How To Effectively Use Macd Indicator In Trading Stockstotrade

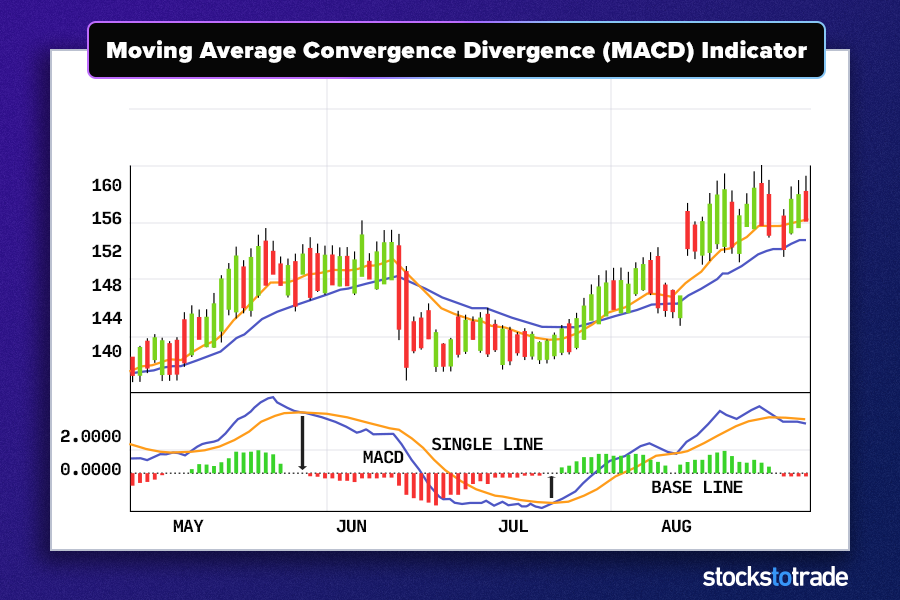

How To Effectively Use Macd Indicator In Trading Stockstotrade To effectively use the macd indicator, traders must first understand how it is calculated. here’s a step by step guide: calculate the 12 period ema of the closing prices. calculate the 26 period ema of the closing prices. subtract the 26 period ema from the 12 period ema to find the macd line. Along with the macd histogram, traders also often use a 9 period ema of the macd, called the "signal line," to help identify potential entry and exit points. if the macd crosses above the signal line, it is considered a bullish signal. if the macd crosses below the signal line, it is considered a bearish signal.

How To Effectively Use Macd Indicator In Trading Stockstotrade Setting up and interpreting signals from a stochastic divergence indicator involves several steps. practice and backtesting are crucial for effective use. steps to use the indicator: set the period lengths for %k and %d lines. adjust sensitivity based on trading style. apply the indicator to your chosen time frame. The macd is a trend following momentum indicator that shows the relationship between two moving averages. to combine the macd and the stochastic oscillator: identify crossovers in the stochastic oscillator. confirm trends with the macd line. use both signals to refine entry and exit points. there are so many technical indicators out there. Macd is a trend following momentum indicator that shows the relationship between two moving averages of a security’s price. the calculation involves subtracting the 26 period exponential moving average (ema) from the 12 period ema, resulting in what is known as the macd line. macd line: the difference between the 12 day and 26 day emas. 3.1 key macd indicators to watch; 4 how to use the macd indicator for trading. 4.1 what is the best time frame for macd? 4.2 how to use macd in crypto trading; 4.3 adapting the indicator to crypto market volatility; 4.4 combining macd with other technical indicators; 5 common mistakes. how not to use the macd indicator; 6 key takeaways; 7.

How To Use Macd Indicator Effectively In Trading Youtube Macd is a trend following momentum indicator that shows the relationship between two moving averages of a security’s price. the calculation involves subtracting the 26 period exponential moving average (ema) from the 12 period ema, resulting in what is known as the macd line. macd line: the difference between the 12 day and 26 day emas. 3.1 key macd indicators to watch; 4 how to use the macd indicator for trading. 4.1 what is the best time frame for macd? 4.2 how to use macd in crypto trading; 4.3 adapting the indicator to crypto market volatility; 4.4 combining macd with other technical indicators; 5 common mistakes. how not to use the macd indicator; 6 key takeaways; 7. Appendix c macd histogram and macd signal (macdext) appendix d stochastic slowd and stochastic slowk (stoch) appendix e stochastic fastd and stochastic fastk (stochf) appendix f custom alert criteria; see all 7 articles. Stockstotrade offers a wide range of indicators to help identify patterns on charts. you may add an indicator by clicking on the indicator button: this will provide you with a list of available indicators. for a complete list, please refer to appendix g. customizing indicators. you can customize the existing indicators (change the period and.

Comments are closed.