Irs Form 941 X Download Fillable Pdf Or Fill Online Adjusted Employer Sођ

Irs Form 941 X Fill Out Sign Online And Download Fillable Pdf File two separate forms. for the adjustment process, file one form 941 x to correct the underreported tax amounts. check the box on line 1. pay the amount you owe from line 27 by the time you file form 941 x. for the claim process, file a second form 941 x to correct the overreported tax amounts. check the box on line 2. Box 4—name and address. enter your name and address as shown on form 941. enclose your check or money order made payable to “united states treasury.”. be sure to enter your ein, “form 941,” and the tax period (“1st quarter 2024,” “2nd quarter 2024,” “3rd quarter 2024,” or “4th quarter 2024”) on your check or money order.

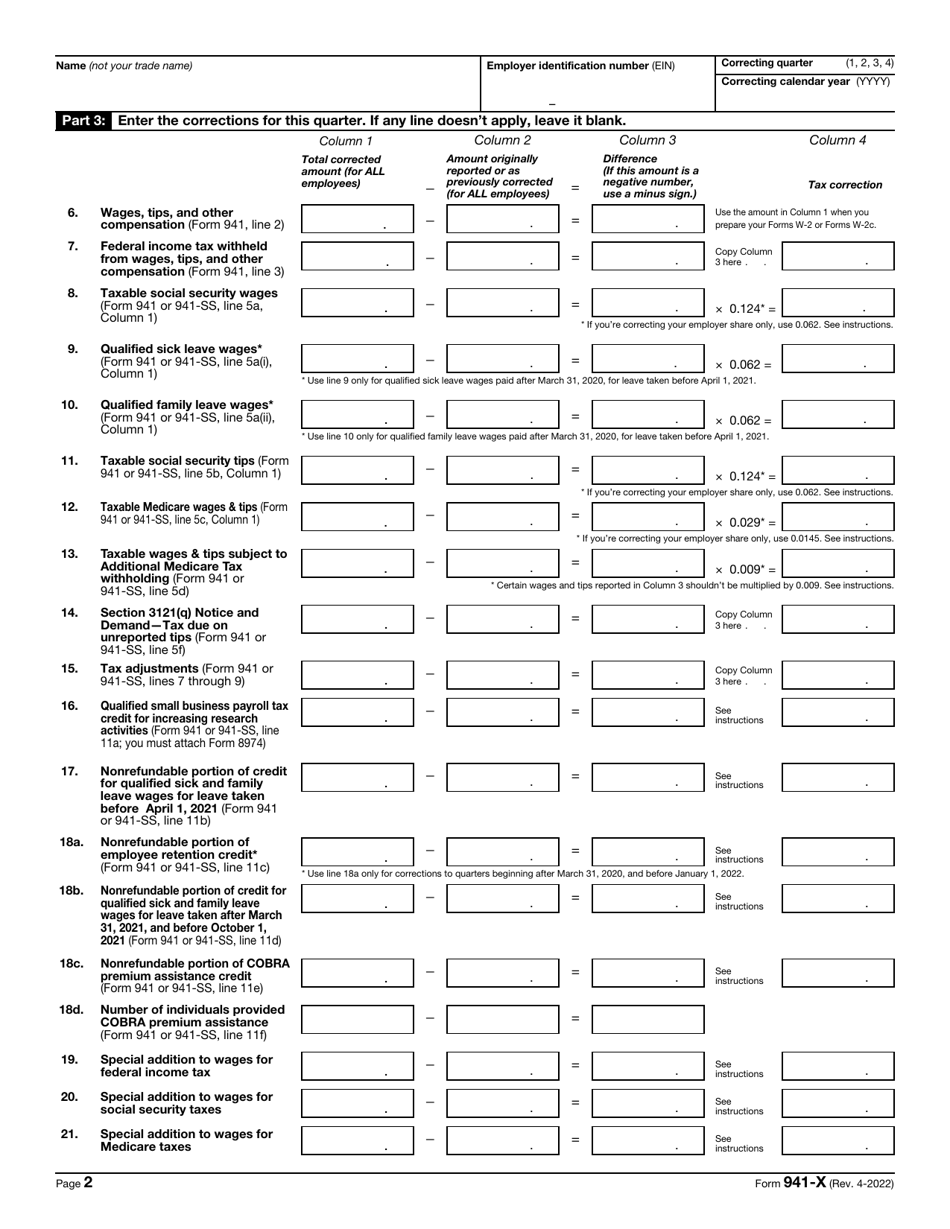

Create And Download Form 941 X Fillable And Printable Download fillable irs form 941 x in pdf the latest version applicable for 2024. fill out the adjusted employer's quarterly federal tax return or claim for refund online and print it out for free. irs form 941 x is often used in federal tax return, amended tax return, quarterly tax return, payroll tax, tax adjustments, employer taxes, claim for refund, tax refund form, tax report, u. Download fillable irs form 941 in pdf the latest version applicable for 2024. fill out the employer's quarterly federal tax return online and print it out for free. irs form 941 is often used in u.s. department of the treasury, u.s. department of the treasury internal revenue service, united states federal legal forms, legal and united states legal forms. Get a 941 x (2023) here. edit online instantly! form 941 x, adjusted employer's quarterly federal tax return or claim for refund, is an essential document employed for rectifying inaccuracies identified in a previously submitted irs form 941 quarterly report. this comprehensive form provides a structured format for employers to make necessary adjustments, ensuring accurate reporting of. Product number form 8879 emp. title irs e file signature authorization for forms 940, 940 (pr), 941, 941 (pr), 941 ss, 943, 943 (pr), 944, and 945. revision date dec 2023. posted date 12 19 2023. page last reviewed or updated: 08 oct 2024. the latest versions of irs forms, instructions, and publications.

Download Instructions For Irs Form 941 X Adjusted Employer S Quarterly Get a 941 x (2023) here. edit online instantly! form 941 x, adjusted employer's quarterly federal tax return or claim for refund, is an essential document employed for rectifying inaccuracies identified in a previously submitted irs form 941 quarterly report. this comprehensive form provides a structured format for employers to make necessary adjustments, ensuring accurate reporting of. Product number form 8879 emp. title irs e file signature authorization for forms 940, 940 (pr), 941, 941 (pr), 941 ss, 943, 943 (pr), 944, and 945. revision date dec 2023. posted date 12 19 2023. page last reviewed or updated: 08 oct 2024. the latest versions of irs forms, instructions, and publications. You may use the “cover letter” module (choose: “form 941 x” from the “other form” dropdown menu on the 2nd screen of cover letter module) to produce a form 941 x client cover letter, which includes the correct irs mailing address for the 941 x. adjust the balance due amount as needed (after considering deposits payments already made. Form was filled out and downloaded 1,432 times already. fillable form 941 x (2022) form 941 x, adjusted employer's quarterly federal tax return or claim for refund, is the form used to correct errors on a previously filed irs form 941 quarterly report. fill online. email.

Comments are closed.