Intraday Trading Guide Macd Indicator Meaning And Calculation Formula

Intraday Trading Guide Macd Indicator Meaning And Calculation Formula In this tutorial, we will cover 5 trading strategies using the indicator and how you can implement these methodologies within your own trading system. beyond the strategies, we will explore if the macd stock indicator is appropriate for day trading and how well the macd stock indicator stacks up against moving averages. After understanding the macd formula and its calculation, the next step is to grasp the significance of the macd indicator’s value. the values of the three macd components are essentially derived from the dif line (macd line) formula. this means the value range displayed in the macd indicator window will match the range of the dif line.

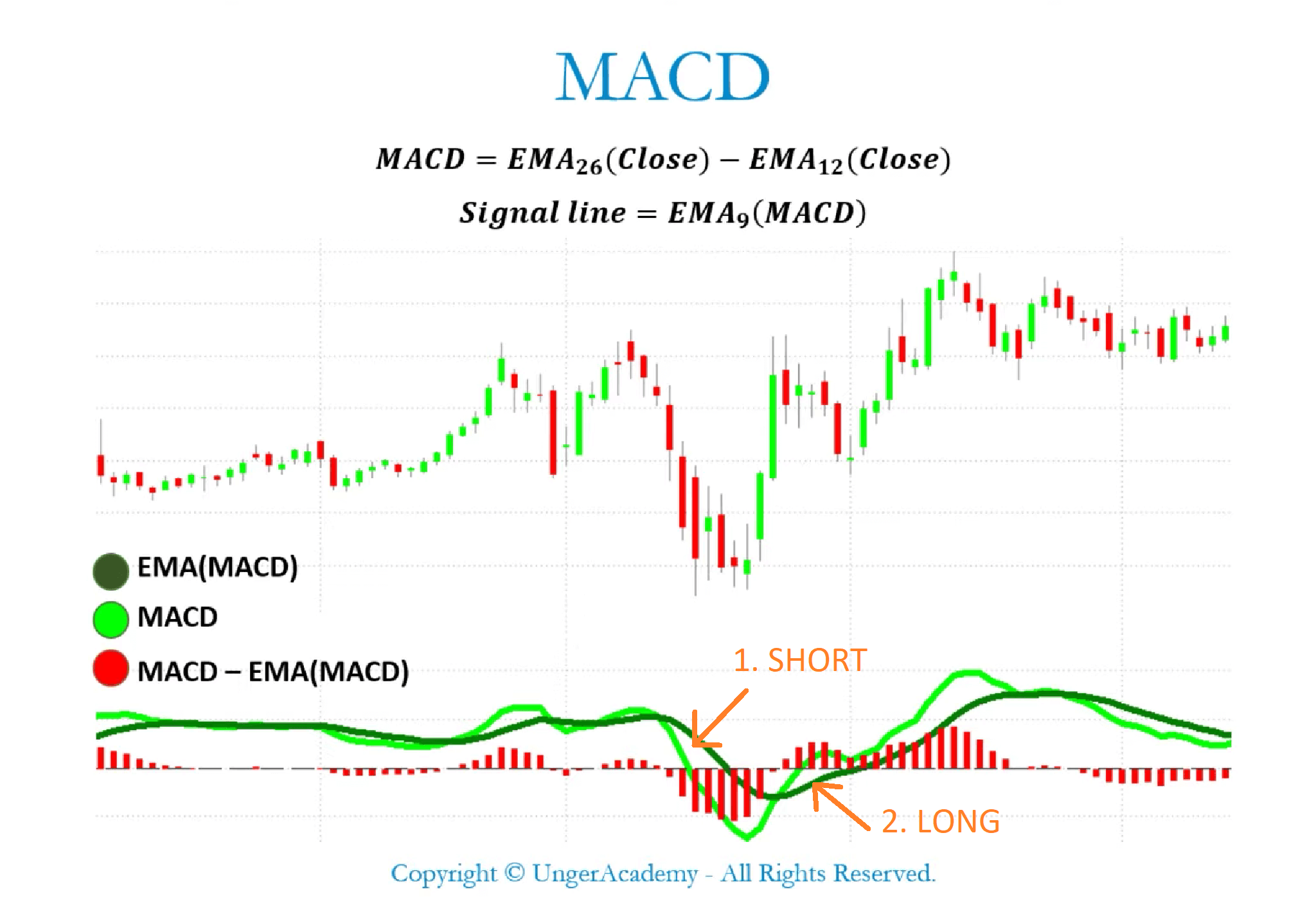

Intraday Trading Guide Macd Indicator Meaning And Calculation Formula To effectively use the macd indicator, traders must first understand how it is calculated. here’s a step by step guide: calculate the 12 period ema of the closing prices. calculate the 26 period ema of the closing prices. subtract the 26 period ema from the 12 period ema to find the macd line. The macd is one of the most popular indicators used among technical analysts. it helps identify the trend’s direction, its velocity, and its rate of change. a macd crossover of the signal line can help spot when the trend’s acceleration is changing. a macd crossover of the zero line may be interpreted as the trend changing direction entirely. Macd indicator explained. the macd indicator consists of three components: the macd line: the main macd line is generated by subtracting the longer moving average (26 period) from the shorter one (12 period). the macd line helps determine upward or downward momentum, i.e., market trend; the signal line: the signal line is the ema (typically 9. Macd is a lagging indicator. the data used in macd calculation is based on the historical price action, therefore macd readings lag the price. this is seen as a bullish trading signal—hence.

Trading With The Macd Indicator Moving Average Convergence Divergence Macd indicator explained. the macd indicator consists of three components: the macd line: the main macd line is generated by subtracting the longer moving average (26 period) from the shorter one (12 period). the macd line helps determine upward or downward momentum, i.e., market trend; the signal line: the signal line is the ema (typically 9. Macd is a lagging indicator. the data used in macd calculation is based on the historical price action, therefore macd readings lag the price. this is seen as a bullish trading signal—hence. It provides a visual representation of the divergence or convergence between the two lines. when the macd line is above the signal line, the histogram is positive, indicating bullish momentum. conversely, when the macd line is below the signal line, the histogram is negative, signaling bearish momentum. macd histogram = macd line – signal line. Calculate a nine period ema of the macd line (the result obtained from step 3) to create the signal line. subtract the signal line from the macd line to create the histogram.

Macd Indicator Best Indicator For Intraday Trading It provides a visual representation of the divergence or convergence between the two lines. when the macd line is above the signal line, the histogram is positive, indicating bullish momentum. conversely, when the macd line is below the signal line, the histogram is negative, signaling bearish momentum. macd histogram = macd line – signal line. Calculate a nine period ema of the macd line (the result obtained from step 3) to create the signal line. subtract the signal line from the macd line to create the histogram.

Comments are closed.