Investigative Consumer Report Sample

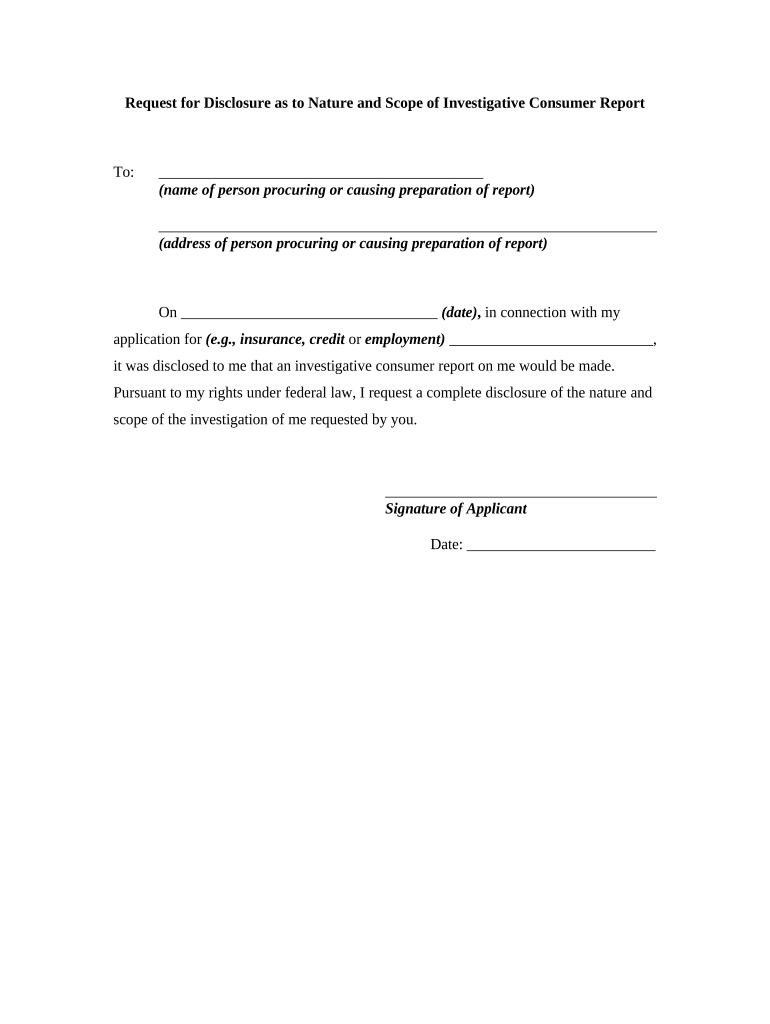

Investigative Consumer Report Doc Template Pdffiller The fcra defines an investigative consumer report as: a consumer report (or any part within a consumer report), with some exceptions, in which information on a consumer’s character, general reputation, personal characteristics, or mode of living is obtained through personal interviews with neighbors, friends, or associates of the consumer, or. Employers who use "investigative reports" – reports based on personal interviews concerning a person's character, general reputation, personal characteristics, and lifestyle – have additional obligations under the fcra. these obligations include giving written notice that you may request or have requested an investigative consumer report.

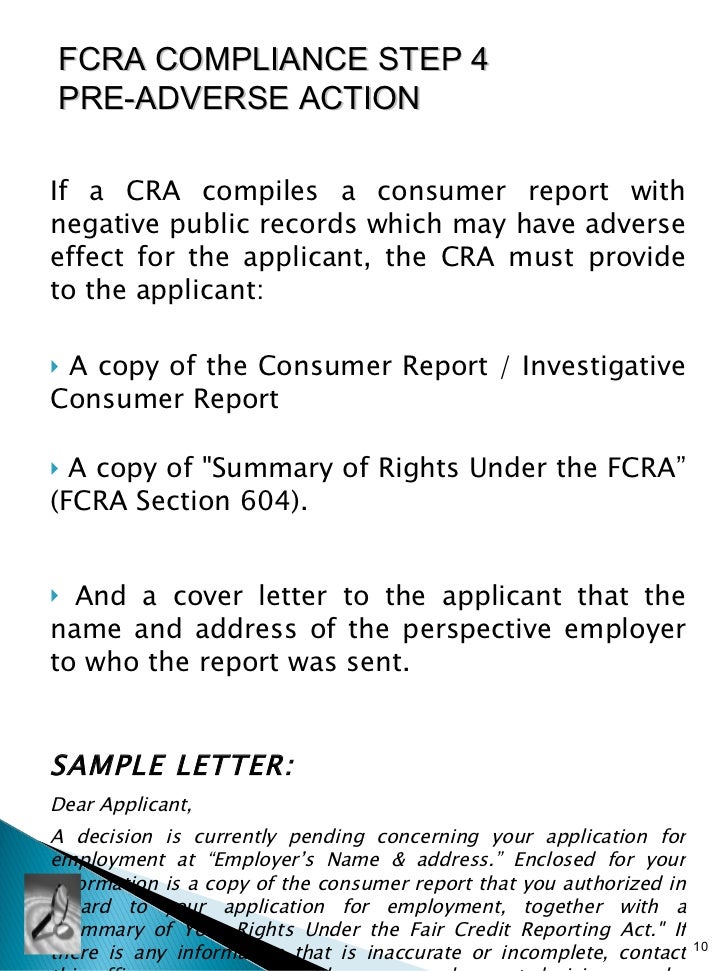

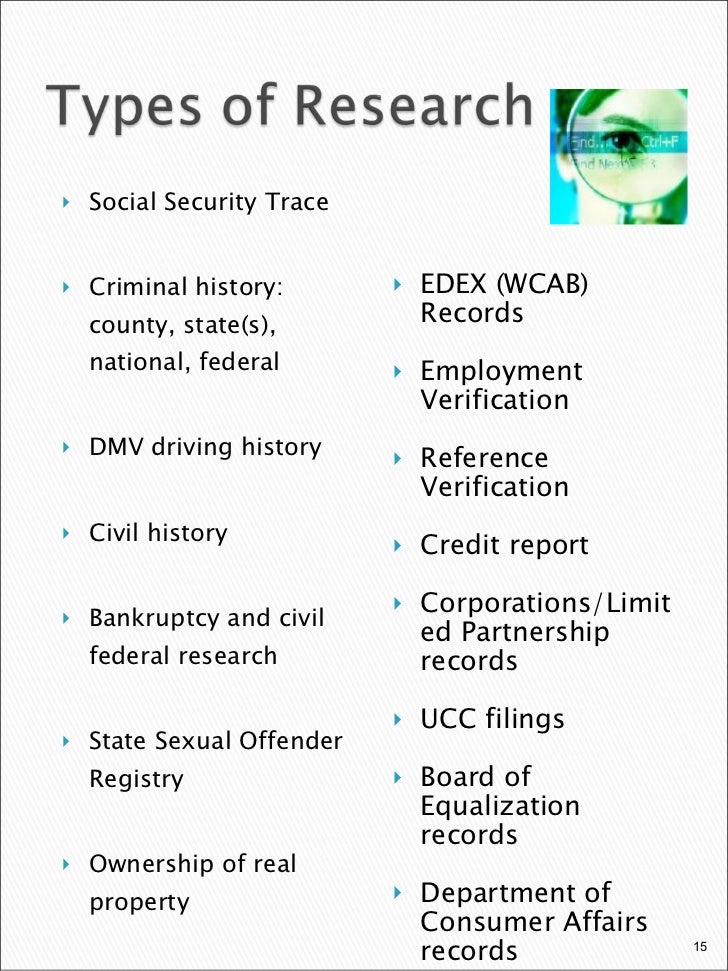

Investigative Consumer Report Presentation Jun 09 07 Version Key takeaways. credit reports contain information on an individual's credit history and are primarily used by lenders. investigative consumer reports contain information on an individual that is. An investigative consumer report (icr) is a report that includes personal or professional opinions or assessments obtained through interviews. learn what an icr is, how to comply with fcra and state laws, and what are the benefits and risks of running an icr. A consumer report contains information about an applicant’s background information including credit, criminal, and driving record. to be covered by the fcra, a report must be prepared by a consumer reporting agency (cra) such as starpoint screening. employers often do background checks on applicants and get consumer reports during their. A typical consumer report lists specific objective information concerning a consumer’s credit history, criminal record, employment, address, or related subjects. the information is obtained from creditor, public, or other written records.

Investigative Consumer Report Presentation Jun 09 07 Version A consumer report contains information about an applicant’s background information including credit, criminal, and driving record. to be covered by the fcra, a report must be prepared by a consumer reporting agency (cra) such as starpoint screening. employers often do background checks on applicants and get consumer reports during their. A typical consumer report lists specific objective information concerning a consumer’s credit history, criminal record, employment, address, or related subjects. the information is obtained from creditor, public, or other written records. Sample form to disclose to an applicant or employee that a background check will be conducted as required by the fcra. discloses to you that a consumer report, including an investigative. A report by an investigative consumer report agency that includes personal information on a consumer. investigative consumer reports may be requested when applying for things such as employment or housing. the contents and limits of such reports are defined by civil statutes. for example: section 1681a of the fair credit reporting act defines.

What S The Difference Between Investigative Consumer Reports And Credit Sample form to disclose to an applicant or employee that a background check will be conducted as required by the fcra. discloses to you that a consumer report, including an investigative. A report by an investigative consumer report agency that includes personal information on a consumer. investigative consumer reports may be requested when applying for things such as employment or housing. the contents and limits of such reports are defined by civil statutes. for example: section 1681a of the fair credit reporting act defines.

Investigative Consumer Report Sample Complete With Ease Airslate Signnow

Investigative Consumer Report Presentation Jun 09 07 Version

Comments are closed.