How To Use The Macd Indicator Effectively Complete Gu Vrogue Co

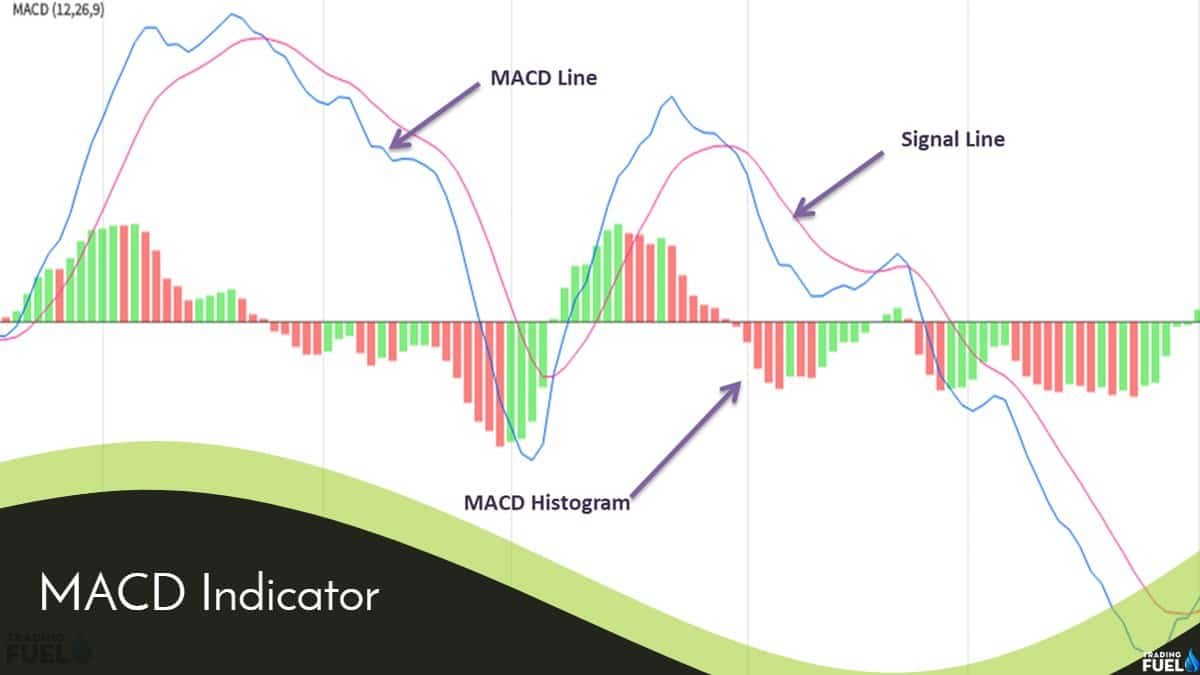

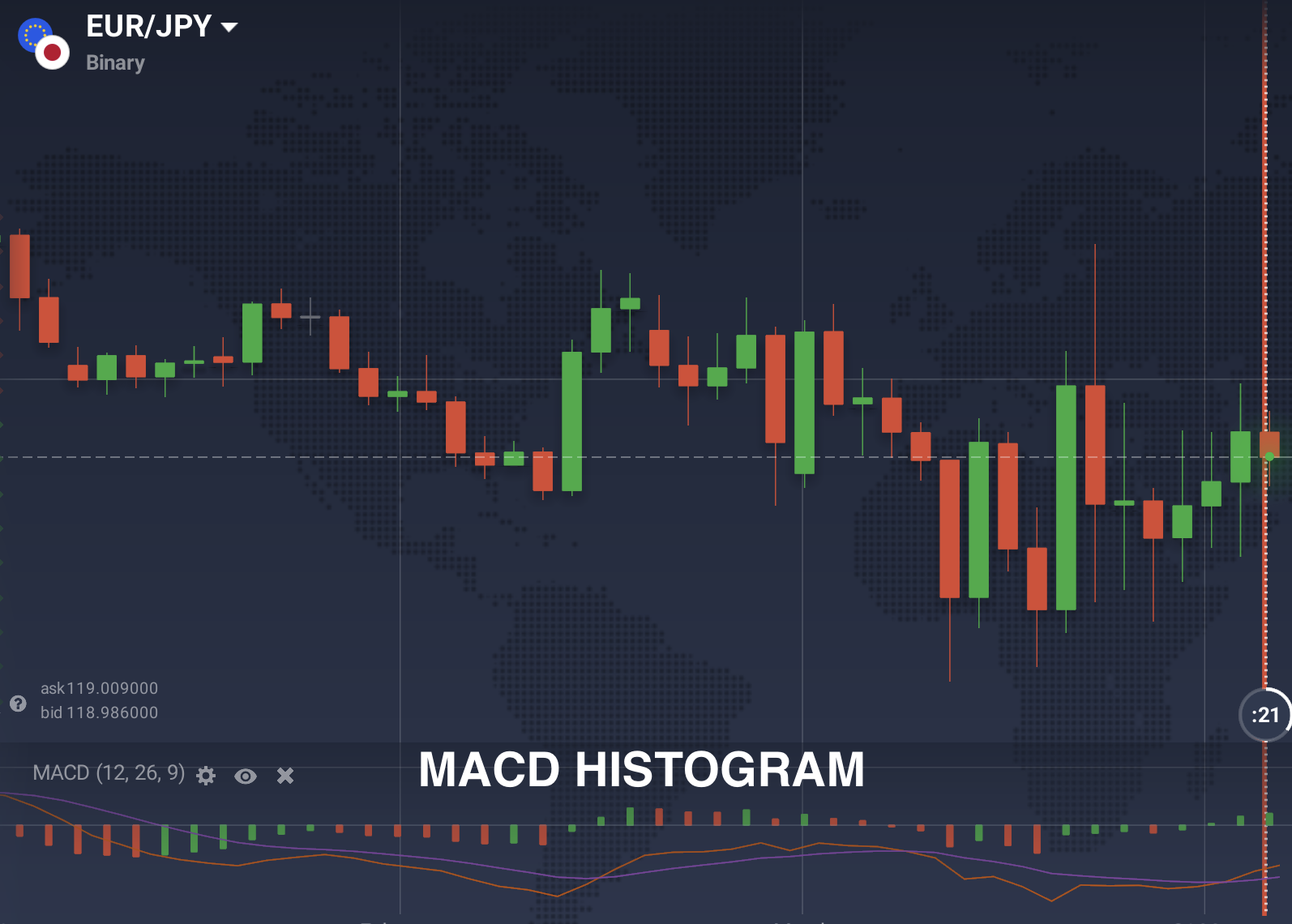

How To Use The Macd Indicator Effectively Complete Guide 2) the space between the macd. when the two macd indicator lines separate, it means that momentum is increasing and the trend is getting stronger. when the two macd lines are coming closer together, it shows that the price is losing strength. furthermore, we can use the 0 line as a trend tiebreaker. when the two macd lines are above the 0 line. The macd indicator, also known as the macd oscillator, is one of the most popular technical analysis tools. there are three main components of the macd shown in the picture below: macd: the 12 period exponential moving average (ema) minus the 26 period ema. macd signal line: a 9 period ema of the macd. macd histogram: the macd minus the macd.

How To Use Macd Indicator The Trading Wolf How to use the macd indicator effectively. to get the most out of the macd, focus on its crosses of the signal line and zero level. look for opportunities when the macd line crosses above or below the signal line to indicate momentum shifts. you can then enter trades in the direction of the new momentum. The macd indicator is a powerful tool that can complement price action in trading. it is not meant to be used in isolation. this article will provide a comprehensive guide on how to use the macd indicator effectively and increase your winning rate. it will cover topics such as understanding the macd indicator and its formula, common mistakes to. To effectively use the macd indicator, traders must first understand how it is calculated. here’s a step by step guide: calculate the 12 period ema of the closing prices. calculate the 26 period ema of the closing prices. subtract the 26 period ema from the 12 period ema to find the macd line. 3.1 key macd indicators to watch; 4 how to use the macd indicator for trading. 4.1 what is the best time frame for macd? 4.2 how to use macd in crypto trading; 4.3 adapting the indicator to crypto market volatility; 4.4 combining macd with other technical indicators; 5 common mistakes. how not to use the macd indicator; 6 key takeaways; 7.

How To Use The Macd Indicator Elevating Empower Inform Lead To effectively use the macd indicator, traders must first understand how it is calculated. here’s a step by step guide: calculate the 12 period ema of the closing prices. calculate the 26 period ema of the closing prices. subtract the 26 period ema from the 12 period ema to find the macd line. 3.1 key macd indicators to watch; 4 how to use the macd indicator for trading. 4.1 what is the best time frame for macd? 4.2 how to use macd in crypto trading; 4.3 adapting the indicator to crypto market volatility; 4.4 combining macd with other technical indicators; 5 common mistakes. how not to use the macd indicator; 6 key takeaways; 7. Macd is an acronym for m oving a verage c onvergence d ivergence. this technical indicator is a tool that’s used to identify moving averages that are indicating a new trend, whether it’s bullish or bearish. after all, a top priority in trading is being able to find a trend, because that is where the most money is made. Macd is a trend following momentum indicator that shows the relationship between two moving averages of a security’s price. the calculation involves subtracting the 26 period exponential moving average (ema) from the 12 period ema, resulting in what is known as the macd line. macd line: the difference between the 12 day and 26 day emas.

How To Use The Macd Indicator Babypips Macd is an acronym for m oving a verage c onvergence d ivergence. this technical indicator is a tool that’s used to identify moving averages that are indicating a new trend, whether it’s bullish or bearish. after all, a top priority in trading is being able to find a trend, because that is where the most money is made. Macd is a trend following momentum indicator that shows the relationship between two moving averages of a security’s price. the calculation involves subtracting the 26 period exponential moving average (ema) from the 12 period ema, resulting in what is known as the macd line. macd line: the difference between the 12 day and 26 day emas.

Comments are closed.