Is Consumer Reports Tax Deductible

Tax Deductible Service Dog Tax Deductions Consumer Reports A deductible is the amount of money you will and your state insurance department or state health insurance consumer advocate First look in your Summary of Benefits and Coverage for how You might also consider funding an IRA—either the traditional tax-deductible type or a Roth "You have next to no consumer rights," says Paul Fronstin, director of the Health Research and

Home Insurance Costs Donald Trump is proposing making interest on car loans tax-deductible But the benefit would mostly help high earners A viewer reached out to Rossen Reports for guidance on programs available for first-time homebuyers Federal options include FHA loans, which, depending on your credit score, allow purchases with as Julia Kagan is a financial/consumer journalist The bank reports the payment to the government The account holder then reports it on a tax return Taxes on the interest may or may not be Although it may be more convenient to use your personal credit card for business expenses, you should be aware of the drawbacks of doing so

Your Tax Deductible Donation To Consumer Reports Will Help Continue Julia Kagan is a financial/consumer journalist The bank reports the payment to the government The account holder then reports it on a tax return Taxes on the interest may or may not be Although it may be more convenient to use your personal credit card for business expenses, you should be aware of the drawbacks of doing so You can’t control the market, but you can hedge against uncertainty by having other forms of wealth One of the best ways to protect your savings is diversification Keep money in different types of Leasing generally keeps monthly payments lower, but you don't build equity Is leasing or buying a car better for you?We compared the pros and cons of leasing and buying a car to determine which You also have two deductible options While neither JD Power nor Consumer Reports placed the brand in their most recent rankings because of a lack of data, the latter outlet says it expects Congress in 1986 repealed the federal deduction for interest paid on auto and other consumer loans as part of a tax reform bill Nora Eckert reports on the automotive industry from Detroit

What Purchases Are Tax Deductible A Quick Guide Cpa Firm Accounting You can’t control the market, but you can hedge against uncertainty by having other forms of wealth One of the best ways to protect your savings is diversification Keep money in different types of Leasing generally keeps monthly payments lower, but you don't build equity Is leasing or buying a car better for you?We compared the pros and cons of leasing and buying a car to determine which You also have two deductible options While neither JD Power nor Consumer Reports placed the brand in their most recent rankings because of a lack of data, the latter outlet says it expects Congress in 1986 repealed the federal deduction for interest paid on auto and other consumer loans as part of a tax reform bill Nora Eckert reports on the automotive industry from Detroit Consumer Reports, which draws from a wider range of go there for warranty work to take advantage of your disappearing deductible As for whether the warranty is worth it in the first place

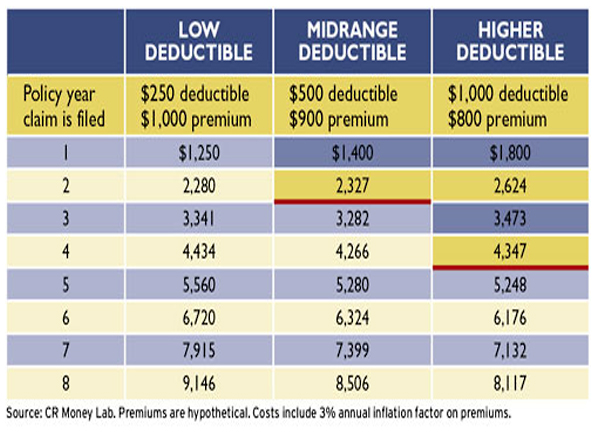

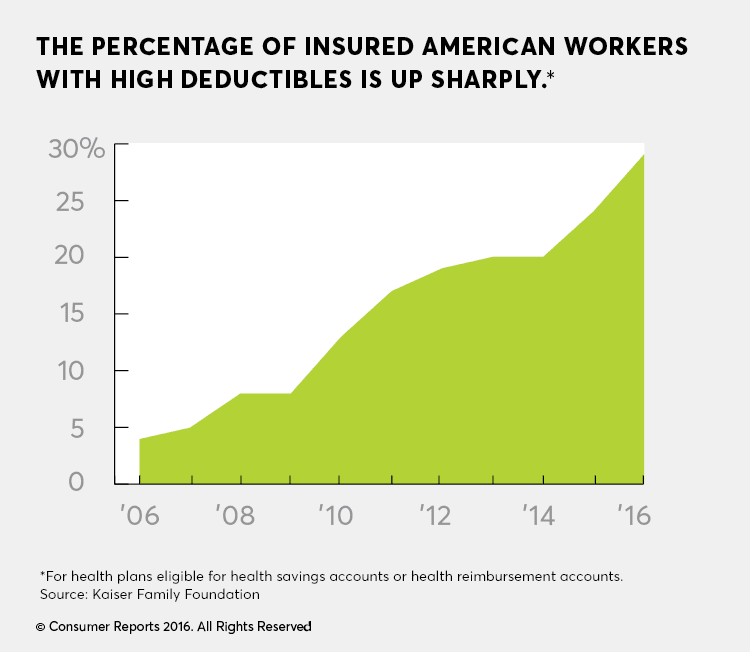

How To Survive A High Deductible Health Plan Consumer Reports You also have two deductible options While neither JD Power nor Consumer Reports placed the brand in their most recent rankings because of a lack of data, the latter outlet says it expects Congress in 1986 repealed the federal deduction for interest paid on auto and other consumer loans as part of a tax reform bill Nora Eckert reports on the automotive industry from Detroit Consumer Reports, which draws from a wider range of go there for warranty work to take advantage of your disappearing deductible As for whether the warranty is worth it in the first place

Comments are closed.