Interpreting A Credit Report Ontario Mortgage Agent Course

Interpreting A Credit Report Ontario Mortgage Agent Course Youtube Interpreting a credit report by remic ( remic.ca) instructs students on how to understand an equifax credit report. this 40 minute video discusses each s. I spent about $220 on practice tests and study kits. whoever is interested, i can sell them for $30. whoever is interested, please email me to sales.fareasttrading@gmail . 1. reply. different elephant23. • 1 yr. ago. just wondering if anyone has any study notes taking the exam soon. 1. reply. beemerkid.

Remic Mortgage Agent Development Program Interpreting A Credit Report Required course materials: mort 201: mortgage agent, white, joseph j., mortgage brokering in ontario – agent edition, 15th edition, real estate and mortgage institute of canada. isbn #978 1 988049 06 9 hp10b ii hewlett packard calculator. link to humber's bookstore. I took it close to a year ago and the exam i had a lot of theory based questions. i know some people had a decent amount of math questions but they are super straightforward as long as you studied. i think once you grasp the idea of what a mortgage is and why it’s needed, supplementary topics will start to make sense. 1. This class is for individuals who are looking to obtain their mortgage agent level 1 licence. price is $365.00 hst exempt. upcoming classes, 9:00am to 4:00pm each day with 3 breaks: january 27 28 & february 3 4, weekend, in person cmba head office closed. february 12 16, mon fri, virtual classroom closed. There are 3 steps to get mortgage agent licensed in ontario: 1. pass the course – the mortgage agent course can be done in as little as 5 days for as little as $338. 2. get hired – you must join a mortgage brokerage first before you can get licensed. 3. complete the fsra application – the fsra (formerly fsco) licensed mortgage brokerage.

Cmba Ontario Mortgage Agent Course This class is for individuals who are looking to obtain their mortgage agent level 1 licence. price is $365.00 hst exempt. upcoming classes, 9:00am to 4:00pm each day with 3 breaks: january 27 28 & february 3 4, weekend, in person cmba head office closed. february 12 16, mon fri, virtual classroom closed. There are 3 steps to get mortgage agent licensed in ontario: 1. pass the course – the mortgage agent course can be done in as little as 5 days for as little as $338. 2. get hired – you must join a mortgage brokerage first before you can get licensed. 3. complete the fsra application – the fsra (formerly fsco) licensed mortgage brokerage. 1. clarity: information was presented clearly and understandably.2. structure: the course was well organized and logical.3. application: practical examples were useful for applying concepts.4. engagement: the course was engaging and maintained interest.5. resources: materials provided were helpful and relevant.6. How to get your mortgage agent level 1 licence. step 1: successfully pass ’s mortgage agent course by achieving at least 60% in the final examination. step 3: the principal broker at the brokerage will register your licence with fsra. information on how to get a mortgage agent level 1 licence is on fsra’s website here: fsrao.ca.

Cmba Ontario Mortgage Agent Course 1. clarity: information was presented clearly and understandably.2. structure: the course was well organized and logical.3. application: practical examples were useful for applying concepts.4. engagement: the course was engaging and maintained interest.5. resources: materials provided were helpful and relevant.6. How to get your mortgage agent level 1 licence. step 1: successfully pass ’s mortgage agent course by achieving at least 60% in the final examination. step 3: the principal broker at the brokerage will register your licence with fsra. information on how to get a mortgage agent level 1 licence is on fsra’s website here: fsrao.ca.

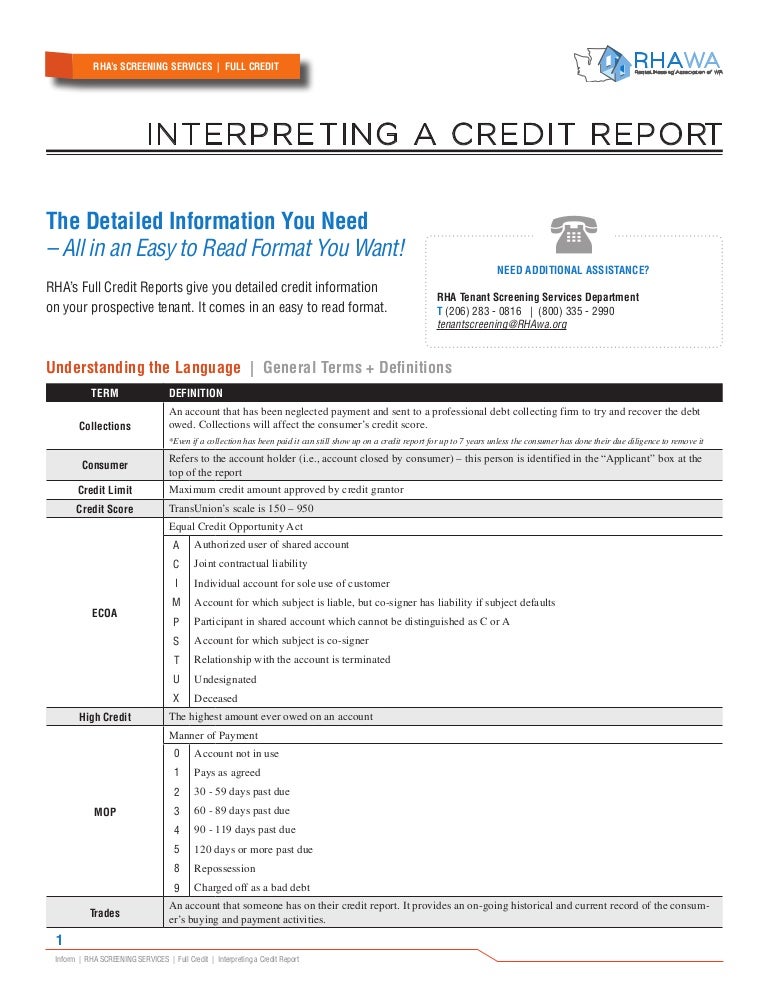

Full Credit Interpreting A Credit Report Copy

Comments are closed.