How To Make A Simple Budget Budgeting Budgeting Money Makingо

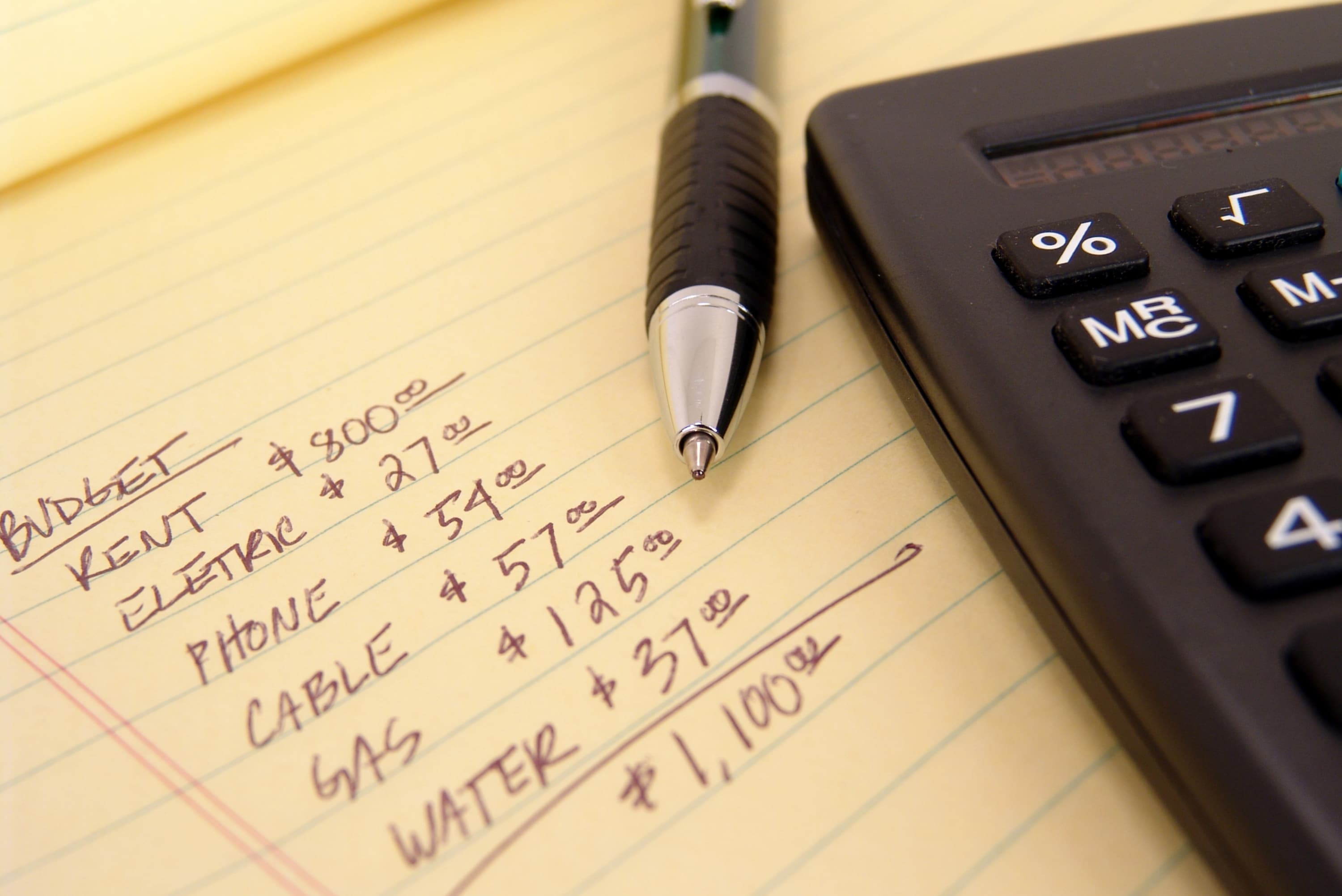

How To Budget Your Money Effectively In 4 Simple Steps Budgeting Here’s how to design your own 50 30 20 plan in three simple steps. 1. use a 50 30 20 calculator. a budget calculator will do the math so you don’t have to divide dollars and cents. try out the. Pull up your bank account or pay stubs and figure out how much each paycheck is. jot down the amounts and make a total of all your income for the month. at the top of the paper write: paycheck 1: $2000. paycheck 2: $2000. total income: $4,000. **amounts are examples.

How To Make A Budget 12 Personal Budgeting Tips For First Timers Let’s do this.) subtract all your expenses from your income. this number should equal zero, meaning you just made a zero based budget. this is key: a zero based budget doesn’t mean you let your bank account reach zero. (leave a little buffer in there of about $100–300.) it also doesn’t mean you blow all your money. Option 2: use a budget app. if you prefer to operate in the 21st century, there are numerous apps to help you track your new budget. personal capital is a good budgeting app for those following the 50 30 30 rule (and it’s free!). it allows you to set a spending target and alerts you to progress throughout the month. 50 30 20 budget. the 50 30 20 approach is a very popular budgeting strategy. this method is based on the idea that you can separate your monthly income into three categories: needs: essential. 1. excel or google sheets budget template (download my free digital budgeting spreadsheet) 2. spending tracker. you should use a spending tracker to keep track of each of your transactions during the month. it’s very important to track every transaction! i personally use the paid app every dollar (on my 3rd year).

How To Make A Household Budget That Works The Easy Way Great Tips 50 30 20 budget. the 50 30 20 approach is a very popular budgeting strategy. this method is based on the idea that you can separate your monthly income into three categories: needs: essential. 1. excel or google sheets budget template (download my free digital budgeting spreadsheet) 2. spending tracker. you should use a spending tracker to keep track of each of your transactions during the month. it’s very important to track every transaction! i personally use the paid app every dollar (on my 3rd year). Set your savings goal first. the rest of budgeting is an exercise in how to achieve it. 2. create a budget spreadsheet. you don’t have to be an excel whiz to put together a simple monthly budget. you don’t even need to create it yourself — try our sample budget template in google sheets. Step 1: calculate your net income. building an effective budget often starts by assessing your net income or take home pay. that’s your total wages or salary after taking out taxes and employee benefits, such as 401 (k) contributions and health insurance premiums. it’s the amount that is deposited in your bank account every pay period.

Comments are closed.