How To File Your Federal Payroll Forms 941 With Quickbooks Desktop Payroll Enhanced

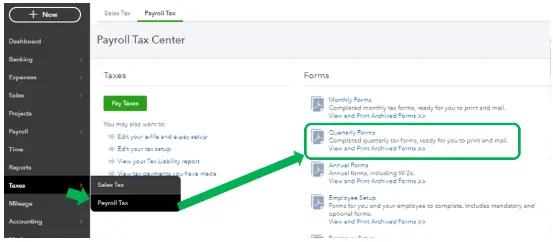

How To File Your Federal Payroll Forms 941 With Quickbooks Desktop Paying your federal taxes and filing the necessary payroll forms on time throughout the year is an essential task. in quickbooks desktop payroll enhanced, you can pay and file your 941 944, 940 taxes, and forms electronically. this is the fastest and easiest way to make sure you stay compliant with the irs. Step 3: e file your federal forms. go to employees, select payroll tax forms and w 2s, then select process payroll forms. select the federal form you need to file from the list. select create form. choose the form filing period, then select ok. review each part of the form. you can select check for errors, then make necessary corrections.

File A Corrected Federal Form 941 940 In Quickbooks Payroll Manually enter payroll paychecks in quickbooks online. by quickbooks•928•updated almost 2 years ago. upload your receipts to quickbooks online. by quickbooks•7076•updated 3 weeks ago. create invoices in quickbooks online. by quickbooks•2812•updated 4 days ago. enter and manage bills and bill payments in quickbooks online. At the end of each calendar quarter and year you’ll need to file federal and state tax forms with the appropriate agencies. you can do this through quickbook. Step 1 e file your tax forms. choose the federal form you need to file from the list. ensure that you review each part of the form. secondly, you can choose check for errors to make necessary corrections. enter the 10 digit irs efile pin and then follow the onscreen instructions to continue filing the form. You can also e file corrected employment tax returns form 941 x, form 943 x, and form 945 x. the form 940 e file program allows you to electronically file an amended form 940. benefits to e filing: it saves you time. it is secure and accurate. you receive acknowledgement within 24 hours. for more information on the irs e file program go to.

with QuickBooks Desktop Payroll Enhanced@2x.png)

How To Videos Step 1 e file your tax forms. choose the federal form you need to file from the list. ensure that you review each part of the form. secondly, you can choose check for errors to make necessary corrections. enter the 10 digit irs efile pin and then follow the onscreen instructions to continue filing the form. You can also e file corrected employment tax returns form 941 x, form 943 x, and form 945 x. the form 940 e file program allows you to electronically file an amended form 940. benefits to e filing: it saves you time. it is secure and accurate. you receive acknowledgement within 24 hours. for more information on the irs e file program go to. To start, click process payroll forms in the file tax forms section of the payroll center. quickbooks will guide you through the e file process. for step by step instructions, search the quickbooks help for “e file a payroll tax form.”. to access the quickbooks help, go to the help menu in quickbooks, and then click quickbooks help. At the end of each calendar quarter and year you’ll need to file federal and state tax forms with the appropriate agencies. you can do this through quickbooks desktop payroll enhanced. let’s go over how to prepare, print, and e file your federal forms. for this example, we’re going to show you the quarterly federal form 941.

How To File Quickbooks Form 941 In Desktop E File And E Pay To start, click process payroll forms in the file tax forms section of the payroll center. quickbooks will guide you through the e file process. for step by step instructions, search the quickbooks help for “e file a payroll tax form.”. to access the quickbooks help, go to the help menu in quickbooks, and then click quickbooks help. At the end of each calendar quarter and year you’ll need to file federal and state tax forms with the appropriate agencies. you can do this through quickbooks desktop payroll enhanced. let’s go over how to prepare, print, and e file your federal forms. for this example, we’re going to show you the quarterly federal form 941.

Comments are closed.