Investigative Consumer Reports

Consumer Report Form Investigative Consumer Report Form Including Learn the key differences between credit reports and investigative consumer reports, which are both regulated by the fair credit reporting act. find out what information they contain, who can request them, and how to access them. Learn what an investigative consumer report (icr) is, how it differs from a regular consumer report, and what are the legal requirements and risks of running one. find out how icrs can provide personal or professional opinions and assessments of applicants for employment or tenant screening.

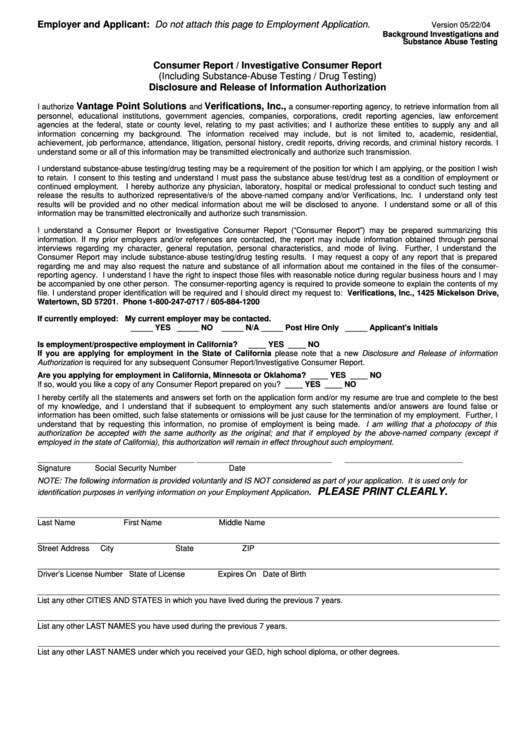

California Disclosure Regarding Investigative Consumer Reports Pdf An investigative consumer report gives employers and insurance companies more relevant information than a credit report, and the fcra ensures that you have the ability to deny a company access to this information. read: 12 things you should never do with your money. ruth sarreal contributed to the reporting for this article. An investigative consumer report is a report by an agency that includes personal information on a consumer, such as character, reputation, or mode of living. learn how such reports are obtained, used, and regulated by civil statutes in the us. The fcra defines an investigative consumer report as: a consumer report (or any part within a consumer report), with some exceptions, in which information on a consumer’s character, general reputation, personal characteristics, or mode of living is obtained through personal interviews with neighbors, friends, or associates of the consumer, or. Employers who use "investigative reports" – reports based on personal interviews concerning a person's character, general reputation, personal characteristics, and lifestyle – have additional obligations under the fcra. these obligations include giving written notice that you may request or have requested an investigative consumer report.

Free 10 Investigative Consumer Report Samples Disclosure The fcra defines an investigative consumer report as: a consumer report (or any part within a consumer report), with some exceptions, in which information on a consumer’s character, general reputation, personal characteristics, or mode of living is obtained through personal interviews with neighbors, friends, or associates of the consumer, or. Employers who use "investigative reports" – reports based on personal interviews concerning a person's character, general reputation, personal characteristics, and lifestyle – have additional obligations under the fcra. these obligations include giving written notice that you may request or have requested an investigative consumer report. Updated nov 4, 2018. investigative consumer reports receive a lot less notoriety than consumer credit reports, probably because you are far more likely to have your credit report pulled than to have a full blown investigative consumer report performed about you. there are some major similarities between these two types of reports; both are an. Investigative consumer reports, on the other hand, can act as a standalone report or provide supplemental information to the consumer report. at one source, we offer both options. investigative reports through the fcra are defined as” information on a consumer’s character, general reputation, personal characteristics, or mode of living is.

Comments are closed.