How To Manage Your Money 50 30 20 Rule

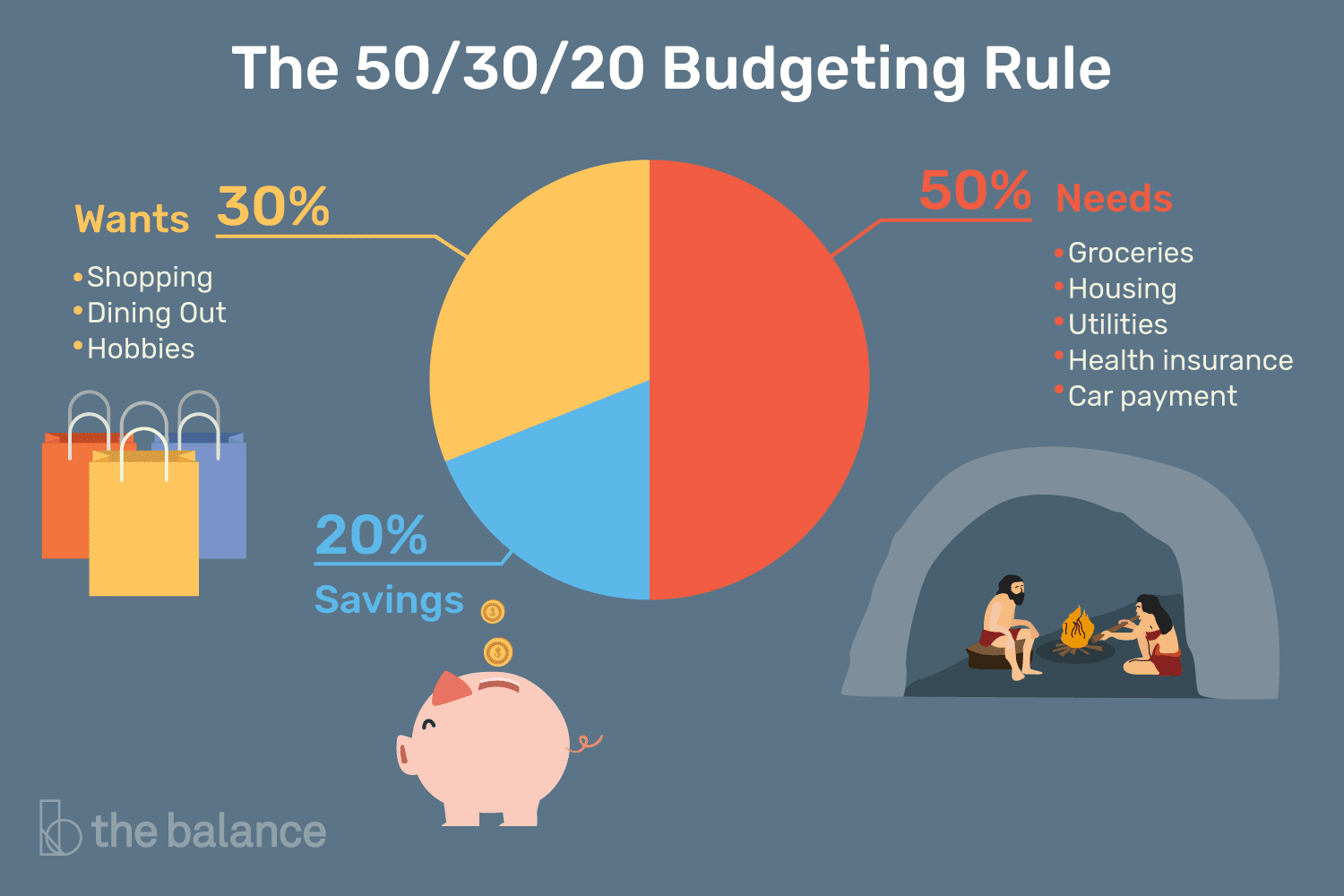

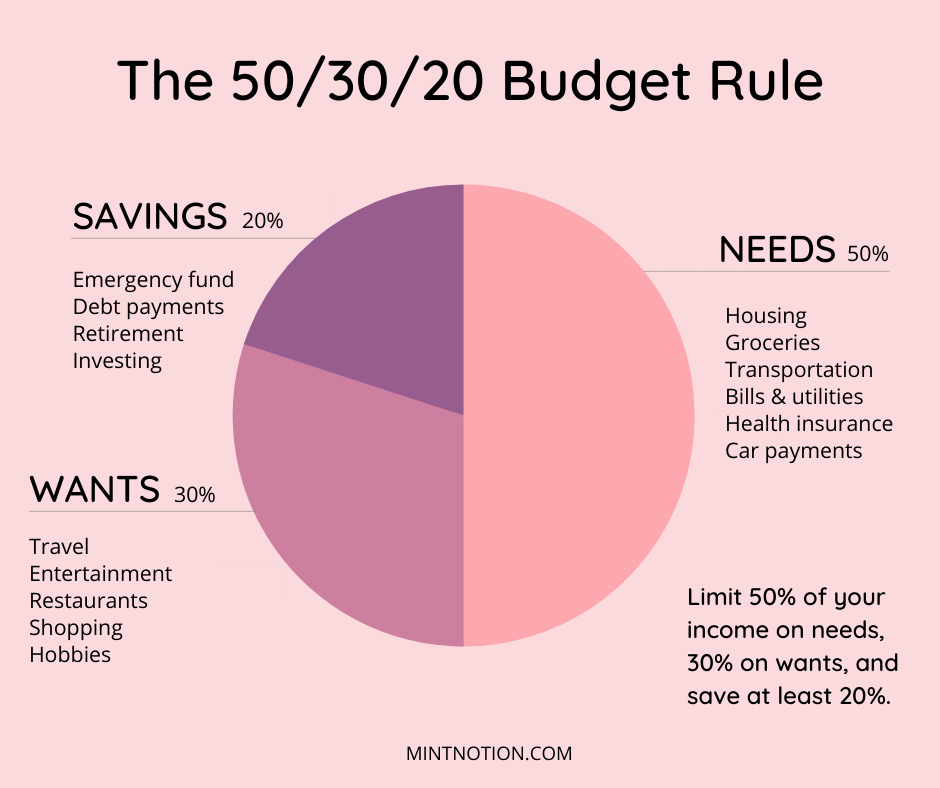

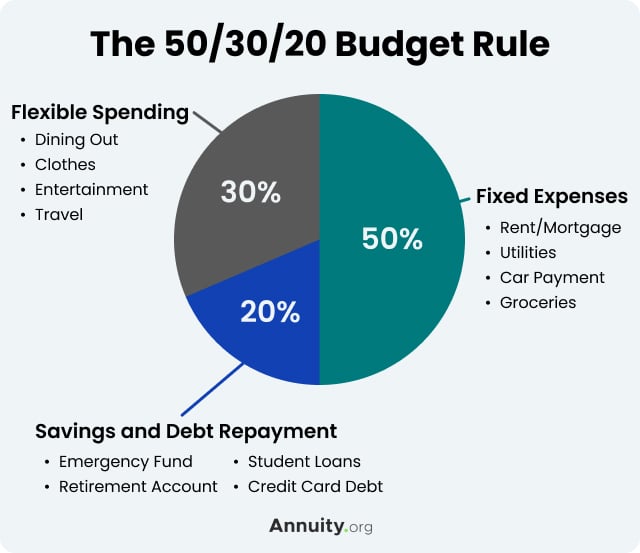

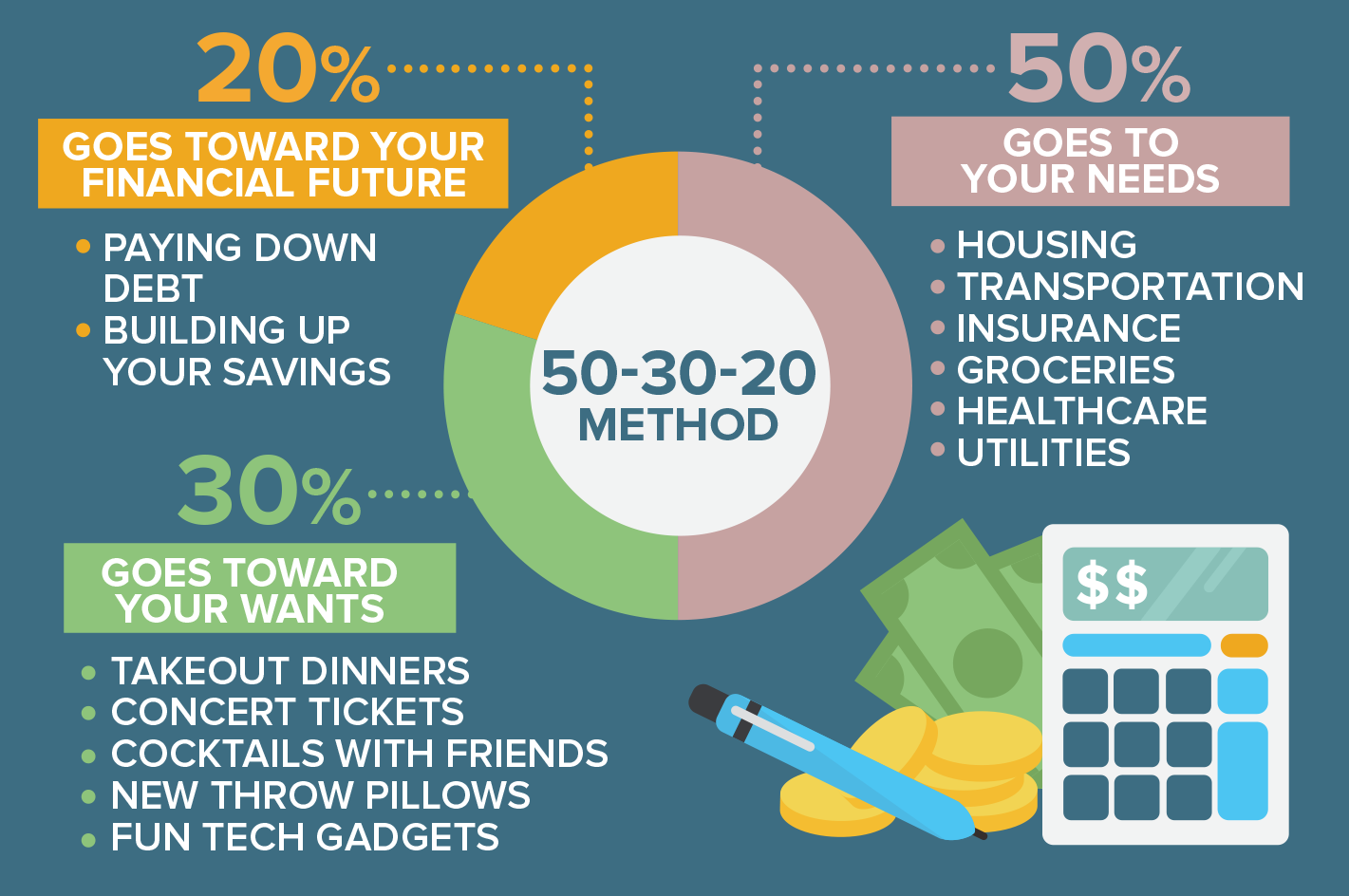

The 50 30 20 Rule A Quick Start Guide To Budgeting The 50 30 20 rule is a budgeting technique that involves dividing your money into three primary categories based on your after tax income (i.e., your take home pay): 50% to needs, 30% to wants and. The 50 30 20 budget rule is a simple and effective plan for personal money management and wealth creation. it balances paying for necessities with saving and investing.

50 30 20 Budget Rule How To Make A Realistic Budget Mint Notion Our 50 30 20 calculator divides your. take home income. into suggested spending in three categories: 50% of net pay for needs, 30% for wants and 20% for savings and debt repayment. Step 1: figure out your take home pay. the first step in creating a 50 30 20 budget is to figure out your net income since that’s the figure you’ll be dividing from. your net income is how much you take home after payroll taxes are deducted. look at your most recent pay stub to see what your take home pay is. Now that you know what the 50 30 20 rule is, we can discuss an example. suppose your monthly after tax income is $4500. according to the rule, you should allocate your salary as follows: 50% of $4500 to your necessities, which is. (4500 × 50) 100 = $2250; 30% of $4500 to your wants, which is. (4500 × 30) 100 = $1350; and. You may have financial goals that require more or less than 20% of your income. and, in some cases, your mandatory expenses may require more than 50% of your income. if the 50 30 20 rule doesn't.

50 30 20 Budgeting Rule What It Is And How To Use It Now that you know what the 50 30 20 rule is, we can discuss an example. suppose your monthly after tax income is $4500. according to the rule, you should allocate your salary as follows: 50% of $4500 to your necessities, which is. (4500 × 50) 100 = $2250; 30% of $4500 to your wants, which is. (4500 × 30) 100 = $1350; and. You may have financial goals that require more or less than 20% of your income. and, in some cases, your mandatory expenses may require more than 50% of your income. if the 50 30 20 rule doesn't. The 50 30 20 rule is a budgeting strategy that allocates 50 percent of your income to must haves, 30 percent to wants and 20 percent to savings. it is a simple plan that works well for those who. Key takeaways. the 50 30 20 rule of thumb is a guideline for allocating your budget accordingly: 50% to “needs,” 30% to “wants,” and 20% to your financial goals. the rule was popularized in a book by u.s. senator elizabeth warren and her daughter, amelia warren tyagi. your percentages may need to be adjusted based on your personal.

How 50 20 30 Rule Will Change Your Life Finance Expert The 50 30 20 rule is a budgeting strategy that allocates 50 percent of your income to must haves, 30 percent to wants and 20 percent to savings. it is a simple plan that works well for those who. Key takeaways. the 50 30 20 rule of thumb is a guideline for allocating your budget accordingly: 50% to “needs,” 30% to “wants,” and 20% to your financial goals. the rule was popularized in a book by u.s. senator elizabeth warren and her daughter, amelia warren tyagi. your percentages may need to be adjusted based on your personal.

How To Use The 50 30 20 Rule For Budgeting Your Money

Comments are closed.