How To Make A Monthly Budget 3 Easy Steps Positively Frugal

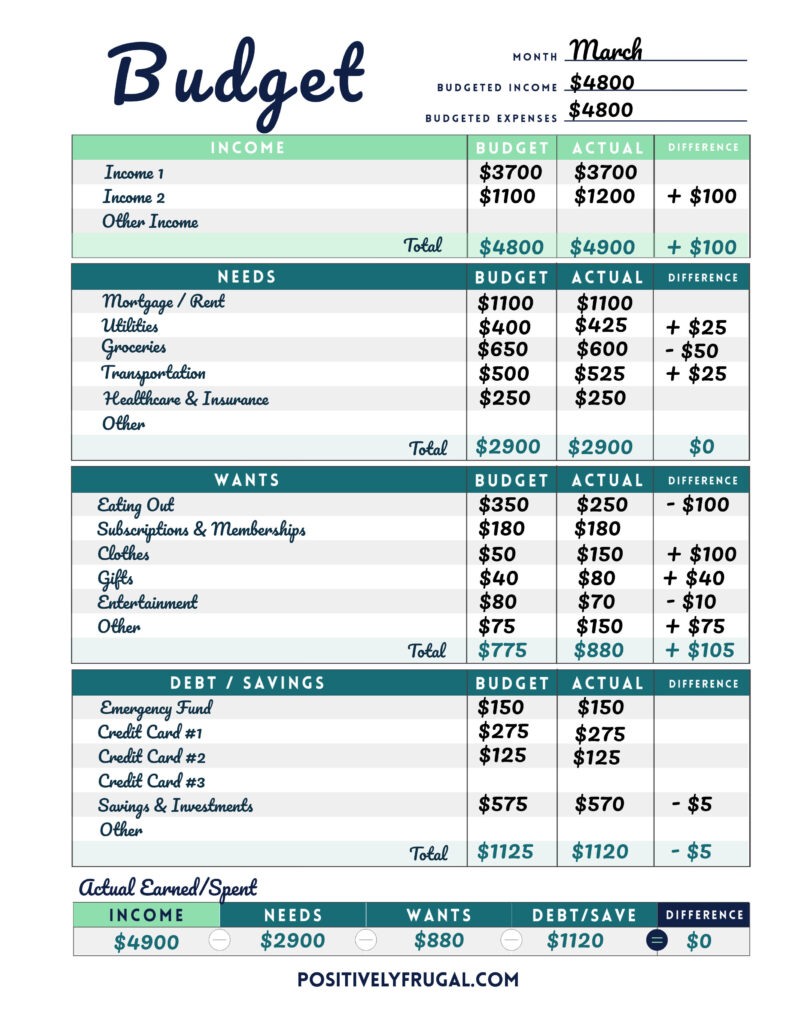

How To Make A Monthly Budget 3 Easy Steps Positively Frugal Step 1: analyze the numbers. the first step of how to make a basic budget is to analyze the numbers. you need to look at the actual figures of your income and expenses. you will need to do a little math, so grab a calculator, a pencil and a piece of paper (or use my free printable monthly budget form). Step 6: add the actual figures to the budget tracker printable to calculate your final figure. at the end of the month, you need to calculate your actual costs to see where you came in under budget, where you were right on target and any places you may have exceeded your budgeted amounts.

The Easiest And Simplest Way To Create A Monthly Budget For A Family 3 Start budgeting now! whether you are taking your first steps on the path to frugality or getting a firm grip on your financial situation, goals and a budget are the place to start. in fact, you can start budgeting right now! get off on the right foot and use my budget template, which you can get for free when you subscribe to positively frugal. 1. use a 50 30 20 calculator. a budget calculator will do the math so you don’t have to divide dollars and cents. try out the one below for yourself. input your monthly after tax income to get. Creating a budget that emphasizes frugal living can help you not only meet your financial goals but also minimize unnecessary expenses. learn more about how to create a frugal budget—from getting started with the materials you need, to the steps you need to take, to sticking to your budget and making it a habit. Key takeaways of budgeting: budgeting is not a spending plan, it is a saving plan. the purpose of a budget is to achieve your financial goals. the 10 steps of budgeting are: commit to a routine. set inspiring goals. calculate your monthly income. prioritize debt, giving and saving. calculate your living expenses.

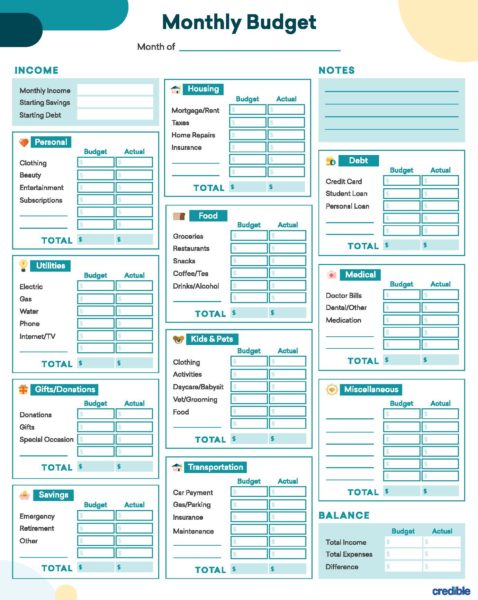

6 Steps To Creating A Budget Tips Tricks And More Credible Creating a budget that emphasizes frugal living can help you not only meet your financial goals but also minimize unnecessary expenses. learn more about how to create a frugal budget—from getting started with the materials you need, to the steps you need to take, to sticking to your budget and making it a habit. Key takeaways of budgeting: budgeting is not a spending plan, it is a saving plan. the purpose of a budget is to achieve your financial goals. the 10 steps of budgeting are: commit to a routine. set inspiring goals. calculate your monthly income. prioritize debt, giving and saving. calculate your living expenses. Step 4 plan out debt payments. step 5 establish savings goals. step 6 start tracking your spending. step 7 tweak your budget as needed. budget plan template with budget example. your new favorite budgeting tool. amazing! how to create a monthly budget: final thoughts. your budget doesn't have to be perfect. The first step to starting a monthly budget is determining how much money you earn each month. this is not your gross income. instead, it is your net income. your income will include the take home pay from your day job plus any money you earn through a side hustle. don’t overlook other streams of income.

How To Make A Budget The Frugal Cottage Step 4 plan out debt payments. step 5 establish savings goals. step 6 start tracking your spending. step 7 tweak your budget as needed. budget plan template with budget example. your new favorite budgeting tool. amazing! how to create a monthly budget: final thoughts. your budget doesn't have to be perfect. The first step to starting a monthly budget is determining how much money you earn each month. this is not your gross income. instead, it is your net income. your income will include the take home pay from your day job plus any money you earn through a side hustle. don’t overlook other streams of income.

How To Set Up A Budget Worksheet

3 Frugal Budgeting Methods For Beginners Budgeting Money Budgeting

Comments are closed.