How To Read A Credit Report Lexington Law

How To Read A Credit Report Lexington Law While a credit score offers a high level overview of your current financial standing, a credit report offers an in depth look at your lending history. each consumer has three main credit reports (one each from experian, equifax, and transunion), and it’s important to read through each of these credit reports at least once a year in order to stay on top of any inaccurate, outdated, or missing. Credit reports are important because they provide the basis for your credit score, which is used by lenders to make decisions about whether to offer you a loan or credit card. each of the five factors that are used to determine your credit score can be traced back to information in your credit report. here’s how your score is calculated.

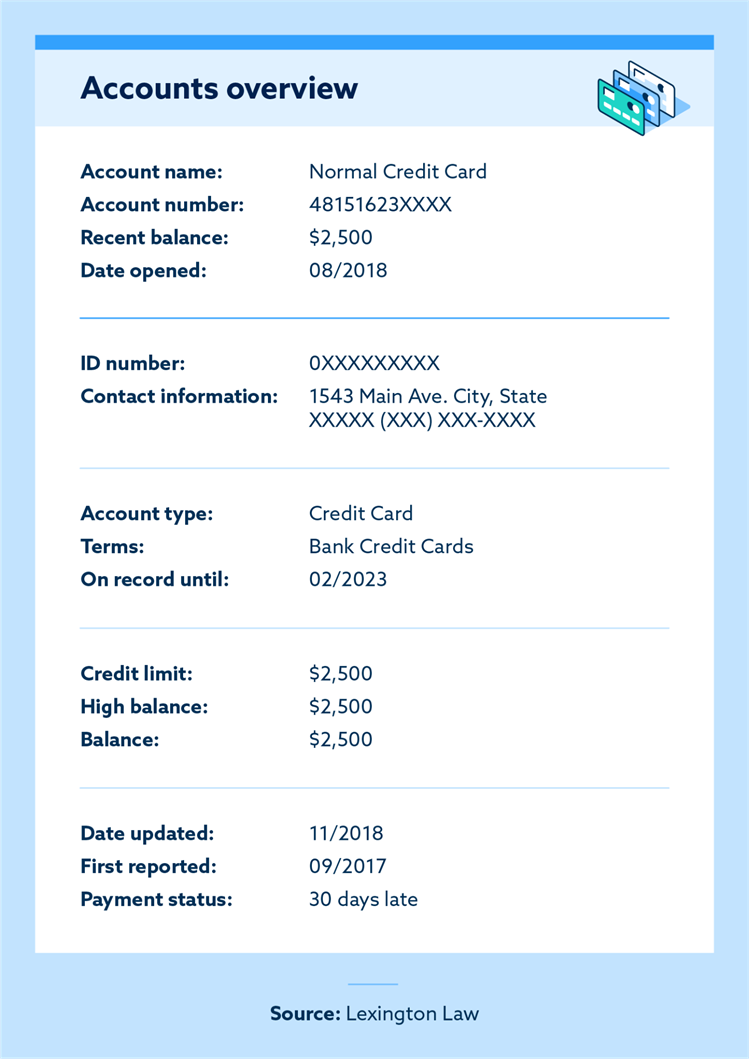

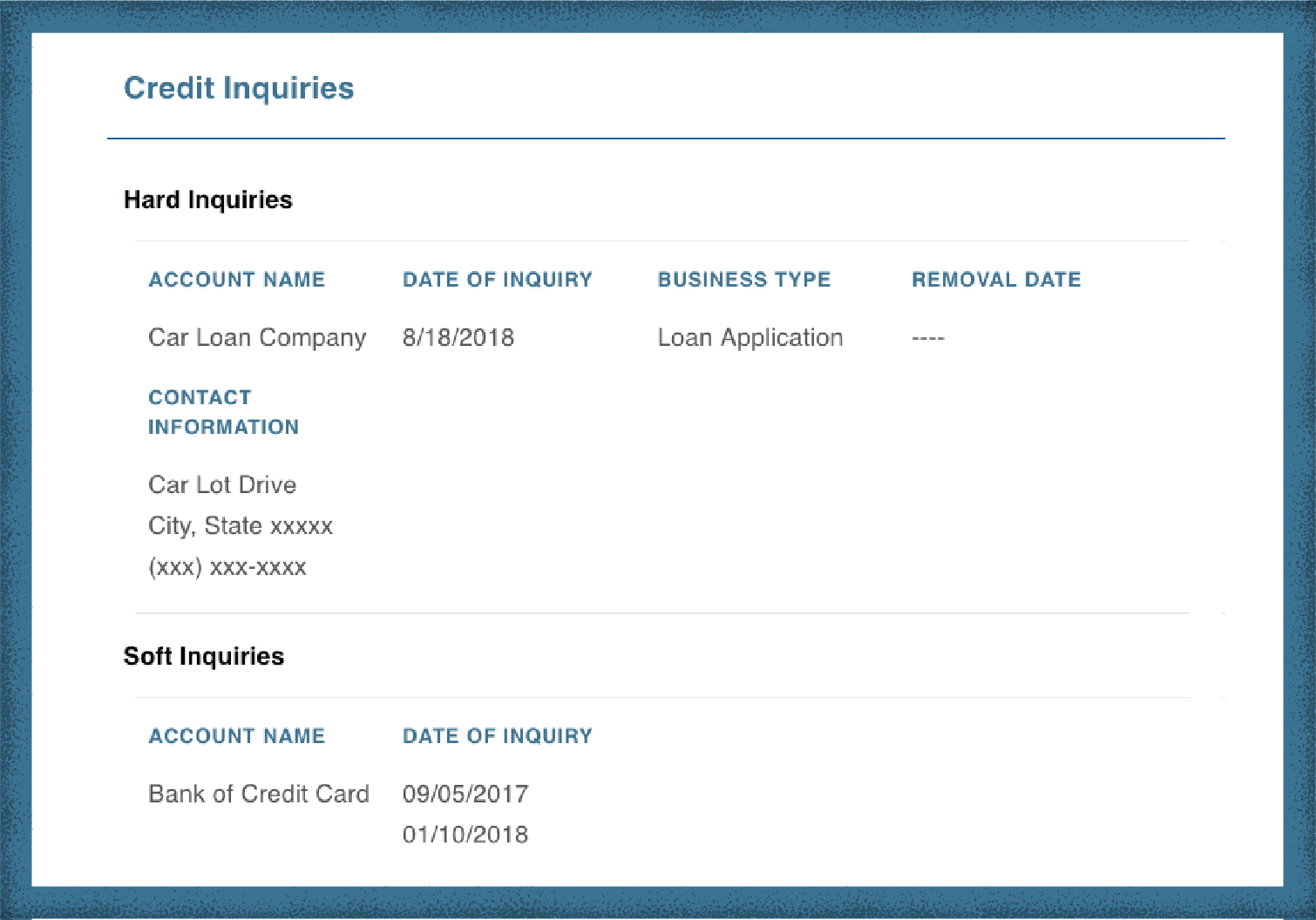

How To Read Your Credit Report Lexington Law Incorporate your business. acquire an employer identification number (ein) apply for a business lines of credit. gain a business credit card. get a d u n s number. frequently check your credit reports. set up a business bank account. prepay on your loans. ask for trade references. The first section of your credit report will list your personal information. this information is gleaned from public records or from credit applications you might have filled out previously, and includes: name. social security number. addresses. phone numbers. birth date. past and current employers. A credit report is a detailed summary of your credit history. it includes key details such as your payment history, account balances, credit checks and any public records like bankruptcies. credit reports are compiled by the three major credit bureaus: equifax, experian, and transunion. Lexington law vs. credit saint. credit saint offers three service packages ranging from $79.99–$129.99 per month. the $99.99 credit remodel plan is most similar to lexington law’s suite of.

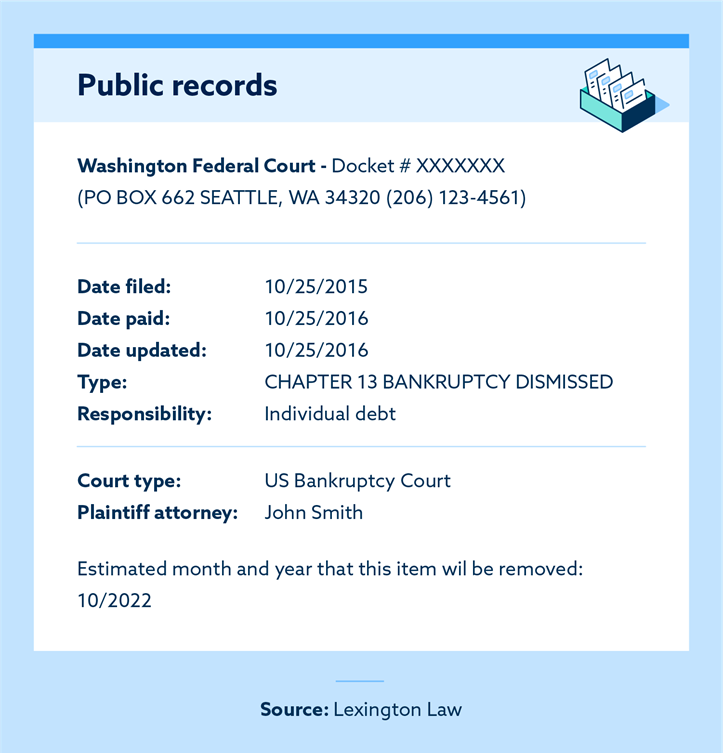

How To Read A Credit Report Lexington Law A credit report is a detailed summary of your credit history. it includes key details such as your payment history, account balances, credit checks and any public records like bankruptcies. credit reports are compiled by the three major credit bureaus: equifax, experian, and transunion. Lexington law vs. credit saint. credit saint offers three service packages ranging from $79.99–$129.99 per month. the $99.99 credit remodel plan is most similar to lexington law’s suite of. Yes, lexington law is a legitimate company offering credit repair services since 2004. it's one of the most reputable companies in the industry, with 2 decades of experience. lexington law has helped thousands of clients remove over 83 million items from their credit reports. Knowing the type of bankruptcy is important for your credit report and score. chapter 7: generally, 10 years from the date the bankruptcy was filed. chapter 13: 7 years from the date the bankruptcy was filed. bankruptcies can have a severe negative impact to your credit score. your score can improve even if there are bankruptcies present on.

Comments are closed.