How To Read And Interpret The Macd Indicator Forex Trading Training

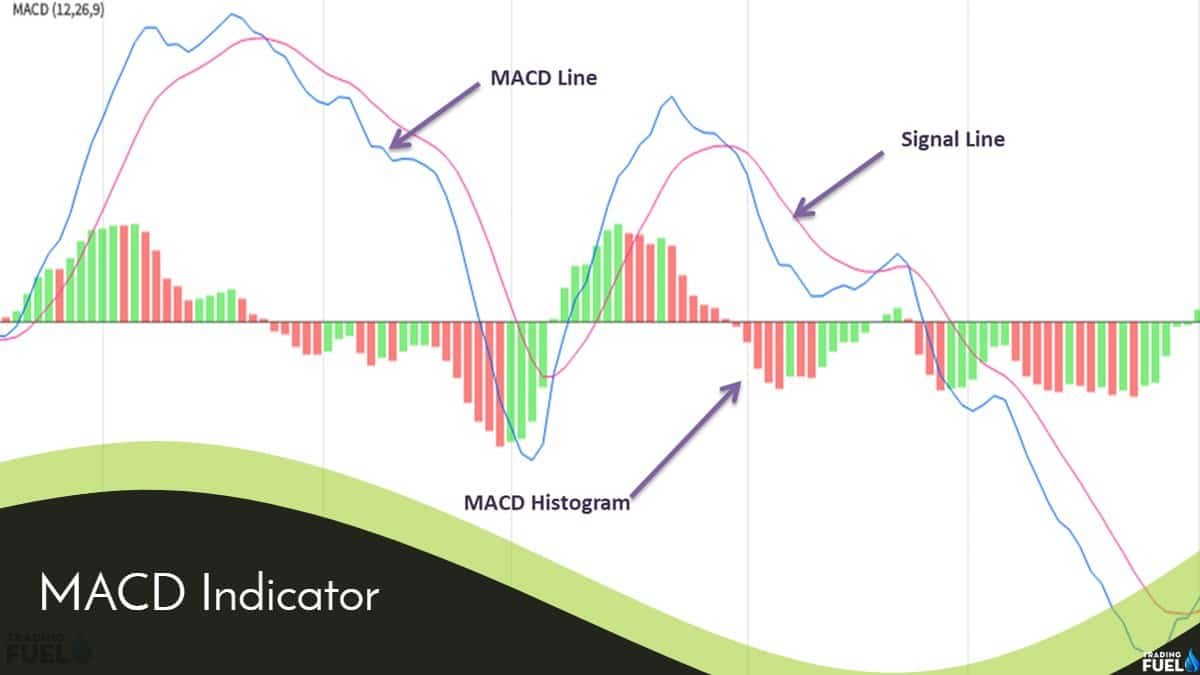

How To Read And Interpret The Macd Indicator Forex Trading Training Value = macd line. avg = moving average of the macd line. diff = difference between the value and the avg. value line is the value we get when we subtract the 26ema from the 12ema. in the picture below, we open the user dialog box for the macd study inside tos and see the signal settings. let’s take a closer look. The macd indicator, also known as the macd oscillator, is one of the most popular technical analysis tools. there are three main components of the macd shown in the picture below: macd: the 12 period exponential moving average (ema) minus the 26 period ema. macd signal line: a 9 period ema of the macd. macd histogram: the macd minus the macd.

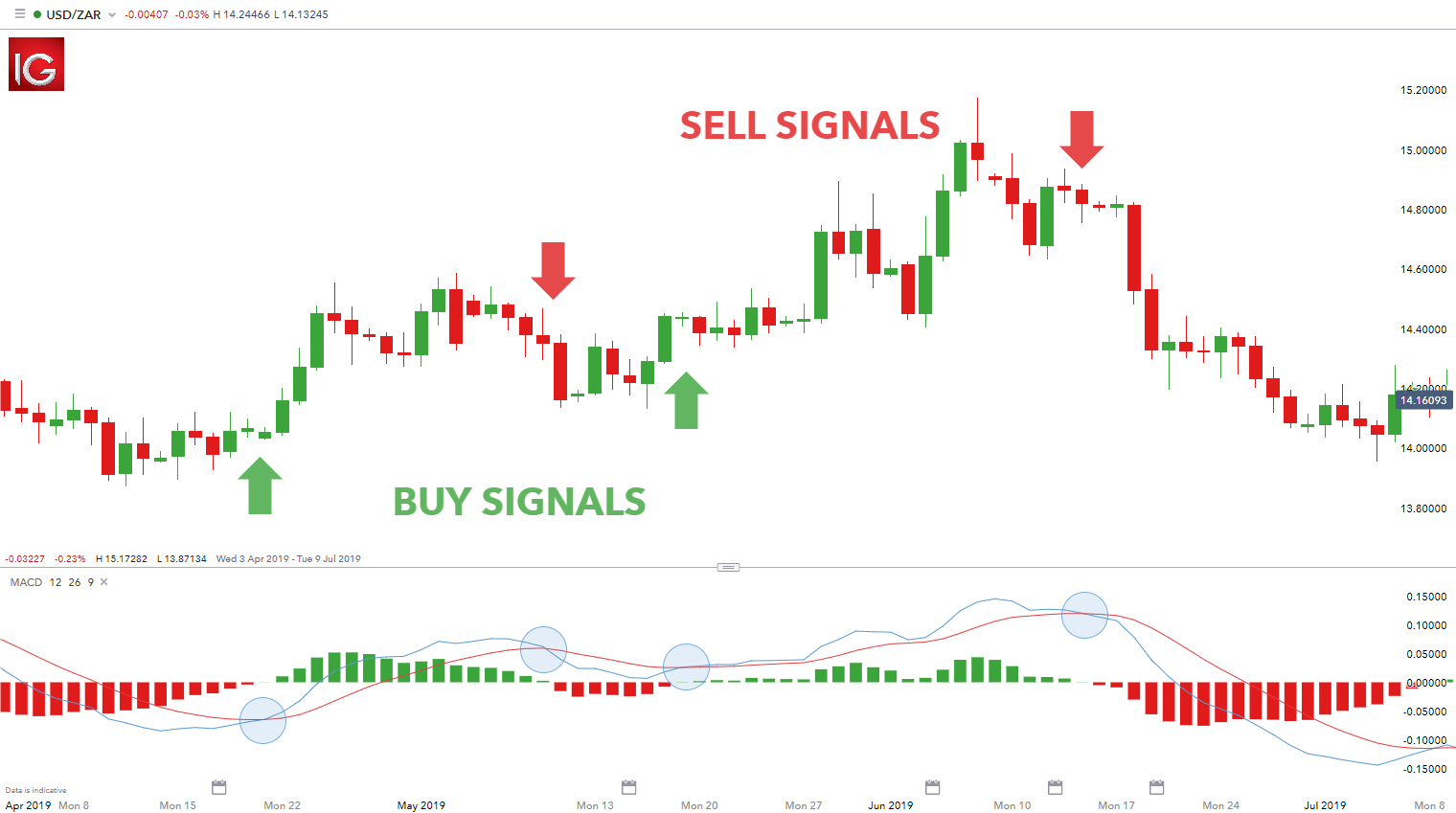

When To Use And How To Read The Macd Indicator Commodity Forex Macd is an acronym for m oving a verage c onvergence d ivergence. this technical indicator is a tool that’s used to identify moving averages that are indicating a new trend, whether it’s bullish or bearish. after all, a top priority in trading is being able to find a trend, because that is where the most money is made. Interpreting macd signals. macd crossover: one of the most popular ways of using the macd involves the macd line and the signal line: bullish and bearish crossovers. once the macd line crosses. The 10 steps to interpret the macd indicator in forex trading are crucial for investors. first, understand the macd line’s crossovers to anticipate trend changes. second, recognize the signal line crossovers for buy and sell signals. Macd signals can provide valuable insights into the forex market’s current trend and potential reversals. understanding how to interpret these signals is crucial for successful trading. 1. bullish signal: a bullish signal occurs when the macd line crosses above the signal line. this indicates a potential uptrend in the market.

How To Read Macd Indicator Explained Oneup Trader Blog The 10 steps to interpret the macd indicator in forex trading are crucial for investors. first, understand the macd line’s crossovers to anticipate trend changes. second, recognize the signal line crossovers for buy and sell signals. Macd signals can provide valuable insights into the forex market’s current trend and potential reversals. understanding how to interpret these signals is crucial for successful trading. 1. bullish signal: a bullish signal occurs when the macd line crosses above the signal line. this indicates a potential uptrend in the market. Macd is a trend following momentum indicator that shows the relationship between two moving averages of a security’s price. the calculation involves subtracting the 26 period exponential moving average (ema) from the 12 period ema, resulting in what is known as the macd line. macd line: the difference between the 12 day and 26 day emas. The macd line is calculated by subtracting the 26 day exponential moving average (ema) from the 12 day ema. the signal line, often referred to as the trigger line, is a 9 day ema of the macd line. the histogram represents the difference between the macd line and the signal line. when analyzing the macd indicator, traders focus on three main.

What The Macd Indicator Is And How It Works Macd is a trend following momentum indicator that shows the relationship between two moving averages of a security’s price. the calculation involves subtracting the 26 period exponential moving average (ema) from the 12 period ema, resulting in what is known as the macd line. macd line: the difference between the 12 day and 26 day emas. The macd line is calculated by subtracting the 26 day exponential moving average (ema) from the 12 day ema. the signal line, often referred to as the trigger line, is a 9 day ema of the macd line. the histogram represents the difference between the macd line and the signal line. when analyzing the macd indicator, traders focus on three main.

How To Use The Macd Indicator Effectively Complete Guide

How To Read Macd Study Indicator And Interpret The Signals

Comments are closed.