How To E File Form 941 Online Late Payments S Corp Employer Payroll Basics

How To E File Form 941 Online Late Payments S Corp Employer You can e file employment tax returns form 940, form 941, form 943, form 944, and form 945. you can also e file corrected employment tax returns form 941 x, form 943 x, and form 945 x. the form 940 e file program allows you to electronically file an amended form 940. benefits to e filing: it saves you time. it is secure and accurate. Learn about basic payroll requirements, including how to complete form 941 and file it online whether for the current quarter or past quartersmy gusto link (.

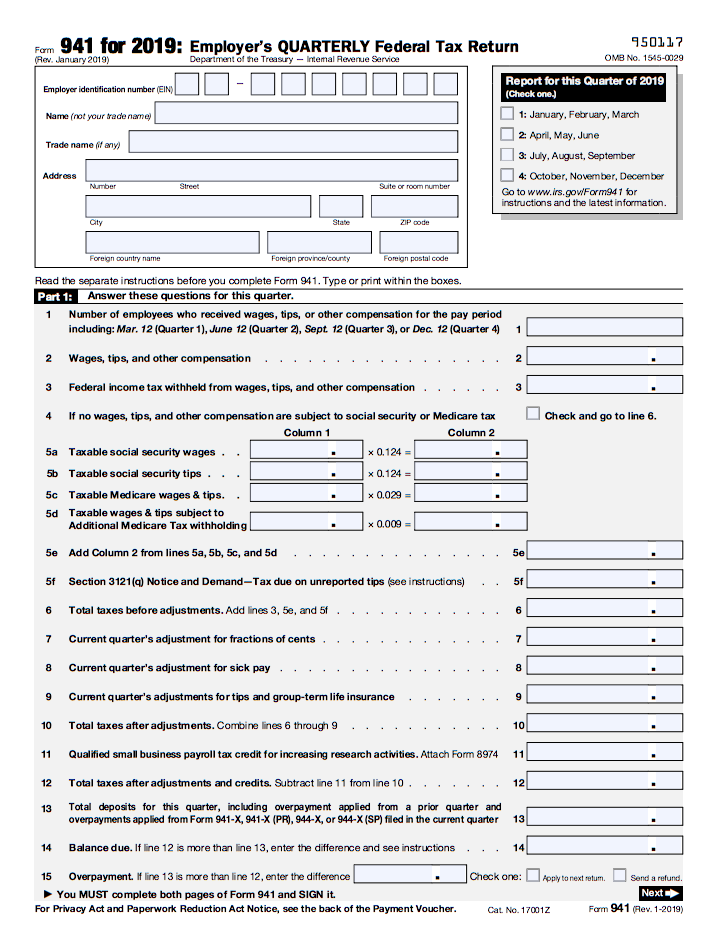

Form 941 Instructions How To File It Bench Accounting English. español. employers use form 941 to: report income taxes, social security tax, or medicare tax withheld from employee's paychecks. pay the employer's portion of social security or medicare tax. Use the march 2024 revision of form 941 to report taxes for the first quarter of 2024; don't use an earlier revision to report taxes for 2024. at this time, the irs expects the march 2024 revision of form 941 and these instructions to also be used for the second, third, and fourth quarters of 2024. if changes in law require additional changes. Make sure you paid all taxes related to the form you want to file (see step 2). go to taxes, and select payroll tax. select filings. you’ll see your forms to file under action needed. forms due later will show in coming up. you can select filter to find the specific form you need faster. select file on the form you want to file. Irs form 941 is a 3 page form with 5 parts. you must complete all 3 pages of form 941 and sign on page 3. failure to do so may delay the processing of your return. here's a step by step for each part of irs form 941. the employer reports the number of staff employed, wages, and taxes withheld in part 1.

How To Fill Out Irs Form 941 Simple Step By Step Instructions Youtube Make sure you paid all taxes related to the form you want to file (see step 2). go to taxes, and select payroll tax. select filings. you’ll see your forms to file under action needed. forms due later will show in coming up. you can select filter to find the specific form you need faster. select file on the form you want to file. Irs form 941 is a 3 page form with 5 parts. you must complete all 3 pages of form 941 and sign on page 3. failure to do so may delay the processing of your return. here's a step by step for each part of irs form 941. the employer reports the number of staff employed, wages, and taxes withheld in part 1. Here's a step by step guide and instructions for filing irs form 941. 1. gather information needed to complete form 941. form 941 asks for the total amount of tax you've remitted on behalf of your. Determining where to send 941 forms by mail can be trickier, as the correct form 941 mailing address varies depending on the employer’s location and intent (i.e., mailing with or without a payment). 941 form 2024 due dates . form 941 submissions must be made by the final day of the month directly following the end of a quarter.

File Form 941 Online For 2019 Express941 Here's a step by step guide and instructions for filing irs form 941. 1. gather information needed to complete form 941. form 941 asks for the total amount of tax you've remitted on behalf of your. Determining where to send 941 forms by mail can be trickier, as the correct form 941 mailing address varies depending on the employer’s location and intent (i.e., mailing with or without a payment). 941 form 2024 due dates . form 941 submissions must be made by the final day of the month directly following the end of a quarter.

Comments are closed.