How Hedge Funds Really Work An Introduction To Hedge Funds Youtu

How Hedge Funds Really Work An Introduction To Hedge Funds Youtube A hedge fund is an investment fund that pools capital from accredited investors or institutional investors and invests in a wide range of assets with the goa. The term “hedge fund” has been around since the 1940s. today this way of investing can be misunderstood, but it’s worth learning about some of their potential benefits. hedge funds offer a broad range of opportunities—but they may not be the right solution for everyone. for properly accredited investors, hedge funds may enhance.

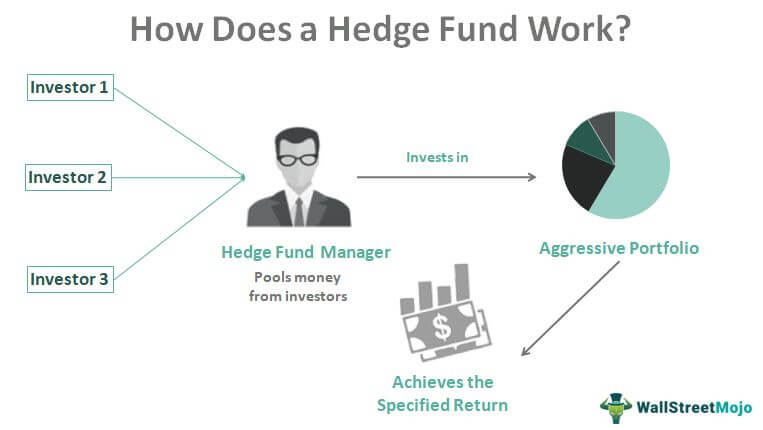

Understanding Hedge Funds A Brief Overview Youtube Hedge funds are investment funds geared towards high net worth individuals, institutions, foundations, and pension plans, they can be very risky and charge high fees, but they have the potential. The two biggest differences between them are the way the funds are structured and the types of companies they invest in. hedge funds are structured as open end funds, allowing investors to contribute money at any time, with withdrawals taking place at certain times throughout the year. on the other hand, pe funds are structured as closed end funds. Both mutual funds and hedge funds charge an annual asset based management fee — also known as an expense ratio or advisory fee. for mutual funds, that fee is usually between 0.25% and 1.5% of. One of the factors that defines a hedge fund, beyond its ability to hedge losses, is the ability to invest in essentially anything. many hedge funds simply invest in equities. most of those funds.

What Do Hedge Funds Actually Do Introduction To Hedge Funds Youtube Both mutual funds and hedge funds charge an annual asset based management fee — also known as an expense ratio or advisory fee. for mutual funds, that fee is usually between 0.25% and 1.5% of. One of the factors that defines a hedge fund, beyond its ability to hedge losses, is the ability to invest in essentially anything. many hedge funds simply invest in equities. most of those funds. There’s trading on event driven basis. so there’s all these different hedge fund strategies, but at the end of the day, they derive from investors seeking uncorrelated returns on their investments. and i’ll note that hedge funds, principally, they’re open ended vehicles. so you’re primarily trading on the public markets. Hedge funds typically offer investors the ability to withdraw their capital, or redeem their shares in the fund, on a monthly or quarterly basis, sometimes following an initial “lock up period,” or a period of time from the date of the initial investment in which the investor’s capital cannot be redeemed. the length of the lock up period.

How Does A Hedge Fund Work Structure Benefits Fees There’s trading on event driven basis. so there’s all these different hedge fund strategies, but at the end of the day, they derive from investors seeking uncorrelated returns on their investments. and i’ll note that hedge funds, principally, they’re open ended vehicles. so you’re primarily trading on the public markets. Hedge funds typically offer investors the ability to withdraw their capital, or redeem their shares in the fund, on a monthly or quarterly basis, sometimes following an initial “lock up period,” or a period of time from the date of the initial investment in which the investor’s capital cannot be redeemed. the length of the lock up period.

Comments are closed.