How To Calculate Straight Line Depreciation In Excel

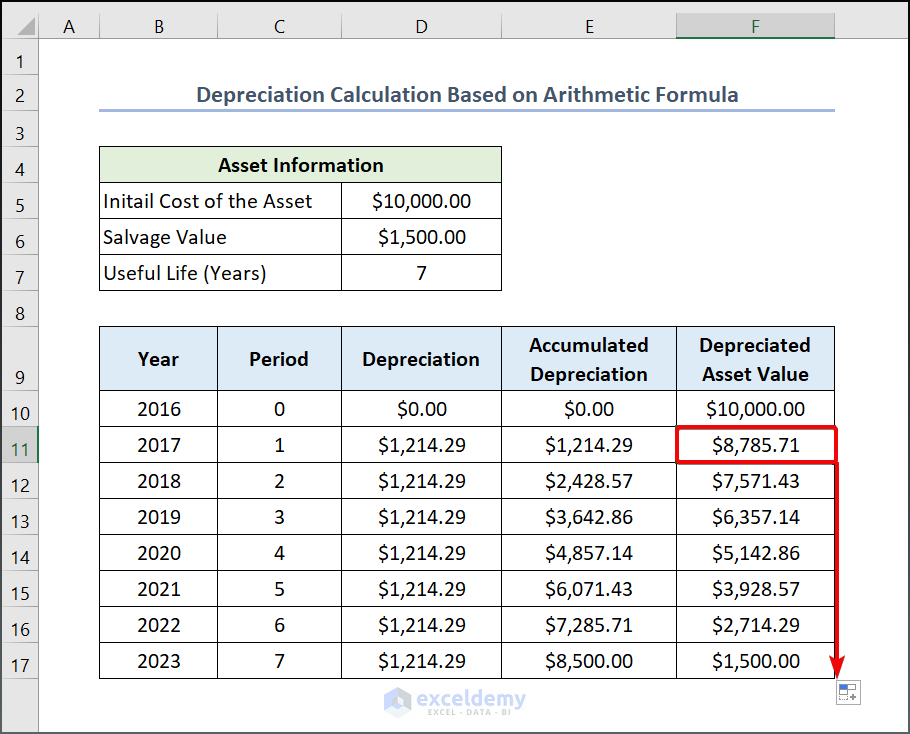

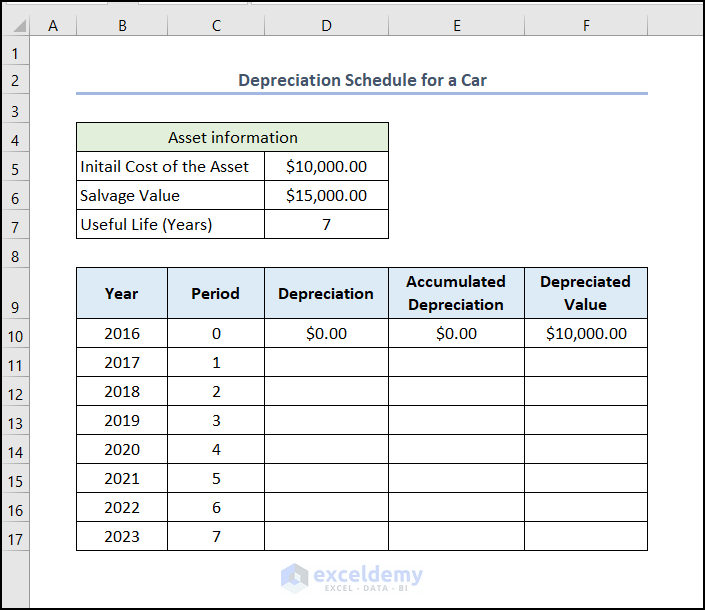

How To Calculate The Straight Line Depreciation Using A Formula In Method 1 using an arithmetic formula. steps: enter the following formula in d11. here, d5 and d6 represent the “initial cost of the asset” and “salvage value”. as the useful life is 7 years, the subtracted value is divided by 7. press enter to get the straight line depreciation value for 2017. Syntax for sln function. =sln (cost,salvage,life) insert the sln function in a new cell where you want the depreciation to be reflected and give cell reference in the same sequence of arguments. according to our data, cell b2 contains the cost, cell b3 contains the salvage scrap value and cell b4 contains the life of the asset.

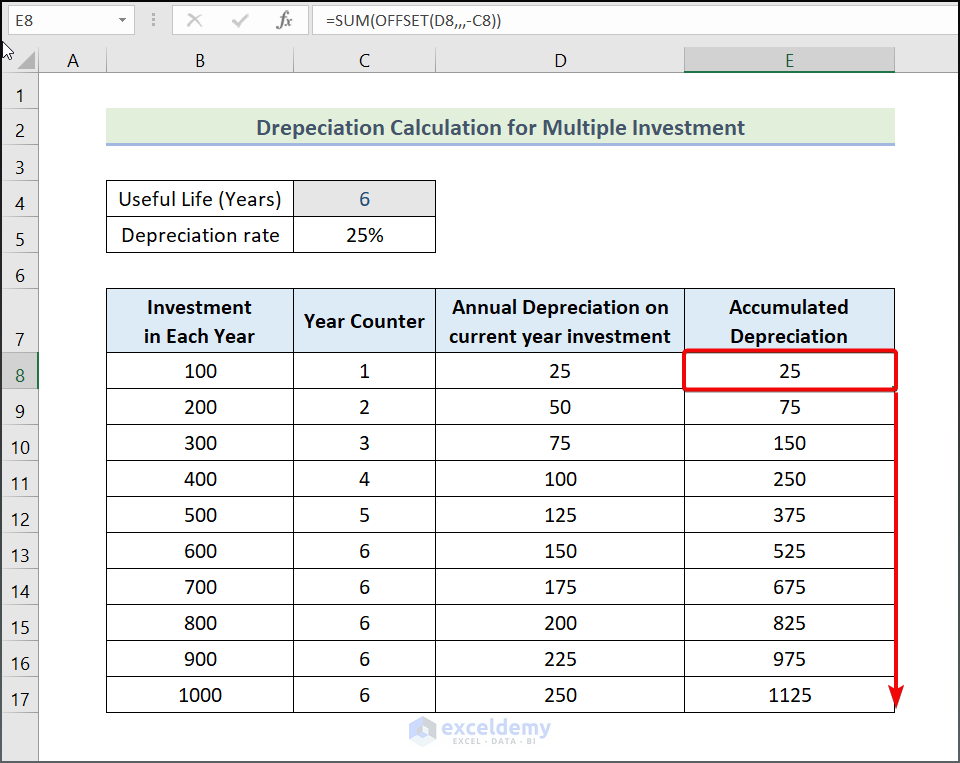

How To Calculate The Straight Line Depreciation Using A Formula In The syd function calculates the sum of years' digits depreciation and adds a fourth required argument, per. the syntax is =syd (cost, salvage, life, per) with per defined as the period to calculate the depreciation. the unit used for the period must be the same as the unit used for the life; e.g., years, months, etc. Example – straight line depreciation. suppose we are given the following data and we need to calculate the depreciation using the straight line method: cost of the asset: $45,000; salvage value (if any): $7,500; useful life (in years): 10; to calculate the straight line depreciation, we will use the following formula: we get the result below:. Method 2 – use syd function to calculate depreciation. steps: go to c8 and write down the following formula. =syd(c4,c5,c6,c7) press enter to get the output. explanation: the amount of depreciation for the 3rd year is $5,833.33. the amount of depreciation will change if you change the per argument. In excel, there is a built in function called “sln” that can be used to calculate the depreciation of an asset over a period of time using the straight line method. this blog post will guide you through the process of using the sln function in excel to calculate the depreciation value of an asset.

How To Calculate The Straight Line Depreciation Using A Formula In Method 2 – use syd function to calculate depreciation. steps: go to c8 and write down the following formula. =syd(c4,c5,c6,c7) press enter to get the output. explanation: the amount of depreciation for the 3rd year is $5,833.33. the amount of depreciation will change if you change the per argument. In excel, there is a built in function called “sln” that can be used to calculate the depreciation of an asset over a period of time using the straight line method. this blog post will guide you through the process of using the sln function in excel to calculate the depreciation value of an asset. French straight line (amorlinc) the french straight line or international straight line method is a form of a straight line depreciation, using custom rates and taking consider the exact days in a year. excel provides the amorlinc function to calculate the depreciation for each accounting period, on a prorated basis. the prorated depreciation. During this tutorial, you will learn how to calculate depreciation with excel using five different functions: the straight line method, the declining balance method, the sum of the year’s digits method, the double declining balance method, and the variable declining balance method. 5 excel depreciation functions you need to know: sln, syd, db.

Finance In Excel 4 Calculate Straight Line Depreciation In Excel French straight line (amorlinc) the french straight line or international straight line method is a form of a straight line depreciation, using custom rates and taking consider the exact days in a year. excel provides the amorlinc function to calculate the depreciation for each accounting period, on a prorated basis. the prorated depreciation. During this tutorial, you will learn how to calculate depreciation with excel using five different functions: the straight line method, the declining balance method, the sum of the year’s digits method, the double declining balance method, and the variable declining balance method. 5 excel depreciation functions you need to know: sln, syd, db.

How To Calculate Straight Line Depreciation Using Formula In Excel

Comments are closed.