How To Build A Budget Money Management For Any Income

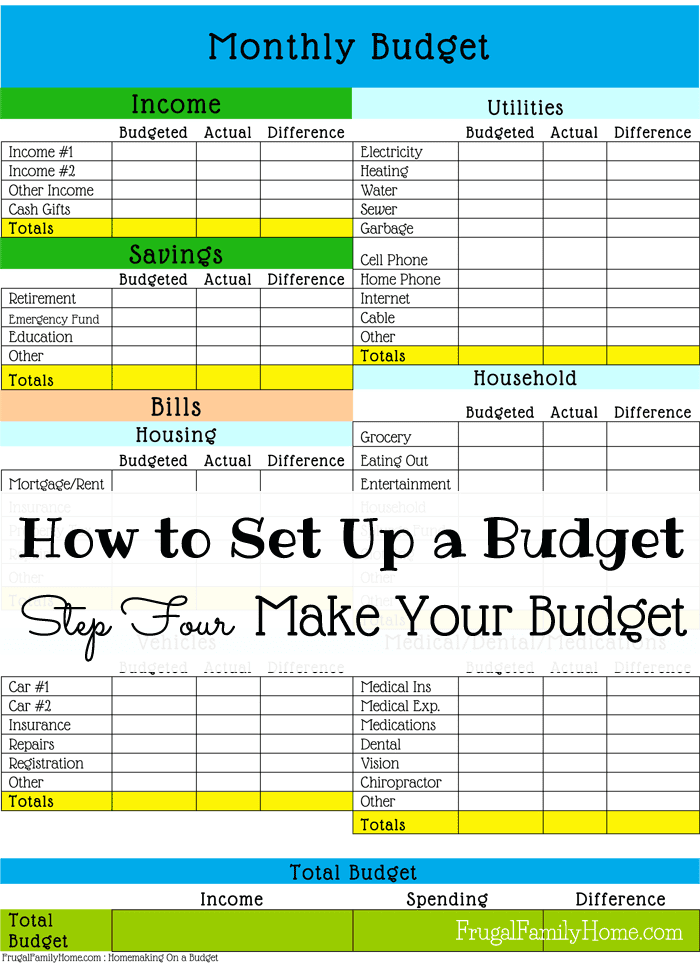

How To Set Up A Budget Make Your Budget Frugal Family Home See full bio. step 1. figure out your after tax income step 2. choose a budgeting system step 3. track your progress step 4. automate your savings step 5. practice budget management. Let’s do this.) subtract all your expenses from your income. this number should equal zero, meaning you just made a zero based budget. this is key: a zero based budget doesn’t mean you let your bank account reach zero. (leave a little buffer in there of about $100–300.) it also doesn’t mean you blow all your money.

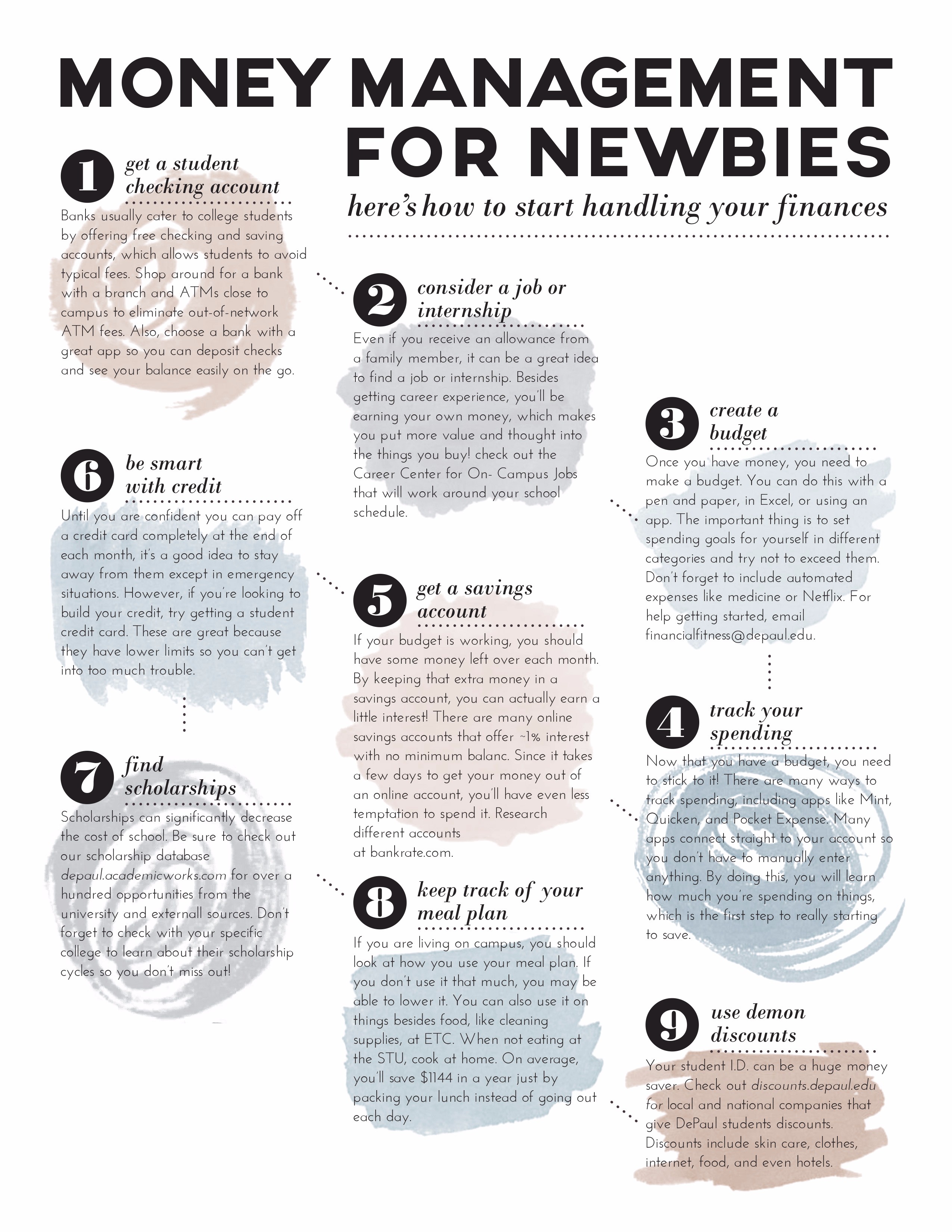

Creating A Money Plan Build A Budget Financial Fitness Depaul How the 50 30 20 budget calculator works. our 50 30 20 calculator divides your take home income into suggested spending in three categories: 50% of net pay for needs, 30% for wants and 20% for. Step 2: list your expenses. now that you’ve planned for the money coming in, you can plan for the money going out. it’s time to list your expenses! (yep, this is when that bank account or statement gets super helpful.) think through these main areas as you're jotting down expenses: give and save. cover the four walls. Label fixed and variable expenses. determine average monthly costs for each expense. make adjustments. 1. calculate your net income. the first step is to find out how much money you make each. Option 2: use a budget app. if you prefer to operate in the 21st century, there are numerous apps to help you track your new budget. personal capital is a good budgeting app for those following the 50 30 30 rule (and it’s free!). it allows you to set a spending target and alerts you to progress throughout the month.

Budgeting How To Make A Budget And Manage Your Money And Personal Label fixed and variable expenses. determine average monthly costs for each expense. make adjustments. 1. calculate your net income. the first step is to find out how much money you make each. Option 2: use a budget app. if you prefer to operate in the 21st century, there are numerous apps to help you track your new budget. personal capital is a good budgeting app for those following the 50 30 30 rule (and it’s free!). it allows you to set a spending target and alerts you to progress throughout the month. 1. calculate your monthly income. the first step is to determine how much money you earn each month. this will determine how much you can spend (and save) each month. when calculating your monthly. Step 1: calculate your net income. building an effective budget often starts by assessing your net income or take home pay. that’s your total wages or salary after taking out taxes and employee benefits, such as 401 (k) contributions and health insurance premiums. it’s the amount that is deposited in your bank account every pay period.

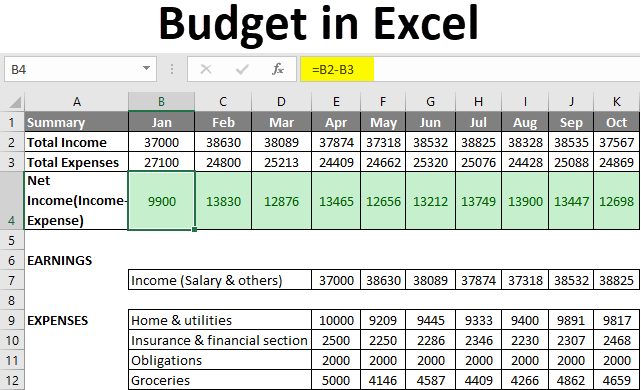

How To Create A Budget In Excel A Step By Step Guide Excel Accountant 1. calculate your monthly income. the first step is to determine how much money you earn each month. this will determine how much you can spend (and save) each month. when calculating your monthly. Step 1: calculate your net income. building an effective budget often starts by assessing your net income or take home pay. that’s your total wages or salary after taking out taxes and employee benefits, such as 401 (k) contributions and health insurance premiums. it’s the amount that is deposited in your bank account every pay period.

Comments are closed.