, the tax incidence falls partly on consumers and partly on producers. figure 8.24 compares the total surplus at equilibrium b with the tax (right panel), with the original surplus at a. at b, when the quantity falls to q 1: consumer surplus falls: consumers pay a higher price, p 1, and buy less salt. Placing a tax on a good, shifts the supply curve to the left. it leads to a fall in demand and higher price. however, the impact of a tax depends on the elasticity of demand. if demand is inelastic, a higher tax will cause only a small fall in demand. most of the tax will be passed onto consumers. when demand is inelastic, governments will see. The total amount of tax revenue paid by consumers is $20. this is the $2 more that consumers pay per unit, times the 10 unit output. since the total tax revenue is $30, then the tax the producers must be paying must be 10 bucks. the producers used to get $12, and now they only get $11, so they get $1 less than before.

Ib Economics Hl Section 1 Microeconomics 1 3 Government Intervention Placing a tax on a good, shifts the supply curve to the left. it leads to a fall in demand and higher price. however, the impact of a tax depends on the elasticity of demand. if demand is inelastic, a higher tax will cause only a small fall in demand. most of the tax will be passed onto consumers. when demand is inelastic, governments will see. The total amount of tax revenue paid by consumers is $20. this is the $2 more that consumers pay per unit, times the 10 unit output. since the total tax revenue is $30, then the tax the producers must be paying must be 10 bucks. the producers used to get $12, and now they only get $11, so they get $1 less than before. From figure 1 the following formula can be derived for consumer and producer surplus: consumer surplus = (qe x (p2 – pe)) ÷ 2. producer surplus = (qe x (pe – p1)) ÷ 2. where: qe is the equilibrium price. pe is the equilibrium price. p2 is the y intercept of the demand curve. p1 is the y intercept of the supply curve. The relative effect on buyers and sellers is known as the incidence of the tax. there are two main economic effects of a tax: a fall in the quantity traded and a diversion of revenue to the government. a tax causes consumer surplus and producer surplus (profit) to fall.

Comments are closed.