How To Interpret The Macd On A Trading Chart Dummies

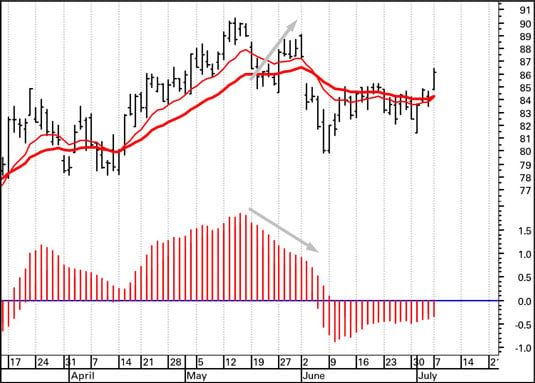

How To Interpret The Macd On A Trading Chart Dummies Sell: the real benefit comes at the next signal — the exit. here, the macd tells you to sell over two weeks ahead of the moving average crossover, saving you $4.68, or almost 5 percent. reenter: at the right hand side of the chart, the macd tells you to reenter, while the moving averages are still lollygagging along and haven’t yet crossed. The macd indicator, also known as the macd oscillator, is one of the most popular technical analysis tools. there are three main components of the macd shown in the picture below: macd: the 12 period exponential moving average (ema) minus the 26 period ema. macd signal line: a 9 period ema of the macd. macd histogram: the macd minus the macd.

How To Read And Interpret The Macd Indicator Forex Trading Training Value = macd line. avg = moving average of the macd line. diff = difference between the value and the avg. value line is the value we get when we subtract the 26ema from the 12ema. in the picture below, we open the user dialog box for the macd study inside tos and see the signal settings. let’s take a closer look. The macd line (marked blue) is calculated by subtracting the 26 period exponential moving average (ema) from the 12 period ema; it is the difference between these two emas. the signal line, marked red, is the 9 period ema of the macd line. the macd line is the faster moving average, while the signal line is the slower moving average. Read on to learn how you can start looking for ways to incorporate this powerful tool into your trading strategy. background knowledge the macd's popularity is largely due to its ability to help. Macd indicator explained. the macd indicator consists of three components: the macd line: the main macd line is generated by subtracting the longer moving average (26 period) from the shorter one (12 period). the macd line helps determine upward or downward momentum, i.e., market trend; the signal line: the signal line is the ema (typically 9.

How To Interpret The Macd On A Trading Chart Dummies Read on to learn how you can start looking for ways to incorporate this powerful tool into your trading strategy. background knowledge the macd's popularity is largely due to its ability to help. Macd indicator explained. the macd indicator consists of three components: the macd line: the main macd line is generated by subtracting the longer moving average (26 period) from the shorter one (12 period). the macd line helps determine upward or downward momentum, i.e., market trend; the signal line: the signal line is the ema (typically 9. Back to the ‘mac dee.’. the standard macd indicator subtracts the 26 day ema from the 12 day ema. this calculation produces the macd line on a chart (example below). the signal line is the 9 day ema of the macd line. if the display includes a histogram, it’s calculated by subtracting the signal line from the macd line. The macd, short for moving average convergence divergence, is a commonly used technical indicator that consists of the macd line and a signal line. traders use this indicator to look at the crossovers and divergences of the two lines to generate buy and sell signals and act on them wherever applicable. the indicator was developed by gerald.

When To Use And How To Read The Macd Indicator Commodity Back to the ‘mac dee.’. the standard macd indicator subtracts the 26 day ema from the 12 day ema. this calculation produces the macd line on a chart (example below). the signal line is the 9 day ema of the macd line. if the display includes a histogram, it’s calculated by subtracting the signal line from the macd line. The macd, short for moving average convergence divergence, is a commonly used technical indicator that consists of the macd line and a signal line. traders use this indicator to look at the crossovers and divergences of the two lines to generate buy and sell signals and act on them wherever applicable. the indicator was developed by gerald.

What Is Macd Moving Average Convergence Divergence Britannica Money

Comments are closed.