Inflation Impact On Consumer Spending

Rising Inflation Affects Consumer Purchasing Power Say Economists Rising inflation means consumers will buy less overall. many consumers are tightening their purse strings in response to the rising cost of living. according to data analytics firm kantar, 47% of u.k. consumers have made or are expecting to make cutbacks in their general expenditure due to inflation. in the same vein, research by intelligence. How does inflation affect consumers and companies differently? inflation affects consumers most directly, but businesses can also feel the impact: consumers lose purchasing power when the prices of items they buy, such as food, utilities, and gasoline, increase. this can lead to household belt tightening and growing pessimism about the economy.

Rising Inflation Affects Consumer Purchasing Power Say Economists Spending by consumers rose by a brisk 0.4% in september the government said friday — even after adjusting for inflation and even as americans face ever higher borrowing costs. economists caution that such vigorous spending isn’t likely to continue in the coming months. many households have been pulling money from a shrinking pool of savings. These are some of the ways inflation is changing americans' spending habits. august 21, 2022 5:01 am et. "and we do have to be a little more flexible with our budget conscious consumers.". Inflation’s ongoing impact on financial well being and spending. when inflation hit 9.1% in june 2022, the percentage of americans concerned about rising prices rose to 83% (figure 1). nearly two years later, that figure has only eased to 73%, even as inflation hovers at a much improved 3%. persisting concern could be driven by a stubborn. Rising prices mean your money buys you less in the future than it does today. it’s in the headlines at the moment because prices are soaring around the world. global inflation will peak at 9.5% this year, up from 4.7% in 2021, but remain high at 6.5% in 2023, before falling to 4.1% in 2024, the international monetary fund predicts.

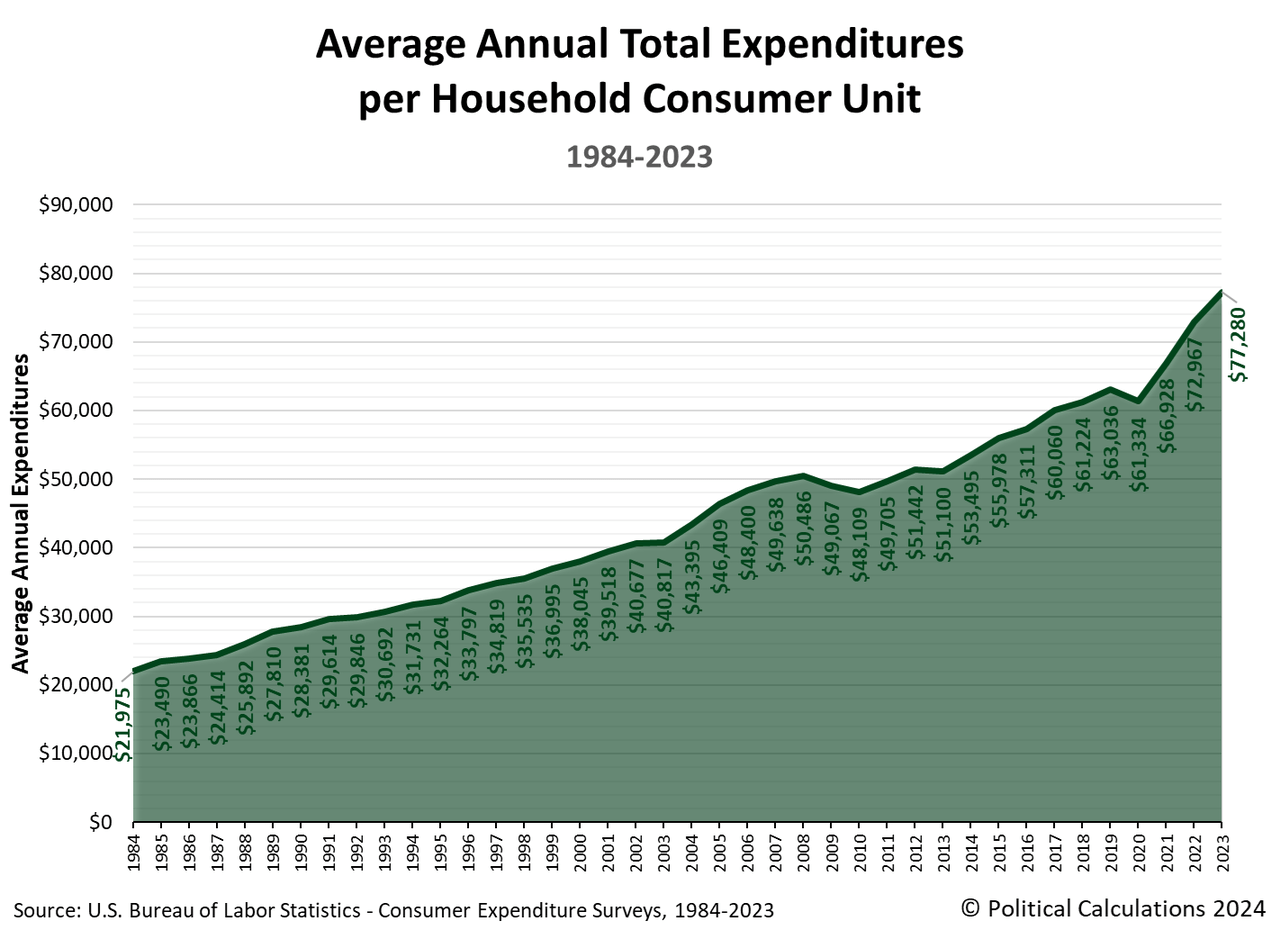

40 Years Of Trends In American Consumer Spending Seeking Alpha Inflation’s ongoing impact on financial well being and spending. when inflation hit 9.1% in june 2022, the percentage of americans concerned about rising prices rose to 83% (figure 1). nearly two years later, that figure has only eased to 73%, even as inflation hovers at a much improved 3%. persisting concern could be driven by a stubborn. Rising prices mean your money buys you less in the future than it does today. it’s in the headlines at the moment because prices are soaring around the world. global inflation will peak at 9.5% this year, up from 4.7% in 2021, but remain high at 6.5% in 2023, before falling to 4.1% in 2024, the international monetary fund predicts. Overall, the global rate of inflation was estimated at roughly 8.75 percent in 2022 compared to 2021 and at roughly seven percent in 2023 compared to 2022, which is a major spike in comparison to. Second, cbo incorporated new data on consumer price changes reported by the bureau of labor statistics for both 2022 and 2023. the actual rate of inflation, as measured by the change in the cpi u, was 8.0 percent for 2022—higher than the 7.5 percent estimate used in the 2022 report. effects not accounted for in the estimates.

Inflation In Nigeria How Rising Costs Are Impacting Consumers Glazia Overall, the global rate of inflation was estimated at roughly 8.75 percent in 2022 compared to 2021 and at roughly seven percent in 2023 compared to 2022, which is a major spike in comparison to. Second, cbo incorporated new data on consumer price changes reported by the bureau of labor statistics for both 2022 and 2023. the actual rate of inflation, as measured by the change in the cpi u, was 8.0 percent for 2022—higher than the 7.5 percent estimate used in the 2022 report. effects not accounted for in the estimates.

Comments are closed.