Index Funds For Beginners Your Guide For Passive Investing In The Stock Market

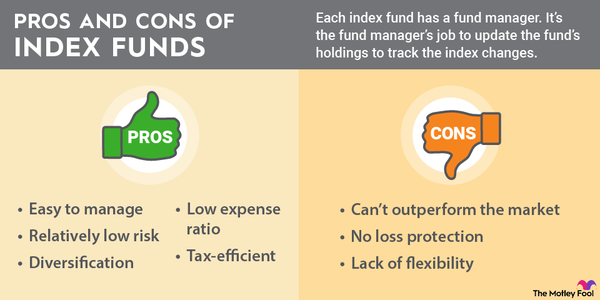

How To Invest In Index Funds A Beginner S Guide The Motley Fool Index funds generally invest in all the components of the index they track and have fund managers to ensure that the index fund performs the same as its target index (known as its benchmark). 1. For exclusive content on stocks and cryptos, please visit our website: clearvalueinvesting get 3 free stocks when you open up a stock account her.

Real Stock Market Secret For Beginners Index Funds Investing And Etf Index funds are a type of investment vehicle aiming to match the returns of a specific market index. investing in index funds can help investors diversify a portfolio and build wealth at a low. Index investing is a passive investment strategy in which you buy shares of an index fund that mirrors the composition and performance of a market index like the s&p 500. index investing is considered passive because index funds are formulated to follow the index and thus deliver market returns. there is no portfolio manager to oversee the fund. Like its benchmark index, the fund was up about 12% in the first four and a half months of 2024. 3. vanguard growth etf. if you want to assume more investment risk in the pursuit of higher rewards. Voo – vanguard s&p 500 etf. no list of index funds is complete without the stalwart s&p 500 index. it is the most popular index to invest in, comprised of the 500 largest american companies that make up roughly 82% of the entire u.s. stock market. the historical annualized return of the s&p 500 has been about 10%.

Introduction To Index Funds And Etf S Passive Investing For Beginners Like its benchmark index, the fund was up about 12% in the first four and a half months of 2024. 3. vanguard growth etf. if you want to assume more investment risk in the pursuit of higher rewards. Voo – vanguard s&p 500 etf. no list of index funds is complete without the stalwart s&p 500 index. it is the most popular index to invest in, comprised of the 500 largest american companies that make up roughly 82% of the entire u.s. stock market. the historical annualized return of the s&p 500 has been about 10%. Index funds are a type of mutual fund or exchange traded fund (etf) designed to replicate the performance of a specific market index, such as the s&p 500 or the dow jones industrial average. unlike actively managed funds, which aim to outperform the market through stock selection and timing, index funds take a passive approach by mirroring the. 2. research index funds. once you know what index you want to track, it's time to look at the actual index funds you'll be investing in. when you're investigating an index fund, it's important to.

Index Funds A Beginner S Guide To Passive Investing Quick Investing Tips Index funds are a type of mutual fund or exchange traded fund (etf) designed to replicate the performance of a specific market index, such as the s&p 500 or the dow jones industrial average. unlike actively managed funds, which aim to outperform the market through stock selection and timing, index funds take a passive approach by mirroring the. 2. research index funds. once you know what index you want to track, it's time to look at the actual index funds you'll be investing in. when you're investigating an index fund, it's important to.

Passive Income Investing In Index Funds For Beginners The Ray Journey

Comments are closed.