How To Trade Bullish Flag Patterns

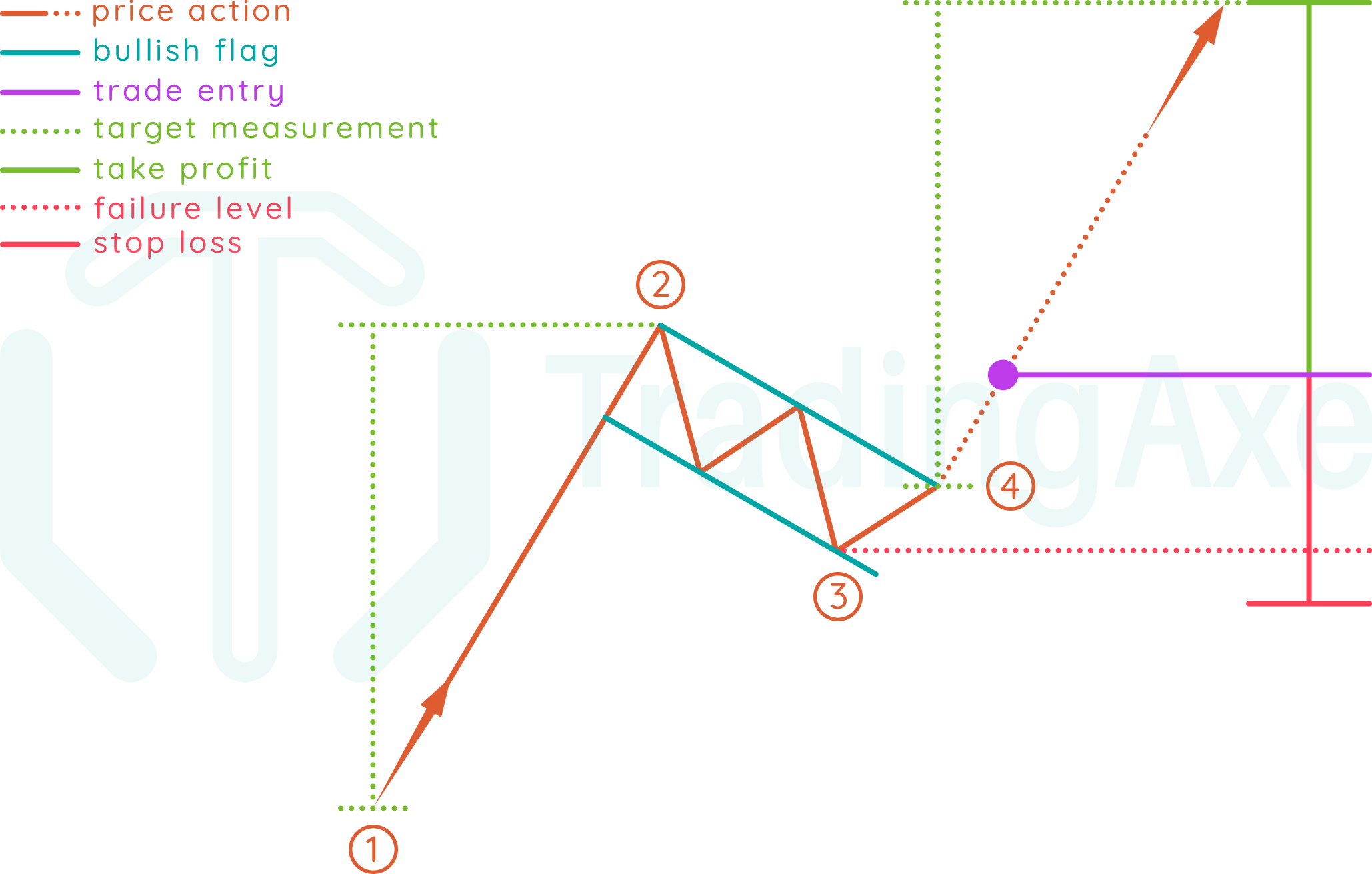

How To Trade Bullish Flag Patterns One of the best things about bullish flag patterns is that they are user friendly. follow the steps below, and you can quickly integrate the bull flag into your financial markets trading: identify an evolving uptrend in an fx pair. use a trend line and draw the vertical flag pole. use a channel, parallel lines, or separate horizontal lines to. 1. bull flag pattern entry. the best place to enter a trade in the bull flag pattern is at the flag’s upper trendline breakout. additionally, significant trading volume is imperative. this indicates the resumption of the upward trend after the brief consolidation phase. 2. bull flag pattern profit target.

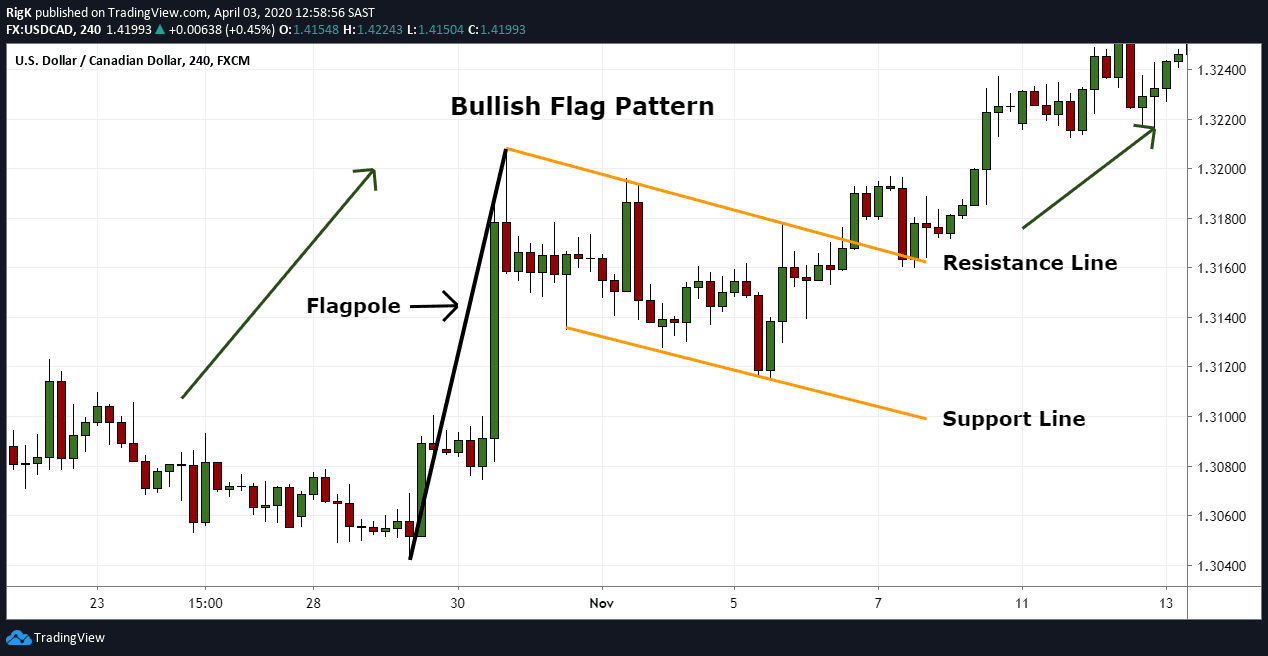

How To Trade Bullish Flag Chart Pattern Tradingaxe A high tight bull flag chart pattern has an 85% success rate on an upside breakout, achieving an average 39% profit in a bull market. if the bull flag is loose, the failure rate is 55%, with only a gain of 9%. source research courtesy of tom bulkowski@the patternsite . Step #1: zoom out your charts and mark on the consolidation zone – the flag – of the bullish flag pattern. step #2 enter long position at the break of the flag pattern. step #3 take profit once the price travels the same distance in price it did in the flag pole. step #4 place the protective stop loss below the flag. In real time trading, a bull flag can be a critical indicator for traders, signaling an opportune moment for profit taking or entry into a bullish market. this pattern, characterized by a sharp price breakout from consolidation, often suggests that the market’s momentum is likely to continue in the direction of the initial surge, presenting a. A bull flag pattern is a bullish chart pattern that occurs when a stock is in a strong uptrend. it is called a flag pattern because when you see it on a chart the large green candle of the initial move looks like a flag pole, and the sideways consolidation near the highs looks like a flag or a pennant. the inverse of a bull flag is a bear flag.

Flag Pattern Full Trading Guide With Examples Asktraders In real time trading, a bull flag can be a critical indicator for traders, signaling an opportune moment for profit taking or entry into a bullish market. this pattern, characterized by a sharp price breakout from consolidation, often suggests that the market’s momentum is likely to continue in the direction of the initial surge, presenting a. A bull flag pattern is a bullish chart pattern that occurs when a stock is in a strong uptrend. it is called a flag pattern because when you see it on a chart the large green candle of the initial move looks like a flag pole, and the sideways consolidation near the highs looks like a flag or a pennant. the inverse of a bull flag is a bear flag. A bull flag is a stock chart pattern comprised of three parts: the flagpole, the flag, and the breakout. the flagpole, sometimes called an impulse wave, is a parabolic stock price rise and signals the start of a bullish trend. after the spike peaks, it forms a consolidation phase known as the flag. this pullback consists of a series of lower. Confirming flag patterns. one useful way to confirm a flag is to watch the market’s volume. in a bullish flag, volume should be high during the initial uptrend, then peter out as the market consolidates. once the breakout hits, volume should spike once more. you could interpret a flag pattern as a brief pause in the middle of a sustained trend.

Comments are closed.