How To Use Macd Effectively Trading Meeting

How To Use The Macd Indicator Effectively Pro Trading School 2) the space between the macd. when the two macd indicator lines separate, it means that momentum is increasing and the trend is getting stronger. when the two macd lines are coming closer together, it shows that the price is losing strength. furthermore, we can use the 0 line as a trend tiebreaker. when the two macd lines are above the 0 line. To effectively use the macd indicator, traders must first understand how it is calculated. here’s a step by step guide: calculate the 12 period ema of the closing prices. calculate the 26 period ema of the closing prices. subtract the 26 period ema from the 12 period ema to find the macd line.

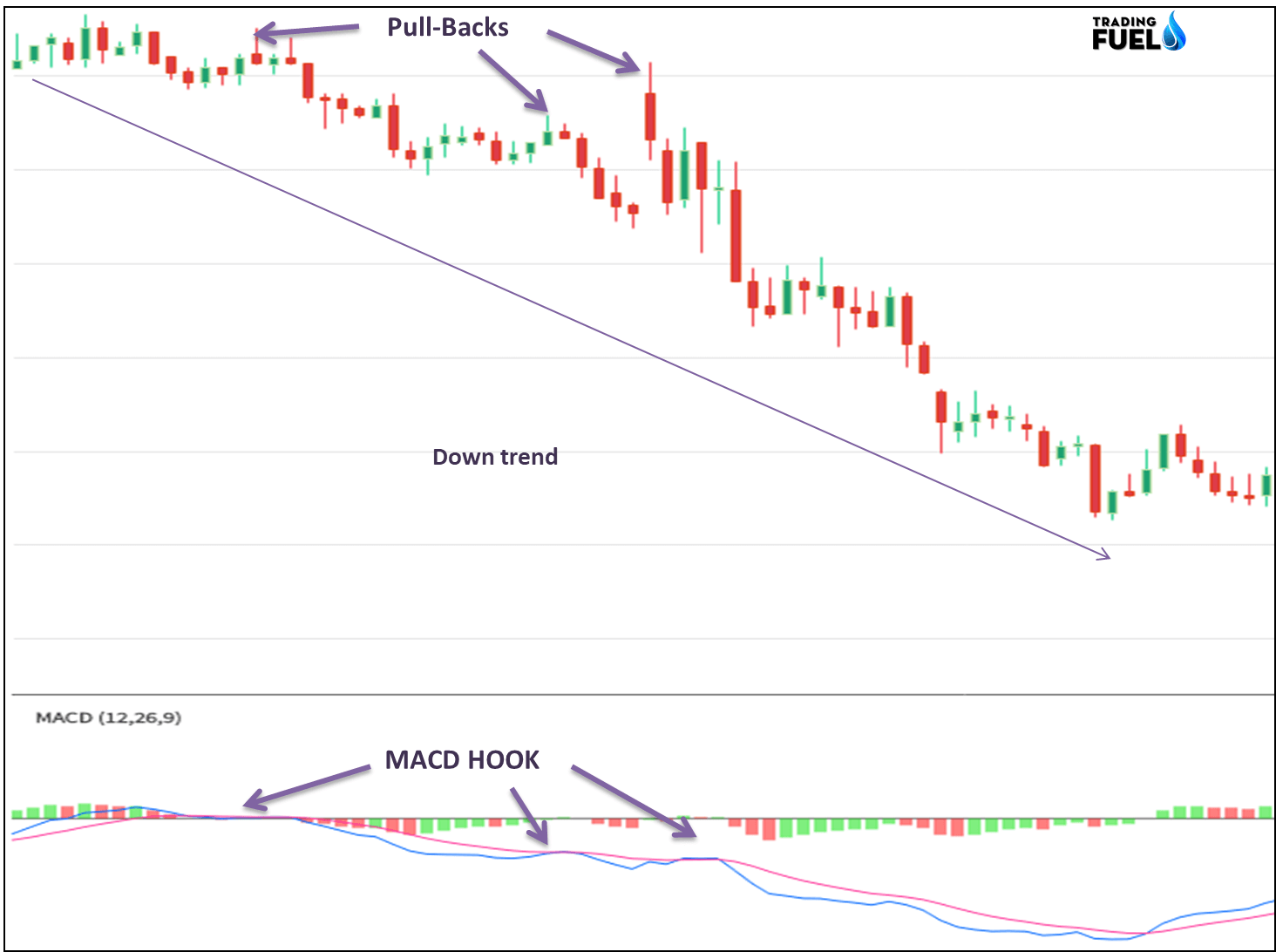

How To Use The Macd Indicator Effectively Complete Guide In this tutorial, we will cover 5 trading strategies using the indicator and how you can implement these methodologies within your own trading system. beyond the strategies, we will explore if the macd stock indicator is appropriate for day trading and how well the macd stock indicator stacks up against moving averages. The macd line is the blue line pointed by the red arrow. to calculate the value of this line, we had to take the value of the 12 day ema and subtract the value of the 26 day ema from it. the value of 12 day ema is 66.8, while the value of 26 day ema is 83.3. after subtraction, we got 16.5. Macd is an acronym for m oving a verage c onvergence d ivergence. this technical indicator is a tool that’s used to identify moving averages that are indicating a new trend, whether it’s bullish or bearish. after all, a top priority in trading is being able to find a trend, because that is where the most money is made. The macd indicator, also known as the macd oscillator, is one of the most popular technical analysis tools. there are three main components of the macd shown in the picture below: macd: the 12 period exponential moving average (ema) minus the 26 period ema. macd signal line: a 9 period ema of the macd. macd histogram: the macd minus the macd.

How To Use Macd Effectively Forex Macd Cci Perfect Trading System Macd is an acronym for m oving a verage c onvergence d ivergence. this technical indicator is a tool that’s used to identify moving averages that are indicating a new trend, whether it’s bullish or bearish. after all, a top priority in trading is being able to find a trend, because that is where the most money is made. The macd indicator, also known as the macd oscillator, is one of the most popular technical analysis tools. there are three main components of the macd shown in the picture below: macd: the 12 period exponential moving average (ema) minus the 26 period ema. macd signal line: a 9 period ema of the macd. macd histogram: the macd minus the macd. The macd is a versatile indicator and can be used as part of a trader’s tool kit for purposes of confirming trends and potential price reversals. the moving average convergence divergence indicator (macd indicator) is one of the most popular tools in all of technical analysis. learn how to use it. Trading the macd involves identifying buy and sell signals based on the interaction of the macd line and the signal line. a common strategy is to buy when the macd line crosses above the signal.

How To Use The Macd Effectively The Ultimate Guide The macd is a versatile indicator and can be used as part of a trader’s tool kit for purposes of confirming trends and potential price reversals. the moving average convergence divergence indicator (macd indicator) is one of the most popular tools in all of technical analysis. learn how to use it. Trading the macd involves identifying buy and sell signals based on the interaction of the macd line and the signal line. a common strategy is to buy when the macd line crosses above the signal.

How To Use The Macd Effectively The Ultimate Guide

Comments are closed.