How To Fill Out Irs Form 941 Simple Step By Step Instructions

How To Fill Out Irs Form 941 Simple Step By Step Instructions Youtube A step by step explanation on how to fill out form 941. businesses with employees must file irs form 941 on a quarterly basis to report income taxes, social. Use the march 2024 revision of form 941 to report taxes for the first quarter of 2024; don't use an earlier revision to report taxes for 2024. at this time, the irs expects the march 2024 revision of form 941 and these instructions to also be used for the second, third, and fourth quarters of 2024. if changes in law require additional changes.

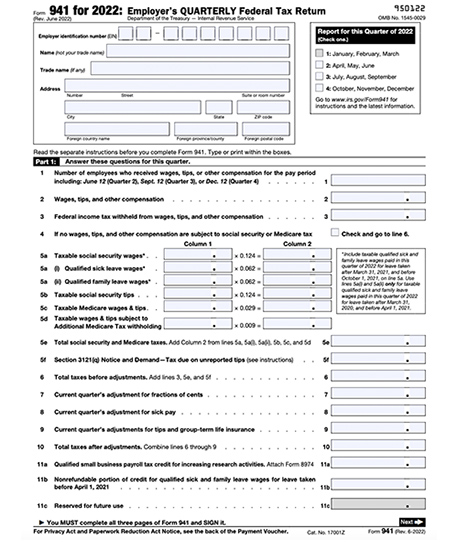

How To Fill Out Irs Form 941 2019 Pdf Expert Here's a step by step guide and instructions for filing irs form 941. 1. gather information needed to complete form 941. form 941 asks for the total amount of tax you've remitted on behalf of your. Business and quarter information. at the top portion of form 941, fill in your ein, business name, trade name (if applicable), and business address. off to the right side, mark which quarter the information is for. for example, put an “x” in the box next to “january, february, march” if the form is for the first quarter. Step by step instructions for form 941. irs form 941 is a 3 page form with 5 parts. you must complete all 3 pages of form 941 and sign on page 3. failure to do so may delay the processing of your return. here's a step by step for each part of irs form 941. part 1. the employer reports the number of staff employed, wages, and taxes withheld in. Employers use schedule d (form 941) to explain certain discrepancies between forms w 2, wage and tax statement, and forms 941, employer's quarterly federal tax return, for the totals of: social security wages. medicare wages and tips. social security tips, federal income tax withheld. advance earned income credit (eic) payments.

Irs Form 941 2023 Printable Forms Free Online Step by step instructions for form 941. irs form 941 is a 3 page form with 5 parts. you must complete all 3 pages of form 941 and sign on page 3. failure to do so may delay the processing of your return. here's a step by step for each part of irs form 941. part 1. the employer reports the number of staff employed, wages, and taxes withheld in. Employers use schedule d (form 941) to explain certain discrepancies between forms w 2, wage and tax statement, and forms 941, employer's quarterly federal tax return, for the totals of: social security wages. medicare wages and tips. social security tips, federal income tax withheld. advance earned income credit (eic) payments. Part 1. line 1 asks you for the number of employees currently working for you. line 2 asks for any wages, tips or other compensation you paid them. line 3 asks for income taxes you withheld from employees’ paychecks. if you have no wages, tips or other compensation subject to social security or medicare to report this quarter, check the box. Make the check or money order payable to “united states treasury.”. enter your ein, “form 941,” and the calendar quarter in which you originally deferred the deposit and payment (for example, “2nd quarter 2020”). payments should be sent to: department of the treasury internal revenue service ogden, ut 84201 0030. or.

How To Fill Out Irs Form 941 2022 2023 Pdf Expert Part 1. line 1 asks you for the number of employees currently working for you. line 2 asks for any wages, tips or other compensation you paid them. line 3 asks for income taxes you withheld from employees’ paychecks. if you have no wages, tips or other compensation subject to social security or medicare to report this quarter, check the box. Make the check or money order payable to “united states treasury.”. enter your ein, “form 941,” and the calendar quarter in which you originally deferred the deposit and payment (for example, “2nd quarter 2020”). payments should be sent to: department of the treasury internal revenue service ogden, ut 84201 0030. or.

How To Fill Out Form 941 For Employee Retention Credit Tax

Irs Form 941 Instructions How To Fill Out And File Form 941 Mojafarma

Comments are closed.