How To Finance Your Small Business Start Up

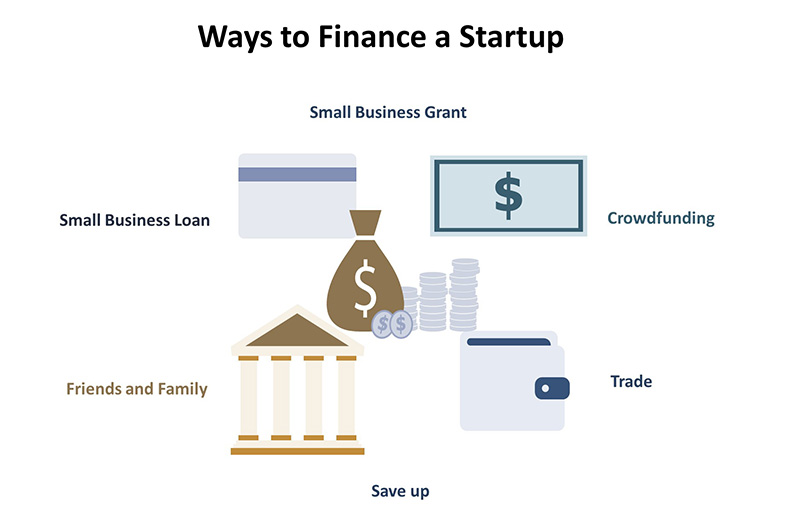

Show Me The Money 6 Ways To Finance Your Startup Otherwise known as bootstrapping, self funding lets you leverage your own financial resources to support your business. self funding can come in the form of turning to family and friends for capital, using your savings accounts, or even tapping into your 401 (k). with self funding, you retain complete control over the business, but you also. 2. sba microloans. the u.s. small business administration (sba) microloan program extends up to $50,000 loans to small business owners who need money to grow or get their business off the ground.

10 Valuable Tips To Finance Your Business Startup Sources In 2022 Lenders also may request copies of business licenses and registrations applicable to your business or industry, as well as banking information for direct deposit. 4. research and compare lenders. Get $500 to $5.5 million to fund your business. loans guaranteed by sba range from small to large and can be used for most business purposes, including long term fixed assets and operating capital. some loan programs set restrictions on how you can use the funds, so check with an sba approved lender when requesting a loan. Get help after a disaster with low interest disaster loans from the small business administration. physical damage loans. mitigation assistance. economic injury disaster loans. military reservist loan. hurricane helene. hurricane milton. recovery center locations. 8. crowdfunding. crowdfunding is an out of the box way to raise cash for your business goals. several crowdfunding options include: debt crowdfunding that you repay; equity crowdfunding where you.

Six Ways To Finance A Startup Founder S Guide Get help after a disaster with low interest disaster loans from the small business administration. physical damage loans. mitigation assistance. economic injury disaster loans. military reservist loan. hurricane helene. hurricane milton. recovery center locations. 8. crowdfunding. crowdfunding is an out of the box way to raise cash for your business goals. several crowdfunding options include: debt crowdfunding that you repay; equity crowdfunding where you. Startup capital often comes in the form of self funding, investors or small business loans. knowing your financing needs and business goals will help you choose the right type of startup funding. Key takeaways. there are various funding options for startups, including microloans, personal loans, equipment loans, and sba loans. other options include business credit cards, crowdfunding, invoice financing, and borrowing from friends and family. many traditional lenders require startups to have established revenue and good credit.

How To Finance Your Small Business Start Up Startup capital often comes in the form of self funding, investors or small business loans. knowing your financing needs and business goals will help you choose the right type of startup funding. Key takeaways. there are various funding options for startups, including microloans, personal loans, equipment loans, and sba loans. other options include business credit cards, crowdfunding, invoice financing, and borrowing from friends and family. many traditional lenders require startups to have established revenue and good credit.

4 Ways To Finance Your Small Business Smallbizclub

Comments are closed.