How To Prepare A Journal Entry Steps Accounting Capital

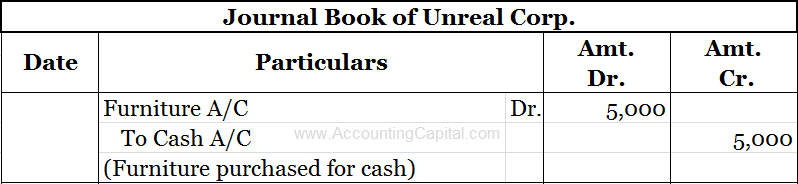

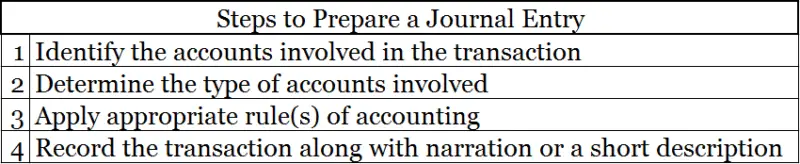

How To Prepare A Journal Entry Steps Accounting Capital Prepare a journal entry to be noted in the journal book. step i – identify the accounts involved in the transaction – there will be a minimum of two such accounts. going back to the above example the accounts identified in this case are “furniture a c” & “cash a c”. simple journal entry – there will be no more than 2 accounts. Capital is an internal liability for the business hence credit the increase in liabilities. example – max started a business with 10,000 in cash. cash a c. 10,000. to capital a c. 10,000. (capital introduced by max in cash for 10,000) related topic – all journal entries on one page. 2.

How To Prepare A Journal Entry Steps Accounting Capital To increase an expense account, debit it. in the journal entry, the $7,300 payment of cash goes on the right (credit) side of the account because cash is decreasing. in the salaries expense account, the $7,300 deposit goes on the left (debit) side of the account because the expense is increasing. Entry #1 — paul forms the corporation by purchasing 10,000 shares of $1 par stock. entry #2 — paul finds a nice retail storefront in the local mall and signs a lease for $500 a month. entry #3 — pgs takes out a bank loan to renovate the new store location for $100,000 and agrees to pay $1,000 a month. A journal entry in accounting is how you record financial transactions. to make a journal entry, you enter the details of a transaction into your company’s books. in the second step of the accounting cycle, your journal entries get put into the general ledger. every journal entry in the general ledger will include the date of the transaction. To make a complete journal entry you need the following elements: a reference number or also known as the journal entry number, which is unique for every transaction. the date of the journal entry. the account column, where you put the names of the accounts that have changed. two separate columns for debit and credit.

Journal Entry For Capital Geeksforgeeks A journal entry in accounting is how you record financial transactions. to make a journal entry, you enter the details of a transaction into your company’s books. in the second step of the accounting cycle, your journal entries get put into the general ledger. every journal entry in the general ledger will include the date of the transaction. To make a complete journal entry you need the following elements: a reference number or also known as the journal entry number, which is unique for every transaction. the date of the journal entry. the account column, where you put the names of the accounts that have changed. two separate columns for debit and credit. Journal entries are recorded in the "journal", also known as "books of original entry". a journal entry is made up of at least one account that is debited and at least one account credited. a simple journal entry has 1 account debited and 1 account credited. a compound journal entry contains more than 1 account on either the debit or credit side. Let's start. transaction #1: on december 1, 2021, mr. donald gray started gray electronic repair services by investing $10,000. the journal entry should increase the company's cash, and increase (establish) the capital account of mr. gray; hence: transaction #2: on december 5, gray electronic repair services paid registration and licensing fees.

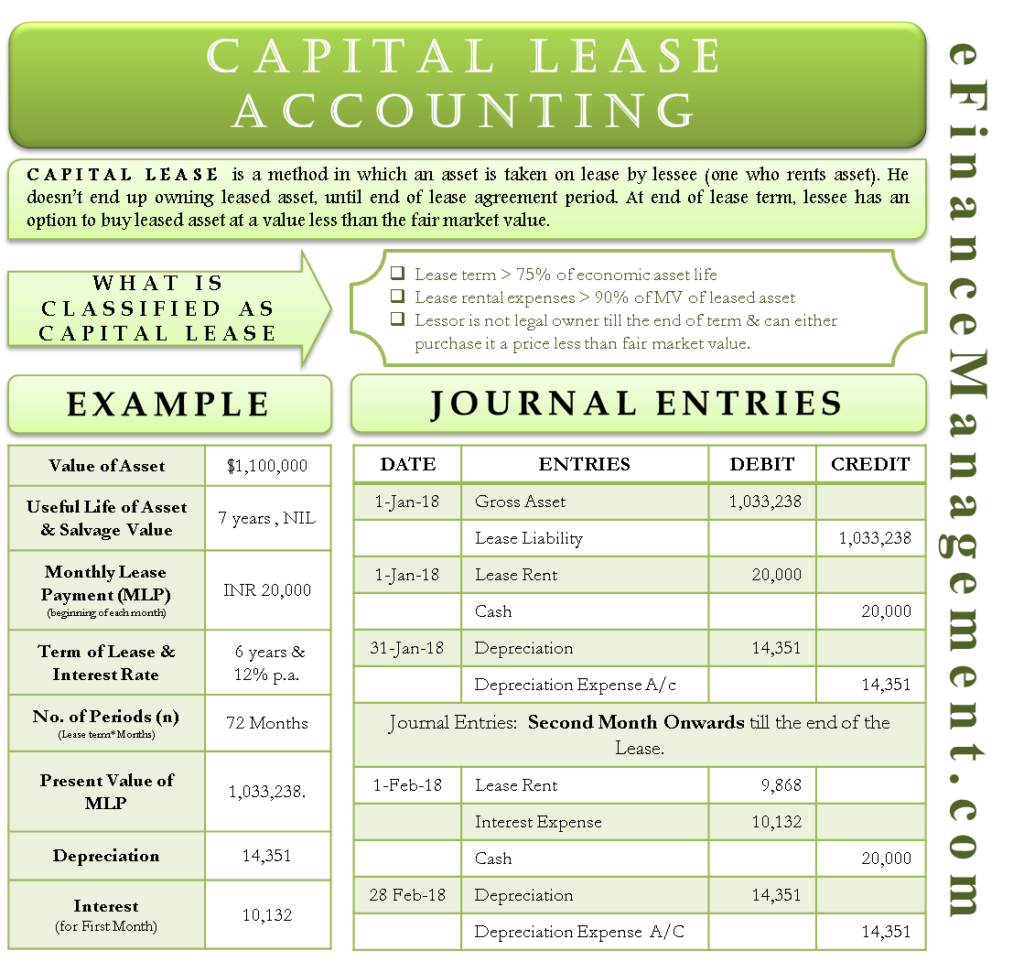

Capital Lease Accounting With Example And Journal Entries Journal entries are recorded in the "journal", also known as "books of original entry". a journal entry is made up of at least one account that is debited and at least one account credited. a simple journal entry has 1 account debited and 1 account credited. a compound journal entry contains more than 1 account on either the debit or credit side. Let's start. transaction #1: on december 1, 2021, mr. donald gray started gray electronic repair services by investing $10,000. the journal entry should increase the company's cash, and increase (establish) the capital account of mr. gray; hence: transaction #2: on december 5, gray electronic repair services paid registration and licensing fees.

Comments are closed.