How To Remove Consumer Statement From Credit Report Creditguide360 Com

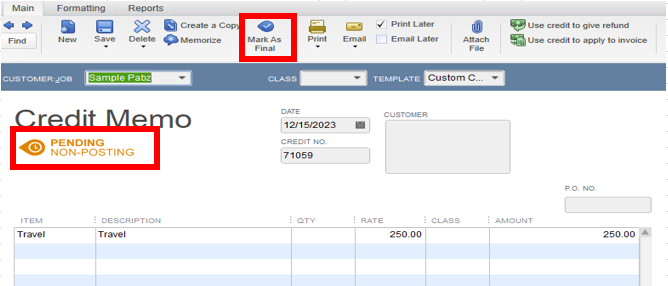

Solved Can You Remove A Credit From Customer Statement Here’s how. you simply can write to the credit bureaus and ask them to remove the consumer statement from your credit report. transunion definitely allows you to easily do this. to send a removal request to transunion, you just write to their pennsylvania offices at transunion consumer relations, p.o. box 2000, chester, pennsylvania, 19022. Be cautious about adding statements. if you choose to add a general statement of explanation to your experian credit report, you should contact experian to remove that statement once the accounts in question are no longer on your credit report. in your case this is important since you stated the negative entries are about seven years old, which.

How To Remove Collections From A Credit Report 11 Steps A provision of the fair credit reporting act gives consumers the option to add a personal statement that it can limit to 100 words to their credit reports, either to explain the circumstances that. A consumer statement is a voluntary 100 word (200 words for residents of maine) or 475 character statement that you can add to your credit report to address any negative information shown in your credit history. once placed, potential lenders may review this statement to help clear up their concerns about your creditworthiness or ability to pay. For example, transunion allows individuals to write a letter to add or remove a consumer statement from their credit reports. to get a consumer statement removed, send a consumer statement removal request, along with your name, address and transunion file identification number to: transunion consumer relations. p.o. box 2000. chester, pa 19022. Here’s how to do it: experian: go to this page, select “request my credit report” and follow the prompts. if you don’t qualify for a free copy, you’ll have to pay up to $12, plus tax. equifax: create a myequifax account. once your profile is set up, you can request a copy from your account page.

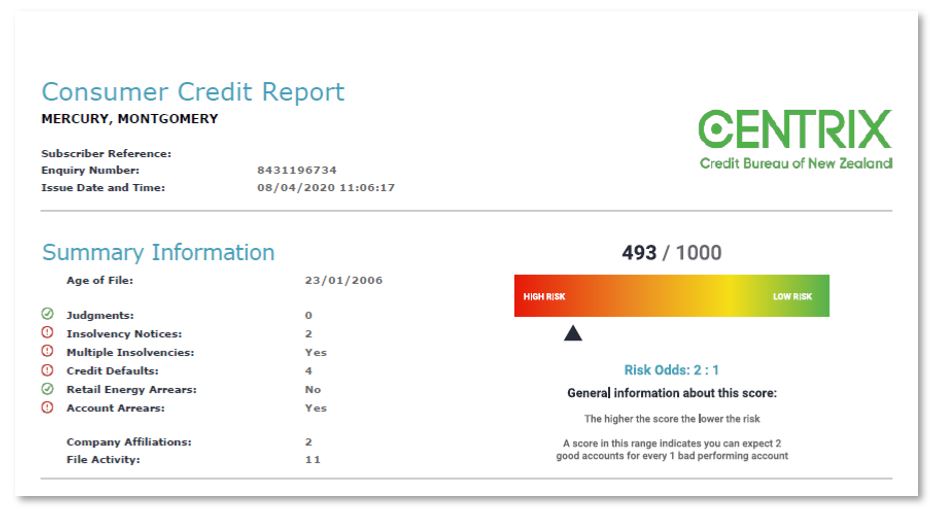

How Can I Clean My Credit Report Myself Leia Aqui How Can I Remove For example, transunion allows individuals to write a letter to add or remove a consumer statement from their credit reports. to get a consumer statement removed, send a consumer statement removal request, along with your name, address and transunion file identification number to: transunion consumer relations. p.o. box 2000. chester, pa 19022. Here’s how to do it: experian: go to this page, select “request my credit report” and follow the prompts. if you don’t qualify for a free copy, you’ll have to pay up to $12, plus tax. equifax: create a myequifax account. once your profile is set up, you can request a copy from your account page. The consumer statement can be added to explain a disagreement with the outcome of a dispute investigation or provide additional information about items on your equifax credit report. potential lenders and creditors will see your consumer statement when they view your equifax credit report. Generally, here’s how to read your credit report and the red flags you should watch for in each section: identify incorrect personal info (name, date of birth, social security number, etc.) check the summary for any missed payments. review the consumer statement. review all your accounts and identify any that don’t belong to you.

How To Remove Collections From Your Credit Report Forbes Advisor The consumer statement can be added to explain a disagreement with the outcome of a dispute investigation or provide additional information about items on your equifax credit report. potential lenders and creditors will see your consumer statement when they view your equifax credit report. Generally, here’s how to read your credit report and the red flags you should watch for in each section: identify incorrect personal info (name, date of birth, social security number, etc.) check the summary for any missed payments. review the consumer statement. review all your accounts and identify any that don’t belong to you.

Consumer Credit Reports Explained Centrix

How To Remove Closed Accounts From Your Credit Report Self Credit

Comments are closed.